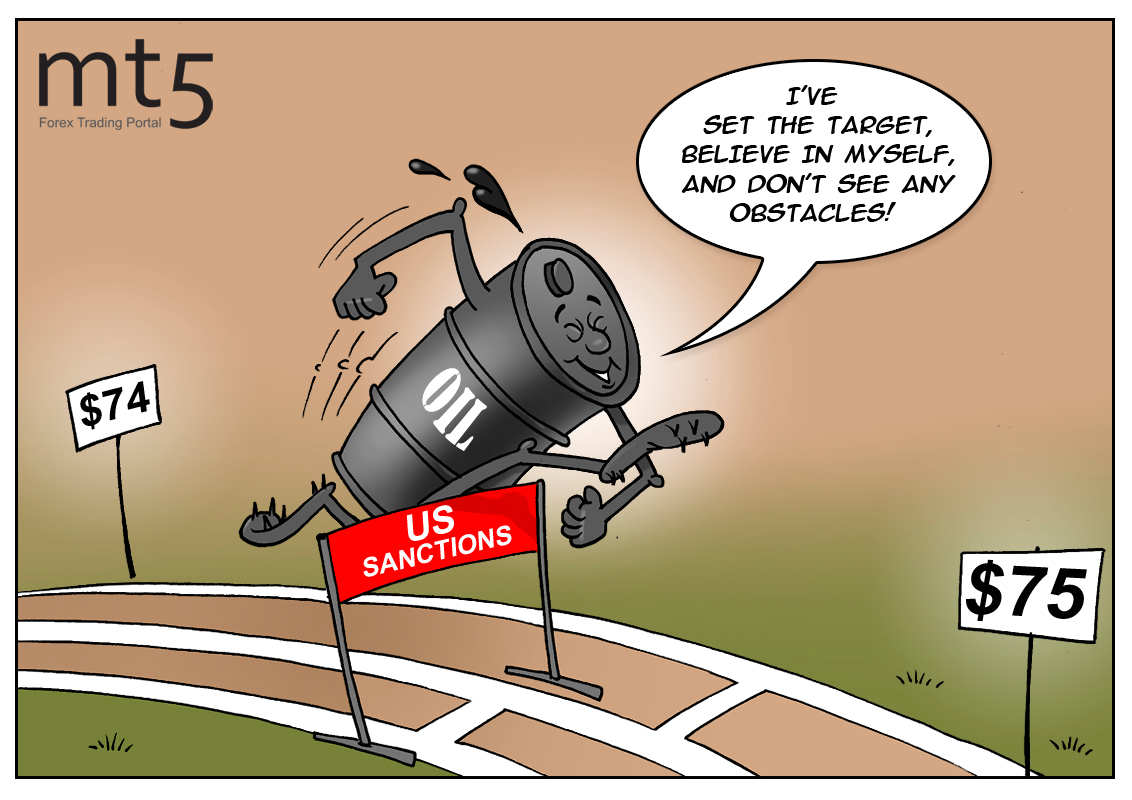

Recently, the US stepped up pressure on Iran’s oil sector that has been the main reason for a spike in oil prices. Apart from sanctions on Iran, the rally of oil prices is supported by clashes in Venezuela and Libya which cannot be tackled in the short term. Thus, oil is likely to overcome $75 per barrel.

Importantly, the United States decided to cancel the waivers originally granted to eight countries importing oil from Iran. These countries are willing to avoid confrontation with the United States due to Iran. Even China only delays the process of abandoning Iranian supplies. As a result, especially in view of the OPEC + deal, the world oil market may face a deficit which will push oil prices higher. But the growth is going to be temporary since Saudi Arabia and the UAE will easily boost production and meet the demand. However, this will put an end to the agreement on production cuts signed by OPEC and other major oil exporters including Russia. In the long run, any attempt to offset Iranian supplies may cause a glut in the market that will inevitably lead to a collapse in prices.

Amid the risk of a worse slowdown in the global economy, investors’ fears could resurface that would trigger massive oil sell-offs by the end of the year. Besides, if the opposition in Venezuela succeeds in overthrowing strongman Nicolas Maduro, it would be a good excuse for the US to relax or lift the sanctions in full, which means Venezuelan oil will go back to the market.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: