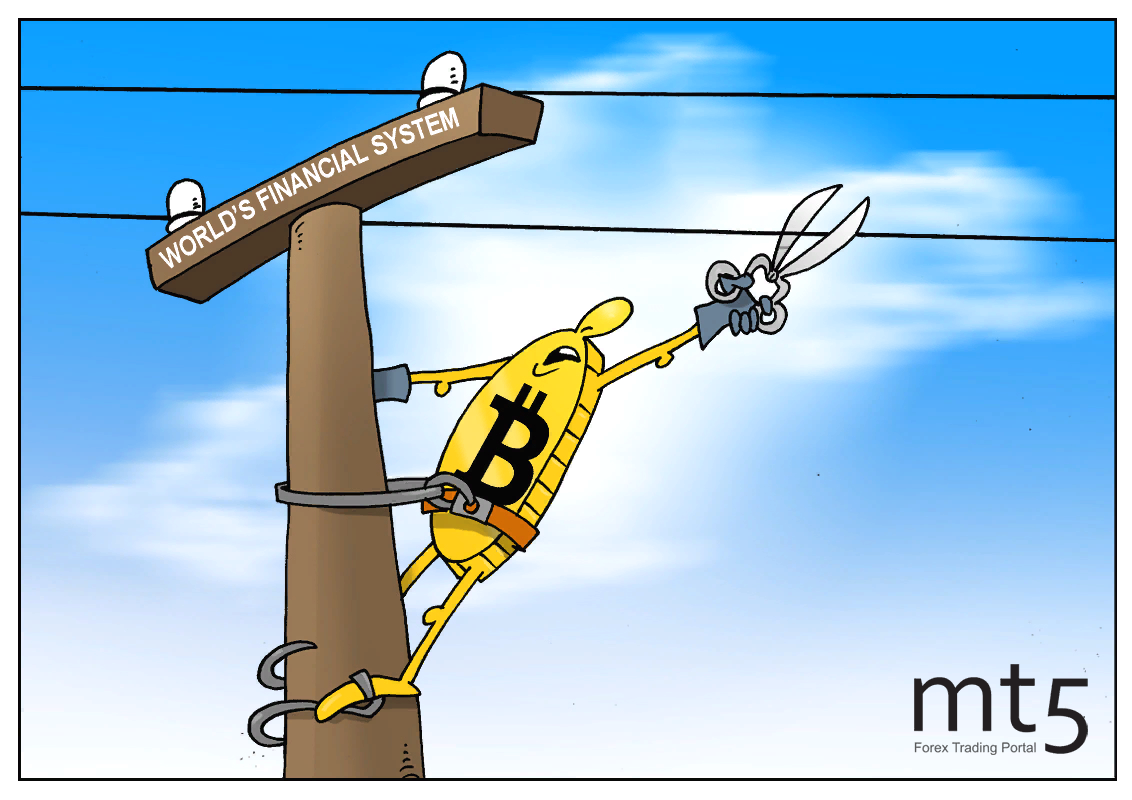

Head of the International Monetary Fund Christine Lagarde unexpectedly criticized cryptocurrencies. She pointed to the changing business models of commercial banks due to digital money. “I think the role of the disruptors and anything that is using distributed ledger technology, whether you call it crypto, assets, currencies, or whatever. That is clearly shaking the system,” Ms Lagarde said adding that such changes in the financial industry must be accompanied by regulation. On the one hand, digital assets are again discussed at the highest level. On the other hand, the reason for it could be better. Moreover, criticisms by the IMF’s head is worth paying attention to.

The International Monetary Fund thoroughly examined the nature of cryptocurrency and drew its conclusions based on the data obtained. As a result, the regulator noticed real changes in the established banking system. Currently, a lot of companies, including big tech ones, enter the banking industry. For example, Facebook is reportedly developing its own cryptocurrency, and Apple has already released its own credit card. All of them must adhere to the requirements. “They will have to be held accountable so that they can be fully trusted,” Christine Lagarde explained. Remarkably, IMF’s attitude to cryptocurrencies changed over time. Thus, back in May last year, the organization claimed that digital assets did not threaten global economic stability, and already in October, it stated that they would make the global economy vulnerable.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: