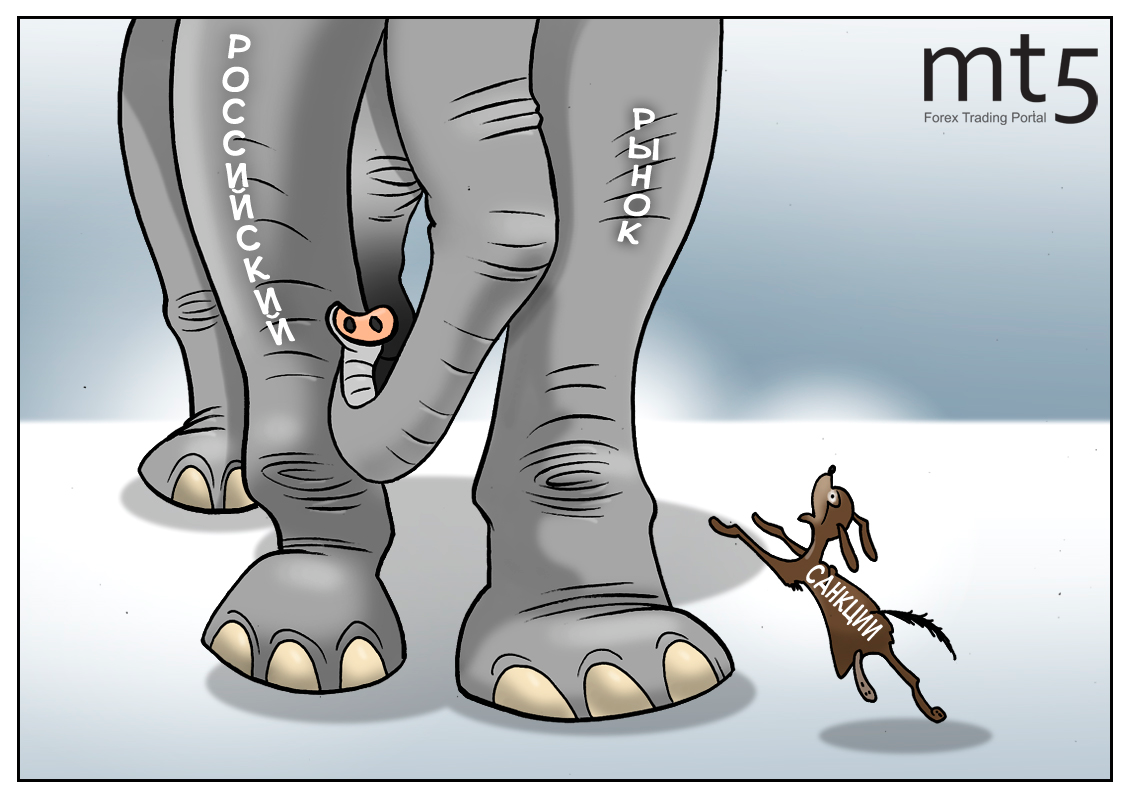

Having survived another round of Western sanctions, Russia’s stock market is extending a winning streak. Independent research groups acknowledge steady growth of Russia’s gross domestic product and upbeat performance of local stocks. Despite strong pressure from the US and EU sanctions, the state-owned Sberbank is a catalyst for a rally in the domestic stock market as the bank’s shares surged 2.57% in Q1 2019. Remarkably, Russia’s banking sector is going to be another target of US punitive restrictions. In fact, a new package of sanctions has not come into force yet and even has not been approved by US lawmakers. The US authorities are still discussing a draft bill which sets out counter-measures against Russia’s interference in US elections in the future.

Nevertheless, a threat of looming sanctions prompted large foreign investors to withdraw capital from Russia’s economy. Actually, capital flight has been going on since 2014 after the first round of Western sanctions. Amid the capital flight, Russia’s Ministry of Finance is not pleased about the latest auction of federal loan bonds. The ministry aimed to sell foreign investors federal loan bonds at a lower value. The secondary market of financial instruments is still lagging behind the primary equity market. However, optimistic analysts predict a price leap in federal loan bonds and corporate bonds in the near future. Thus, Russia’s economy has proved its resilience despite severe restrictive measures.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: