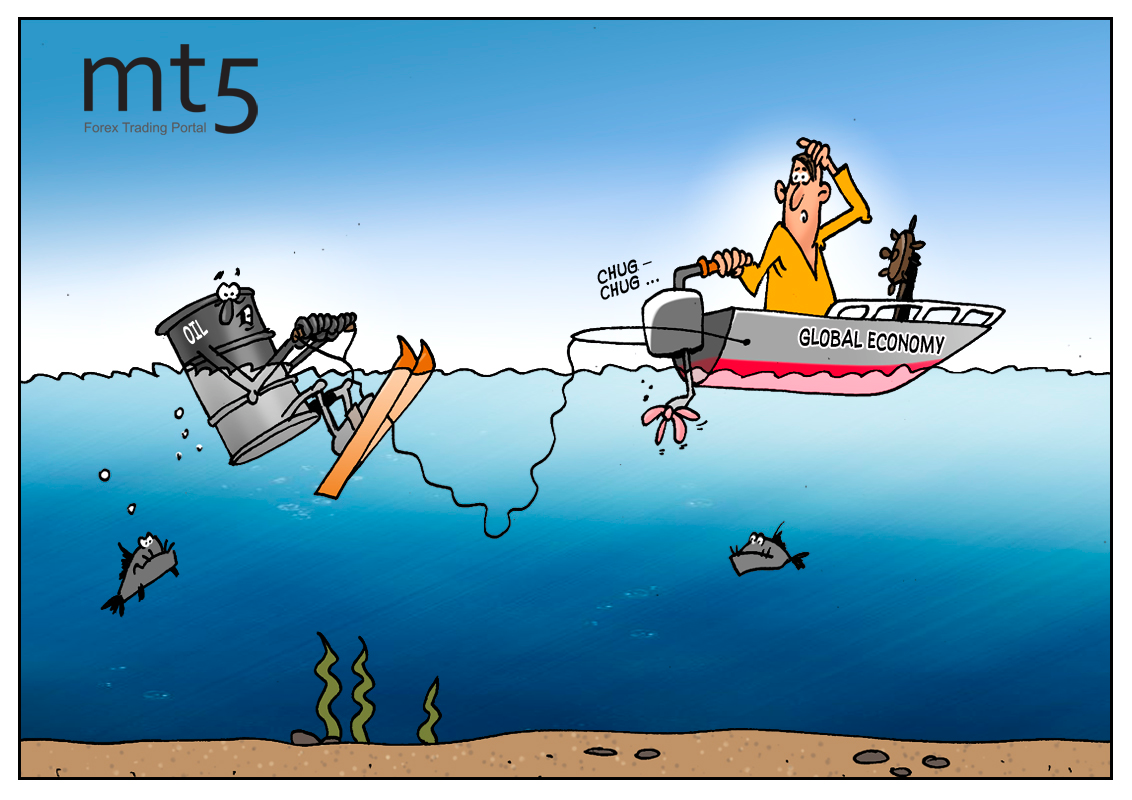

Bad news for oil producers. The Fitch Ratings agency predicted a significant decline in demand for crude oil this year. Moreover, the situation may become even worse. The reason for such a gloomy outlook is clear-cut. The global economic slowdown is to be blamed. Naturally, active popularization of alternative sources of energy and an increasing number of electric cars can dent the demand but not significantly. These factors have a minor impact on the global oil market, but weak economic growth can give the commodity a hard blow. The agency predicted that the pace of global economic growth would decelerate to 2.8% in 2019-2020 from 3.2% in 2018. “If the global growth slowdown becomes more pronounced, or even if recession materializes, then demand for oil could fall sharply which is the main risk for global oil prices,” Fitch Ratings’ senior director Dmitry Marinchenko said. According to the agency’s forecast, the Brent crude benchmark will cost about 65 dollars per barrel in 2019 while in 2020 the price is expected to plunge to 62.5 dollars. In 2022, the North Sea crude oil may slump to as low as 57.5 dollars per barrel.

Oil prices are likely to decline despite the prolongation of the OPEC+ deal and disturbances in Iran and Venezuela. These countries are doomed to cut production amid sanctions, but even this factor can hardly provide significant support to oil prices.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: