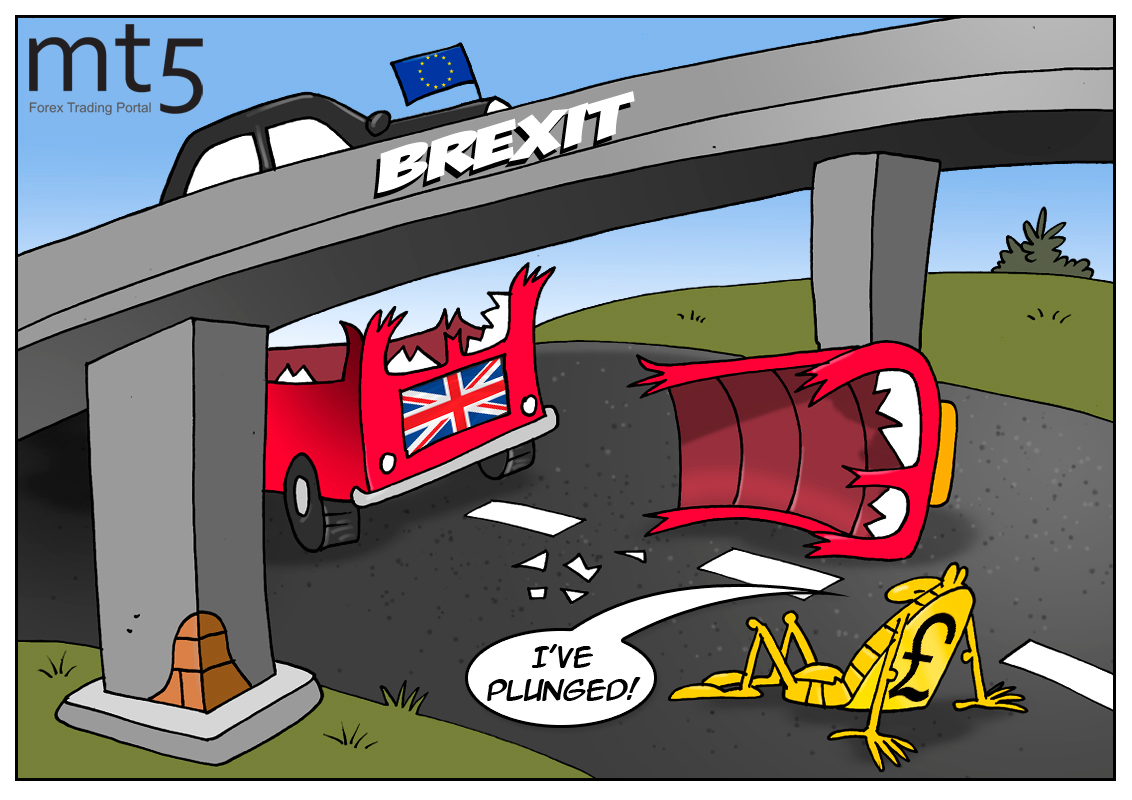

The British national currency looks extremely weak in the foreign exchange market. It is not only the American dollar, having an impact on major currencies, is to blame for this. The fact is that traders shy away from the risks associated with the pound because of the Brexit uncertainty.

The closer March 2019, the deadline for the official withdrawal of the Kingdom from the EU, the greater the likelihood of a hard scenario that puts pressure on the pound. Sterling tested a new record low, falling amid concerns about the Brexit deal absence. So, for one pound at Heathrow airport travelers paid 1.08 dollars, or 0.93 euros.

Since mid-April, the British national currency has lost more than 10% of the value in pair with the dollar; the decline was seen in pair with the euro, too. In the future, the currency may fall by the same rate.

The current situation, according to traders, is due to the lack of progress on Brexit. If the agreement will not be reached, the GPB/USD rate may fall to 1.20, analysts predict. With a positive outcome, the pair can move to 1.39.

The meeting of the London and Brussels representatives will be held in Salzburg in September this year. Its results, of course, will affect the foreign exchange market.

Studies of the British National Institute for Economic and Social Research have shown that the UK exit from the EU will lead to a pound drop of 20% and strong inflation. Moreover, Brexit will have negative impact over many years. It is expected that by 2030 the country's economic growth will be lower by 1.5-3.7% than if it remained part of the EU.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română