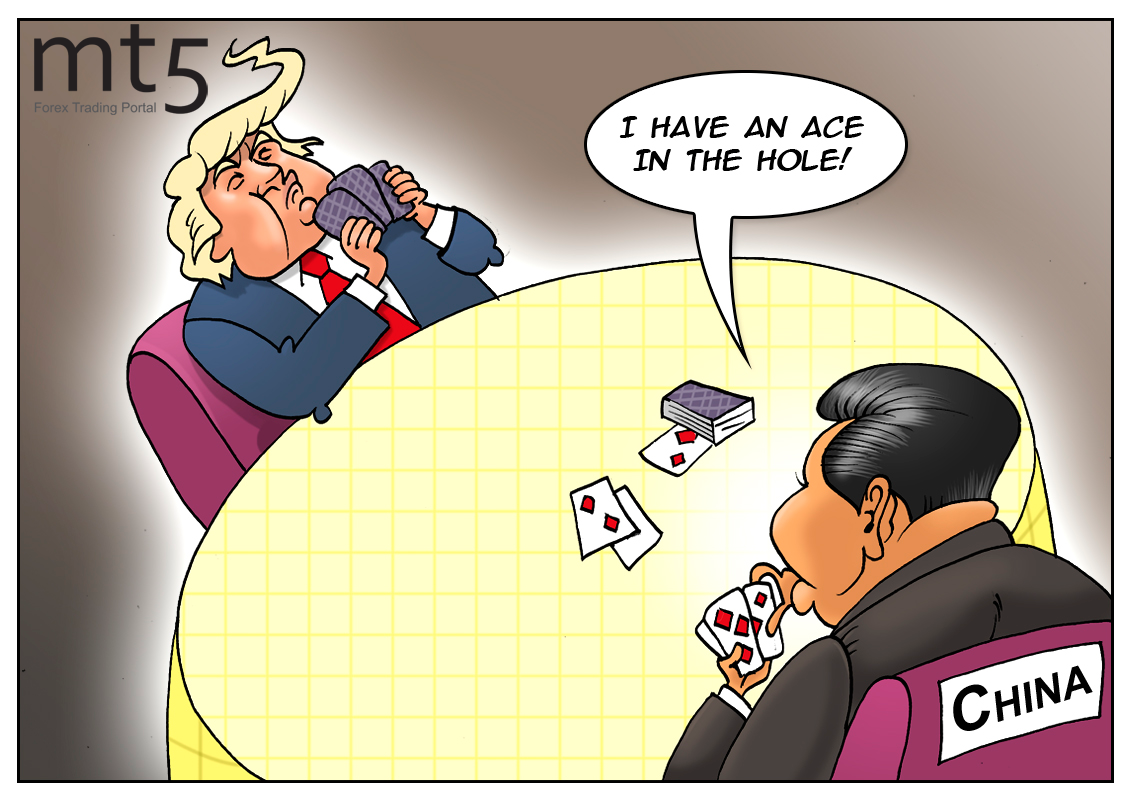

Donald Trump claims trade wars are “good”, while his Chinese counterpart Xi Jinping criticizes the United States for actions which, he believes, will lead to nothing good. China’s president promised to prove that Trump is as cocky as the king of spades.

Undoubtedly, export-reliant China is suffering from new tariffs. But so are Japan, South Korea and Singapore, its main trading partners. Besides, markets are dealt a bad hand by Trump’s actions and statements.

There are many ways for China to hit back. Xi could devalue the yuan, complicate the life for US companies producing in China, encourage a widespread boycott of US goods, etc.

But Xi is quietly reminding Washington he also has some plans up his sleeve. Here are the four most ambitious ones:

Scuttling corporate deals

San Diego-based Qualcomm’s multiyear effort to buy Dutch chipmaker NXP Semiconductors for $44 billion failed. China blew that deal by not signing it. Analysts read Beijing's actions as retribution for Trump’s new tariffs.

In addition, Beijing could stop the flow of mainland startups worth more than $1 billion listing on US exchanges. Since March, when Trump started talking about tariffs, the flow of Americans' favorite large Chinese IPOs began to decline. Wall Street will bear losses, and Hong Kong make profits. Beijing can show Trump who is the boss here.

Banning Facebook in China

The empire of Zuckerberg also suffered from the situation. At the time when Facebook shares lost 20% in a single day, Beijing turned down the company’s request to set up a subsidiary worth $30 million. In other circumstances and at other times, this could be the beginning of an important business friendship between the world's largest consumer market and the largest social network.

Calling in Washington's loans

China, the largest holder of US bonds, has already hinted at reducing or even refraining entirely from buying US public debt. The time has come to raise the ante. So, Trump's party reduced taxes depriving the Treasury of $1.5 trillion. The first fears about the insolvency of the United States appeared, so Washington needs Asia to compensate for the losses.

If China ignored several auctions or sold out large number of its US government bonds, markets would be in shock. And what if other investors, Japan, Taiwan, India, and Singapore, follow suit? It will be a victory, but at a high cost. And yet, China may want to play such a game. Trump's trade war is imbued with economic nihilism, making Americans suffer as much as anyone.

Taiwan card

Recently, US airlines were faced with a choice: to leave the prosperous Chinese market or to describe Taiwan as part of China on their websites. American, Delta and Unite unquestioningly added “China” after “Taiwan” in the search bar.

American Express, Citibank and Goldman Sachs played their cards right by removing from their websites any mention of Taiwan not being part of China. Gap, a large clothing retailer, apologized for selling T-shirts, inconsistent with the country’s sovereignty claims. Another major trading company, Costco, put itself in trouble because of a map on its website.

Now that Beijing holds all the cards, what might Xi try next?

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: