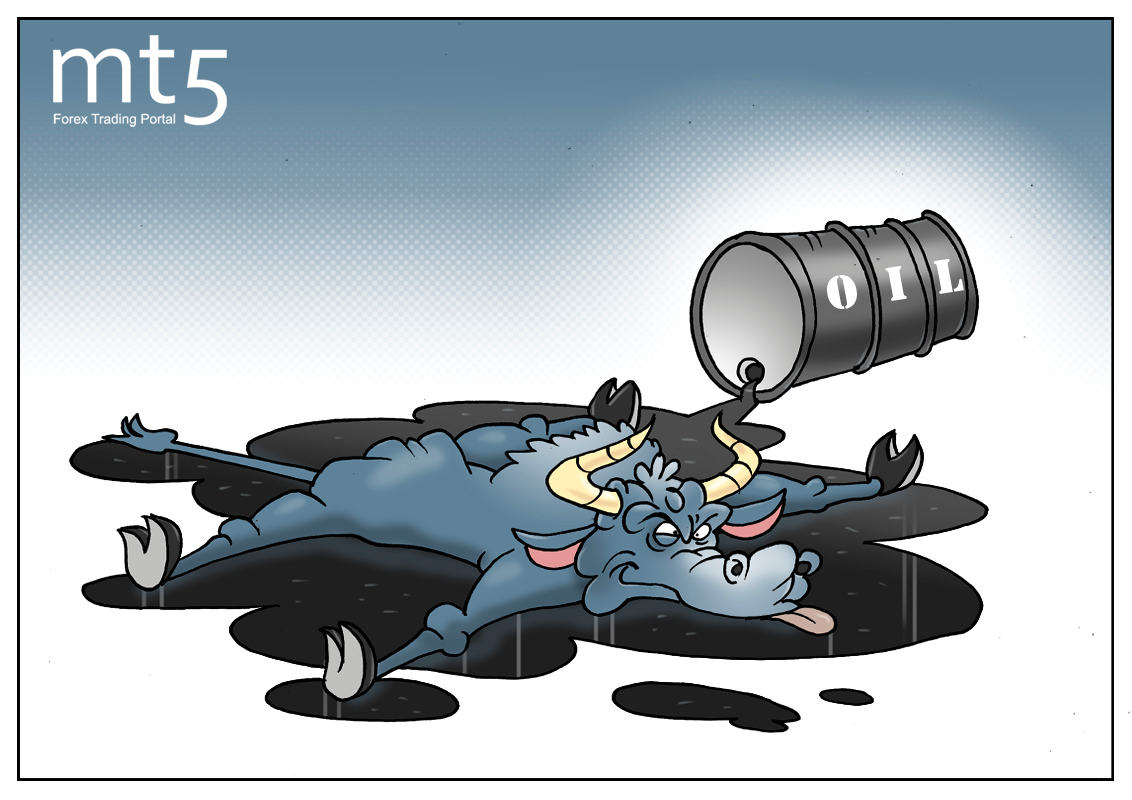

Commodity experts do not rule out that the oil rally will inevitably come to an end sooner or later. Oil bulls are about to lose their optimism amid vague prospects. Despite recent efforts to halt a decline, oil prices are not able to bounce back to the levels, last seen more than 3½ years ago.

The US has been ramping up production rates and increasing shipments of crude imports at a record pace. Such a robust activity of US drilling companies proves huge demand. Saudi Arabia foresees sharp contraction of crude oil inventories by the year end. These are benign fundamentals to encourage a further rally in the global oil market. However, it has not happened. Oil bulls made determined efforts to push prices to a four-year high, but this attempt was in vain. The steady advance was tempered by negative market sentiment. The pessimistic mood was triggered mainly by the US and Russia. The two top oil exporters have boosted domestic oil production. Recently, the US oil output has swollen to over 11 million barrels per day, thus having outpaced Russia. Russia is unwilling to take a back seat, but it has to restrain its oil output, complying with the OPEC production cuts deal.

Nevertheless, positive forecasts can cheer up energy investors. Some analysts say that from the technical viewpoint, the ongoing price move looks more like a downward correction than the overall bearish trend. Indeed, the market can tolerate a $10 drop on the back of the rapid oil rally for the most part of the year.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română