It seems that Russia has nearly run out of money. The useful sanctions, as the Russian media calls them, proved to be of little benefit to the economy and the political sphere. The economic growth is sluggish, the national currency is depreciating, and the budget deficit is widening. Even the latest pension reform will hardly eliminate this problem. So, the Russian government decided to sell off assets.

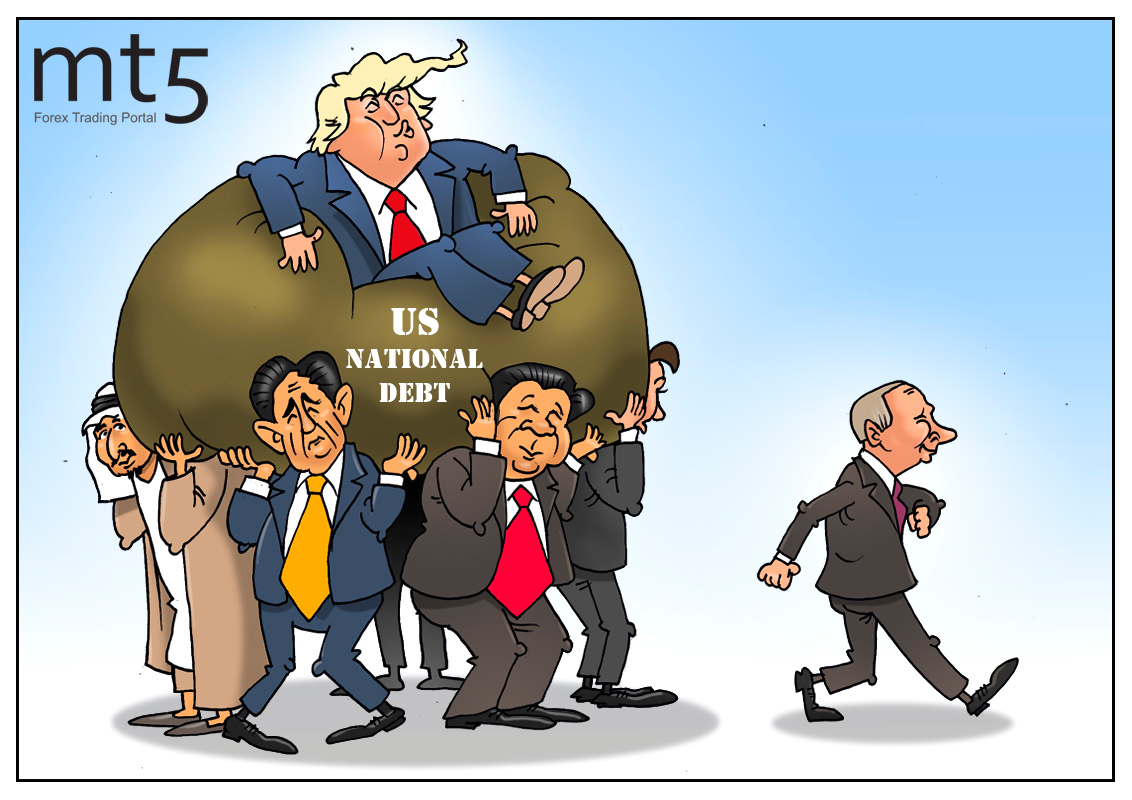

Russia has long been one of the world’s biggest holders of the US Treasuries, but recently it has lost this status. Remarkably, the treasuries do not bring high profits, but they are considered to be safe-haven assets. In other words, they are the perfect assets to keep money in. It is much safer than any bank, so governments, pension funds, and insurance companies prefer to put their money in the US Treasuries. When an owner sells such safe-haven assets, it means that the owner is short of money.

In March Russia was 16th in the list of the biggest holders of the US Treasuries. In April it sold a significant part of the American bonds and declined to the 22nd place. Nowadays, Russia is not even in the list of 33 biggest holders of the US Treasuries. Chile with 40 billion dollars in the US Treasuries is on the last place in this rating.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română