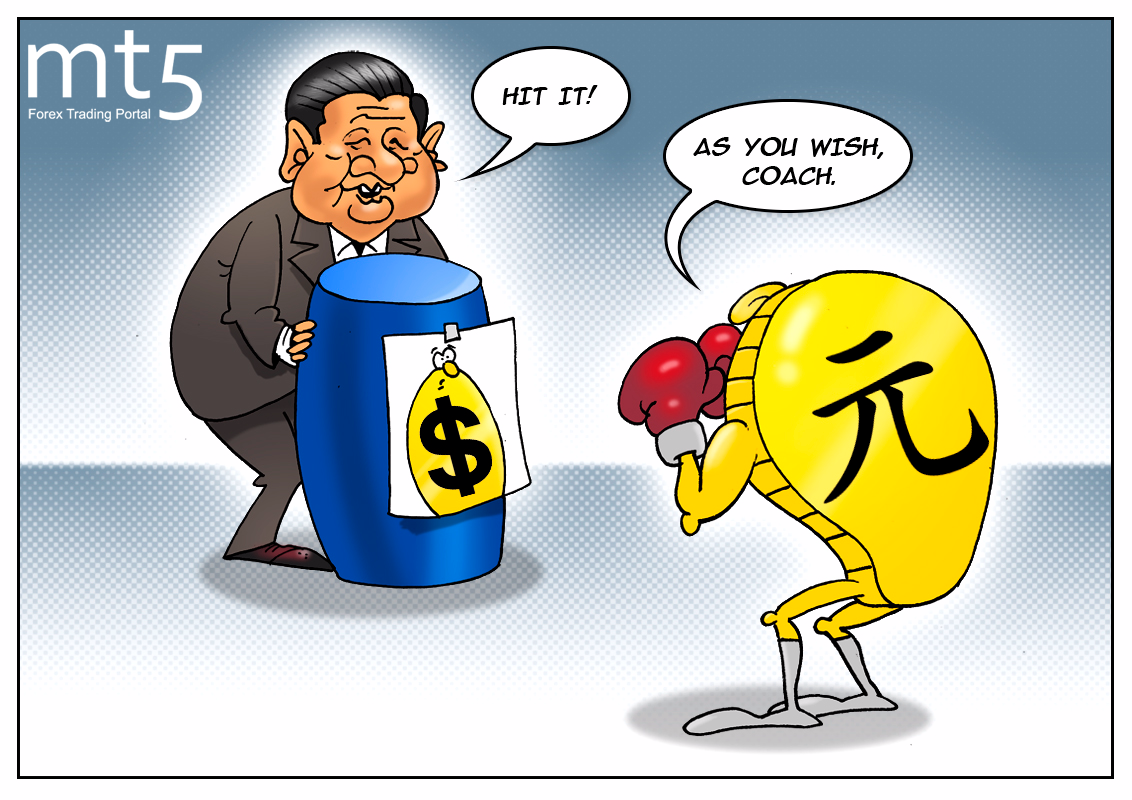

The US dollar has been unable to stand the pressure from the Chinese yuan for the most part of the year for several reasons. The renminbi is taking advantage of the US dollar’s weakness. On September 8, the Chinese currency climbed to the 16-month high against the US dollar when it closed at $6.4817. This year, the yuan has gained 5.4% against the greenback. Another reason is that China’s monetary authorities have been taking measures to tighten financial control.

The government understands the gravity of the problem with capital flight. At the end of 2016, the People’s Bank of China imposed strict rules for capital outflows which have enabled the regulator to bring the process under control. This measure provided the yuan with support and encouraged China’s foreign exchange reserves to grow. The PBOC reported that the country’s foreign exchange reserves had risen for the 8th straight month in September by $17 billion to $3.109 trillion. In the struggle with capital outflows, the government adopted a bill which bans Chinese companies from purchasing overseas assets in certain sectors. So the authorities compiled “a black list” being worried that domestic companies are interested in buying foreign assets with the aim of withdrawing funds out of China.

“We believe that Chinese officials view the outflows as a critical threat, as they deplete China’s FX reserves and invoke unpleasant memories of the Asian Financial Crisis,” economists at ANZ said in a recent note. “Therefore, we think the authorities will prefer stability more than anything else in the near term, particularly as the 19th Communist Party Congress approaches in mid-October.”

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română