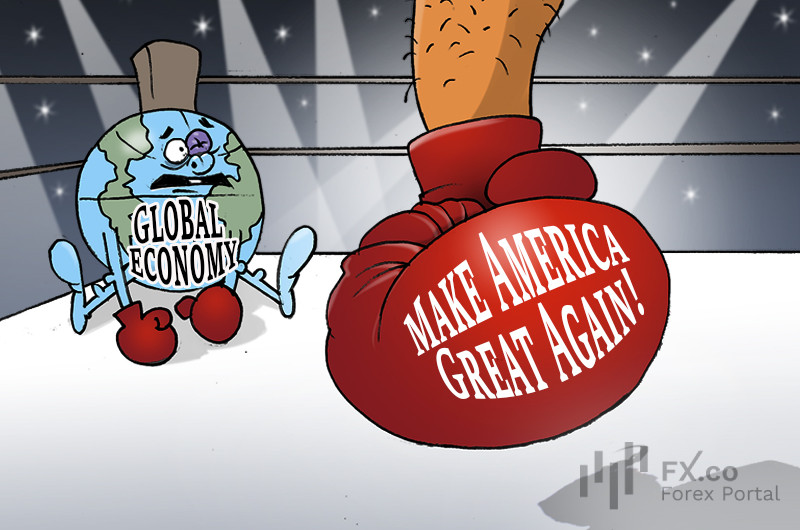

The global economy is facing tough times! It will have to deal with numerous challenges! According to analysts from the Institute of International Finance (IIF), US import tariffs will trigger a sharp slowdown in global GDP growth. That is just the beginning!

The re-election of Donald Trump and his announcement of import tariffs on foreign goods will become the first step toward massive disruptions in global supply chains.

Experts have drawn attention to these risks. This was previously reported in a document provided by the IIF analysts, who warned of a significant slowdown in global economic growth following the Republican’s re-election. This would be driven by the introduction of 10%-20% tariffs on all goods imported into the United States.

IIF considers this scenario aggressive. In such a case, China would suffer the most. Previously, Donald Trump stated that if he won the US presidential election, he would impose tariffs of 60% on goods from China based on their customs value. This measure would reduce China’s GDP growth by 1.5-2 percentage points. Furthermore, the Republican’s economic policy would negatively affect the GDP growth prospects of Germany and Japan.

Two other scenarios proposed by IIF experts suggest a more restrained approach to trade barriers. The so-called middle-ground scenario focuses restrictions on specific sectors. Under this plan, Washington may impose tariffs on imported cars and luxury goods from the EU, as well as technology and equipment from Japan and China.

The third scenario envisions a moderate approach to imposing tariffs. It suggests no restrictions on importing key goods into the United States, including high-tech products. Both scenarios would cause less harm to the global economy but would lead to increased costs for producers in the affected sectors.

The negative effects of Donald Trump’s economic policies would impact most of the world’s economies, as well as US citizens. Previously, analysts from The Wall Street Journal (WSJ) predicted rising inflation in America following the Republicans’ return to power. According to experts, Americans would face noticeably higher consumer prices. This would be fueled by several factors, including high tariffs on imported goods, the deportation of migrants, and pressure on the Federal Reserve to lower the key interest rate.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: