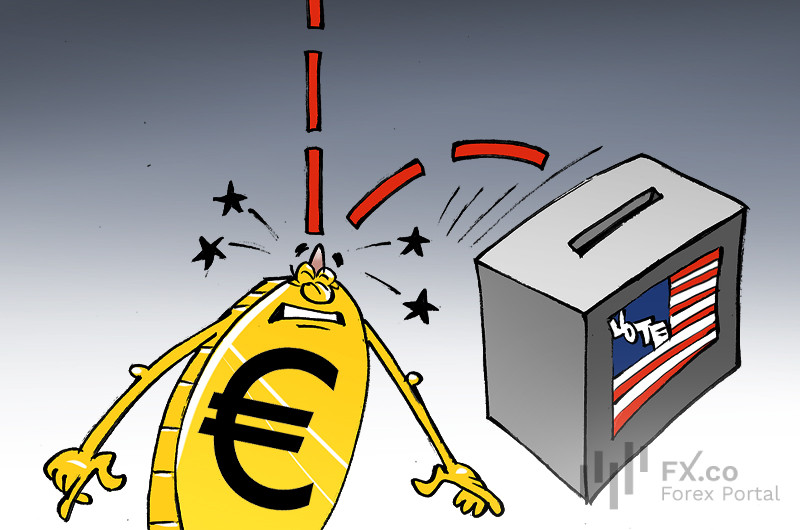

November 6 was, to put it mildly, not the euro’s finest moment. The currency dropped more than two percent, marking its steepest fall since June 2016, when Britain voted to leave the EU. Meanwhile, the US dollar, thrilled by the Trump news, enthusiastically soared to its annual peak.

According to Bloomberg, Donald Trump’s election as US president was a major blow to the euro, the worst it had seen in eight years. US-focused industries were thrilled, while other European sectors braced themselves for potential import tariffs.

The European Union was not caught off guard, as it already had a plan. European officials devised a two-step trade strategy with the US, hoping that a carrot-and-stick method might tame the Republican’s ambitions of 10-percent tariffs, which could cost the EU a hefty 150 billion euros annually in lost exports. If the “carrot” approach fails, Europe has a “stick” in the form of a list of imports that could face tariffs as high as 50%.

As for other countries, the Russian stock market seemed to celebrate the election with record highs while the Mexican peso sighed in disappointment, sinking to its lowest levels since August 2022 and officially losing its “most profitable currency” title. The US election is like a party where everyone reacts differently: some are dancing, others are down in the dumps.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: