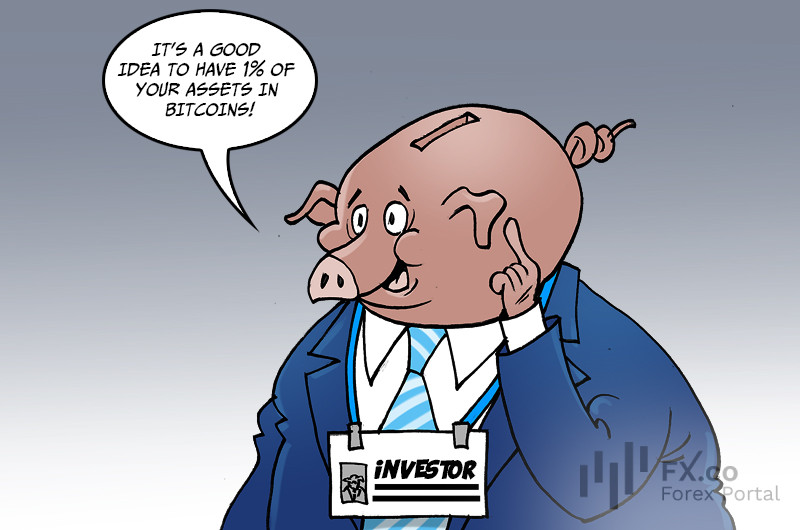

JPMorgan’s currency strategists have shared an interesting take on Bitcoin! According to them, investing just 1% of your assets in BTC is the optimal way to hedge risks associated with the volatility of traditional financial instruments like stocks, bonds, and commodities. This sounds like solid advice.

JPMorgan’s financial experts believe that flagship cryptocurrencies, such as Bitcoin, are incredibly useful as a “portfolio diversifier.” Since virtual currencies have almost no correlation with traditional financial market assets, they can provide effective risk hedging. The strategists argue that even if you invest a small portion of your assets in BTC, you have little to lose, even if Bitcoin’s price crashes. On the flip side, if the price of this leading cryptocurrency rises while traditional markets for commodities and raw materials fall, it will offset potential losses.

“In a multi-asset portfolio, investors can likely add up to 1% of their allocation to cryptocurrencies in order to achieve any efficiency gain in the overall risk-adjusted returns of the portfolio,” analysts believe. However, they emphasize that their calculations could be applied only to commodity markets. When it comes to the financial market, especially currency pairs, their approach may not be as effective.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: