The yellow metal is again enjoying its investment luster. While global investments in gold are breaking records, the gold price is extending its rally. According to Japan-based periodical Nikkei, investment returns from gold have surged eightfold since the late 2000s.

Meanwhile, returns from investments in securities in the US stock market have increased sixfold, and globally, only doubled.

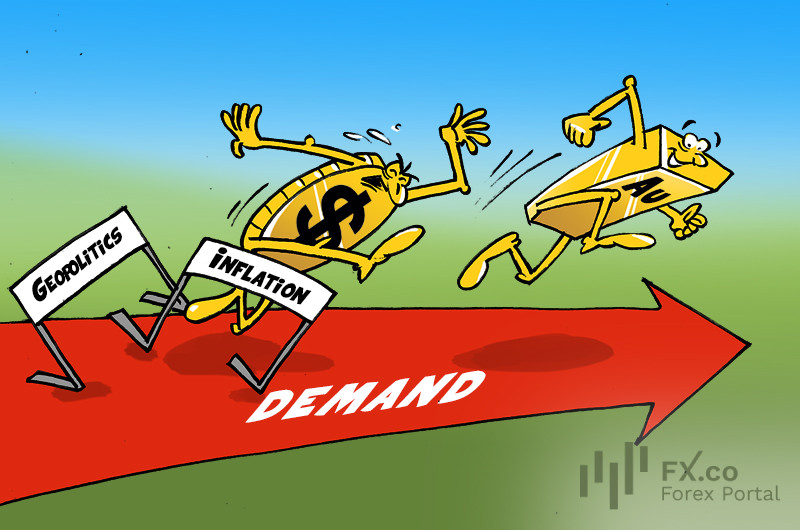

Experts attribute the interest in gold to rising global inflation and geopolitical tensions. Amid such fundamentals, the US dollar weakens and gold becomes a so-called "non-state currency." As a result, the precious metal becomes more attractive for long-term investments.

Commodity experts suggest that the greenback’s fading popularity will set the stage for a significant increase in gold's share in global reserves over the next five years. By 2025, nearly 13% of developed countries are expected to boost their gold reserves. Analysts estimate that in 2023, 56% of developed economies anticipated a decrease in the US dollar’s share in global gold and forex reserves.

In early May this year, it was reported that major central banks replenished their gold reserves by 15.7 tons. In March 2024, Uzbekistan was the largest seller of gold, having released 10.9 tons from its reserves. The main buyers were Turkey (14.1 tons), India (5.1 tons), and China (5 tons). Russia’s monetary authorities purchased 3.1 tons of gold.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: