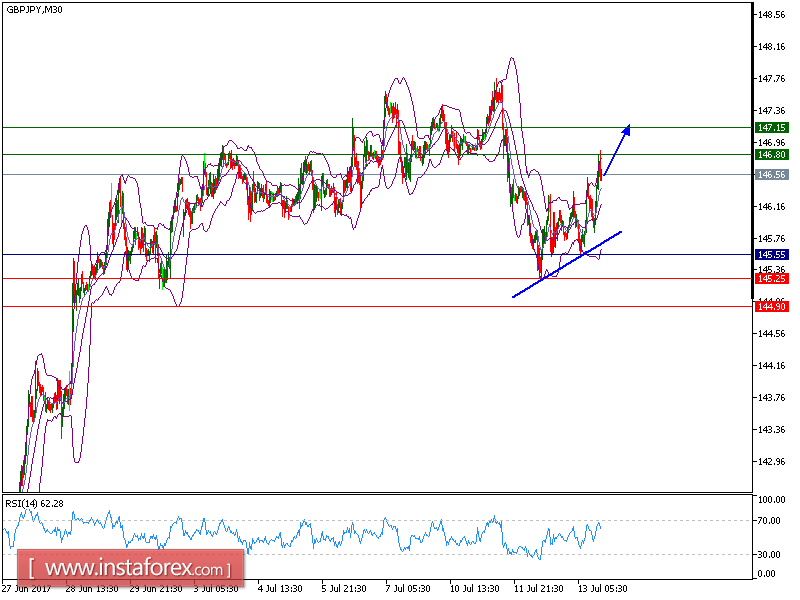

Our take profit target which we mentioned in yesterday's analysis has been hit. The pair signals further upside potential after its upward breakout of a bullish channel. The rising 20-period and 50-period moving averages are playing support roles and maintain the upside bias. The RSI is above its neutrality level at 50.

As long as 145.55 is seen as support, look for a further advance towards 146.80 and even 147.15.

Alternatively, if the price moves in the opposite direction as predicted, a short position is recommended below 145.55 with the target at 145.25.

Chart Explanation: the black line shows the pivot point. The price above pivot point indicates the bullish position and when it is below pivot points, it indicates a short position. The red lines show the support levels and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Strategy: BUY, Stop Loss: 145.55, Take Profit: 146.80.

Resistance levels: 146.80, 147.15, and 147.50

Support levels: 145.25, 144.90, and 144.00

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română