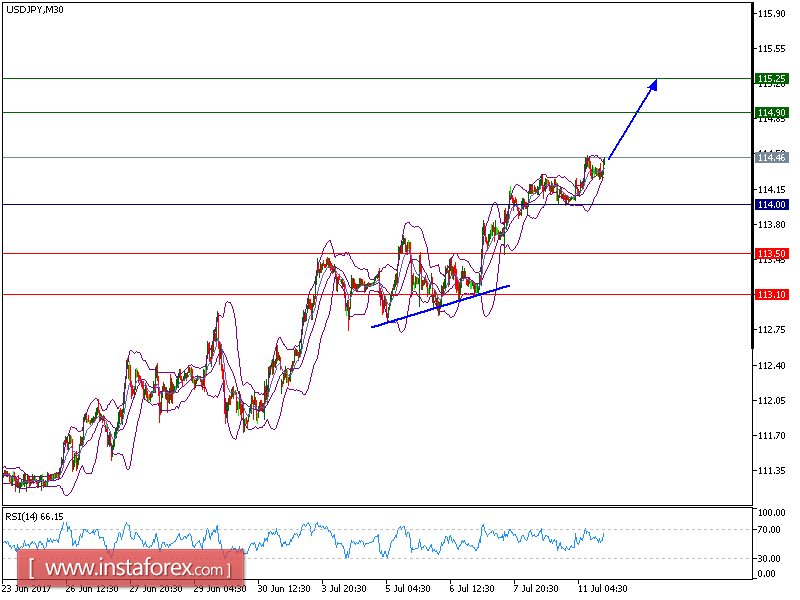

USD/JPY is expected to trade with a bullish bias above 114.00. The pair is consolidating above the key support at 114.00, which should limit the downside potential. The relative strength index lacks downward momentum. Even though a continuation of consolidation cannot be ruled out, its extent should be limited.

Hence, as long as 114 holds on the downside, look for a further upside to 114.90 and even to 115.25 in extension.

Alternatively, if the price moves in the opposite direction as predicted, a short position is recommended below 114.00 with a target at 113.50.

Chart Explanation: The black line shows the pivot point. The current price above the pivot point indicates a bullish position while the price below the pivot point is a sign for a short position. The red lines show the support levels and the green line indicates the resistance level. These levels can be used to enter and exit trades.

Strategy : BUY , Stop Loss: 114, Take Profit: 114.90

Resistance levels: 114.90, 115.25, and 115.50

Support levels: 113.50,113.10, and 112.65

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română