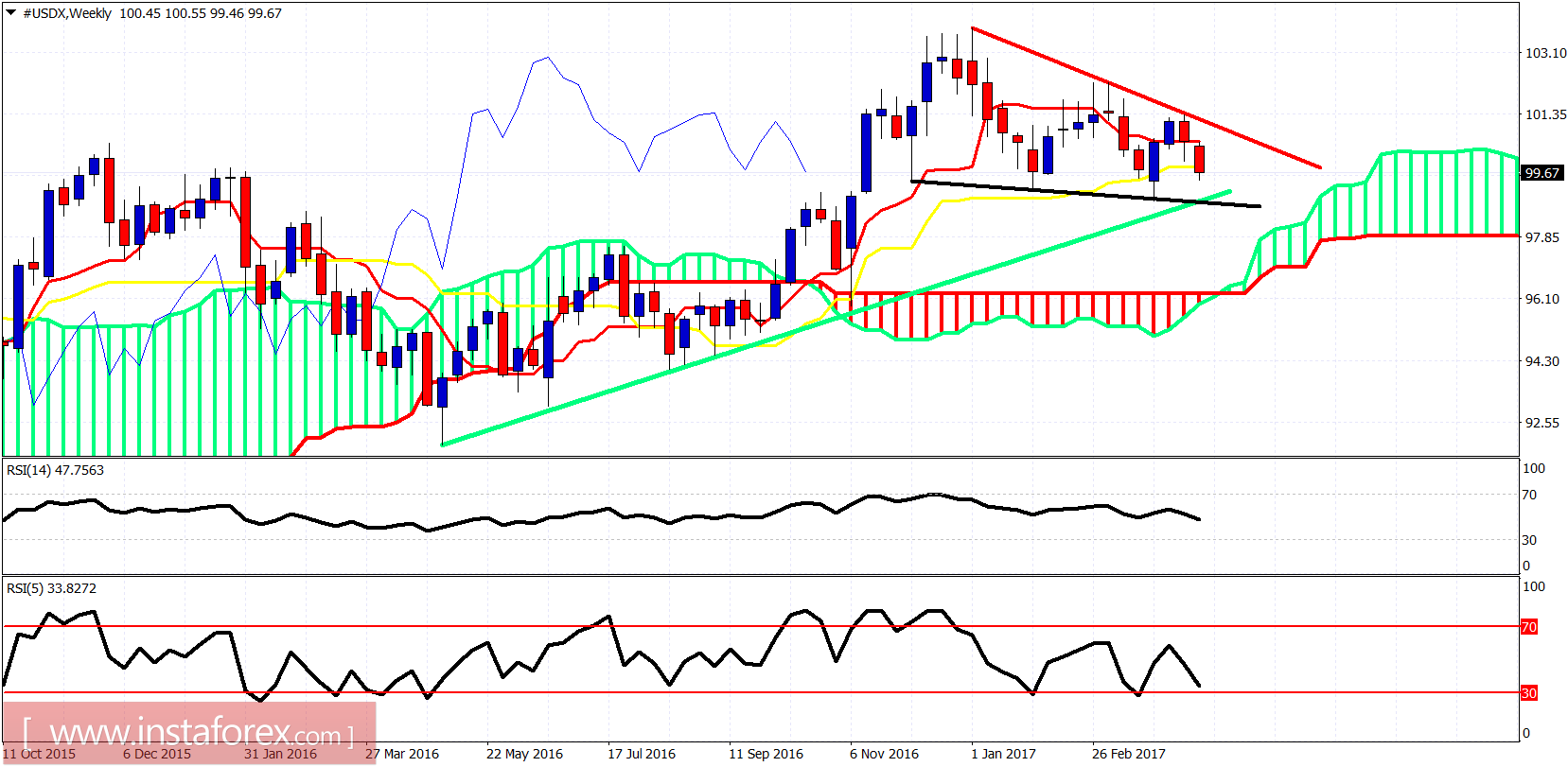

The US dollar index has not bottomed yet. The trend remains bearish. I expect the index to decline further as we are about to test very important long-term support levels. At 98.80-99 price level many things about the medium- and longer-term trend will clear up, and we will have a better picture of the most probable scenario.

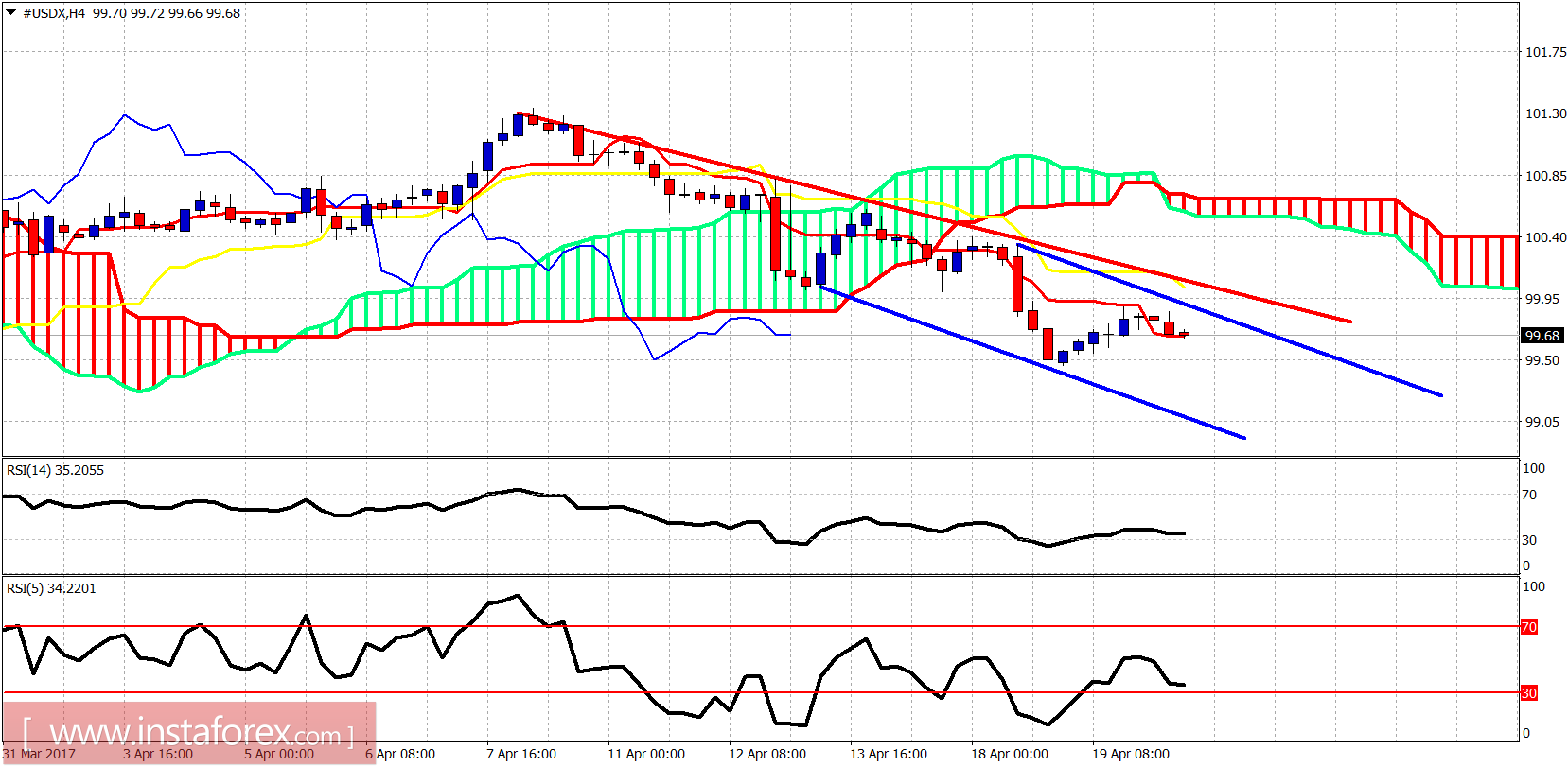

Blue lines - bearish channel

The dollar index is making lower lows and lower highs. The price is below the 4-hour Kumo cloud and the kijun-sen (yellow line indicator) while trading around the tenkan-sen. The short-term resistance is at 99.95 while the support lies at 99.40. I expect the dollar index to make a new low towards 99.

Black line - support

Green line - long-term support trend line

The dollar index is approaching the important junction where the long-term trend line is converging with the black trend line support. The price is still above the weekly Kumo cloud support, maintaining the bullish trend. However, a weekly close below the kijun-sen and a break below the green trend line will increase the chances of a bigger bearish reversal and trend change.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română