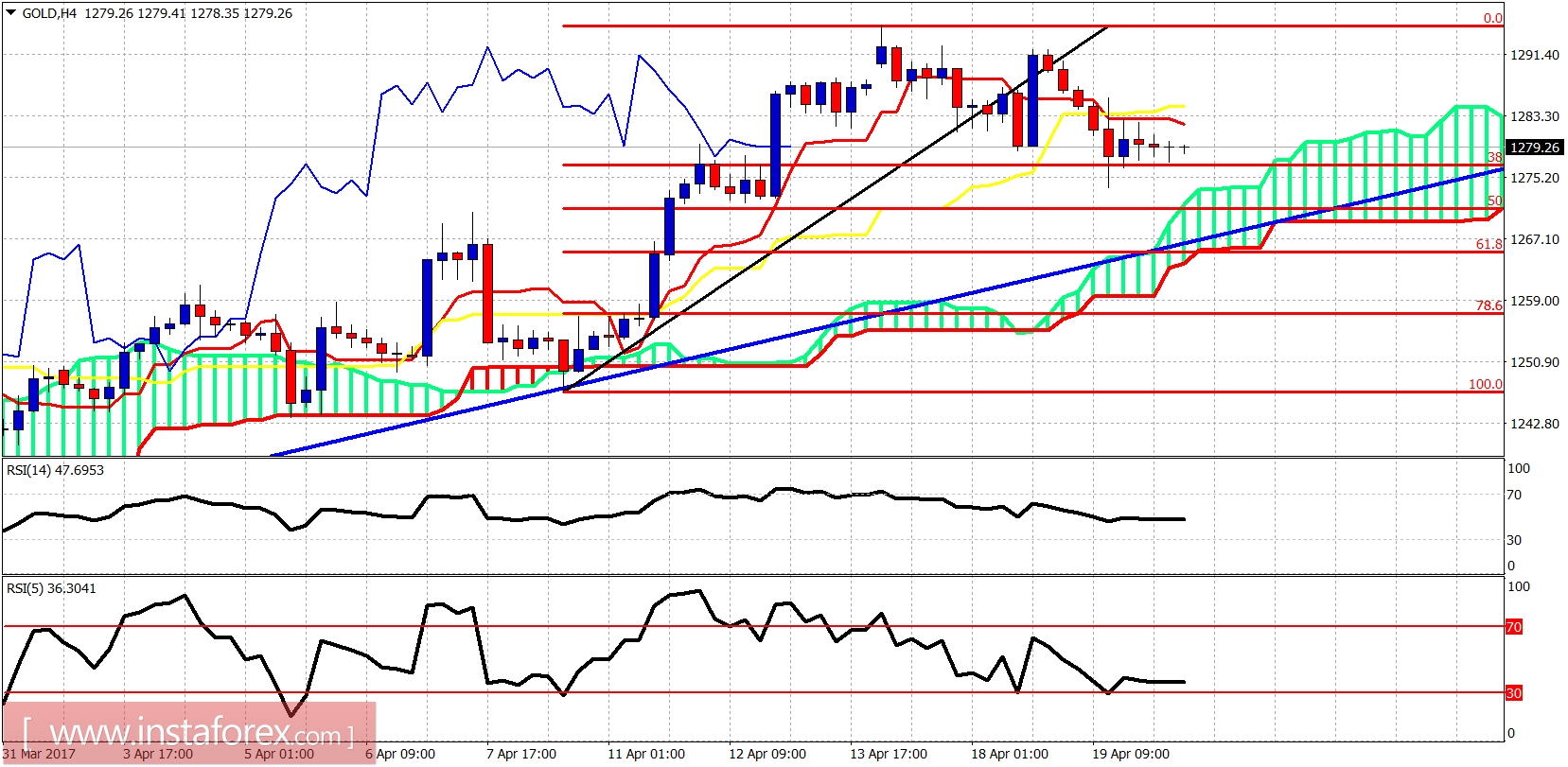

Gold price made a sharp move lower yesterday below $1,280 and almost reached our first target of $1,270. The inability to break above $1,293 pushed prices lower as we expected. Gold could continue even lower towards $1,250-60 but my overall longer-term view remains unchanged and bullish.

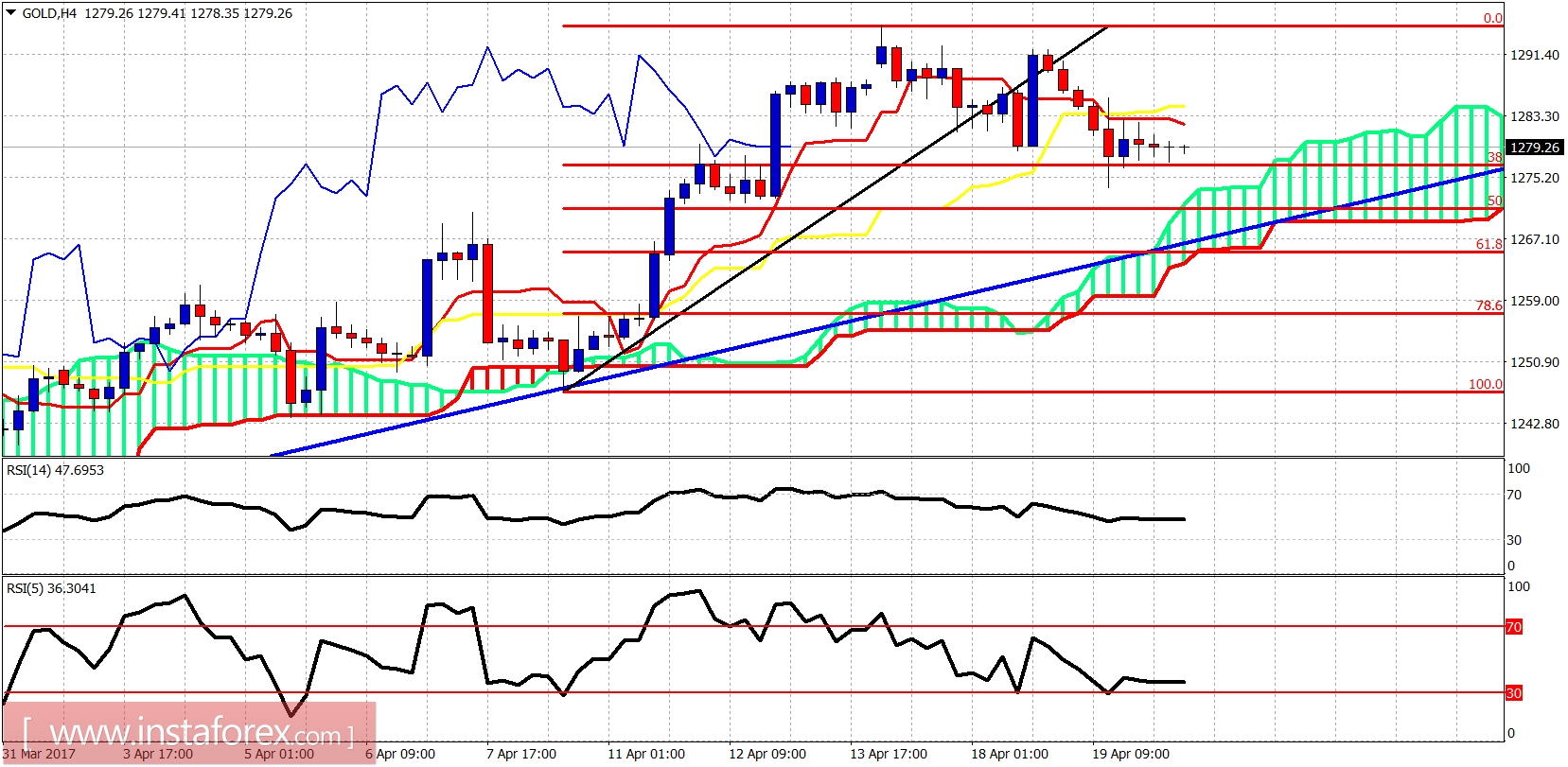

Gold price decline stopped at the 38% Fibonacci retracement. Price is above the 4-hour cloud but below both the tenkan- and kijun-sen indicators. Resistance by these two indicators is at $1,283-85. So the first resistance bulls need to break is at $1,283-85. Next and most important one is at $1,293. Short-term support is found at $1,275-70 where the Kumo is found.

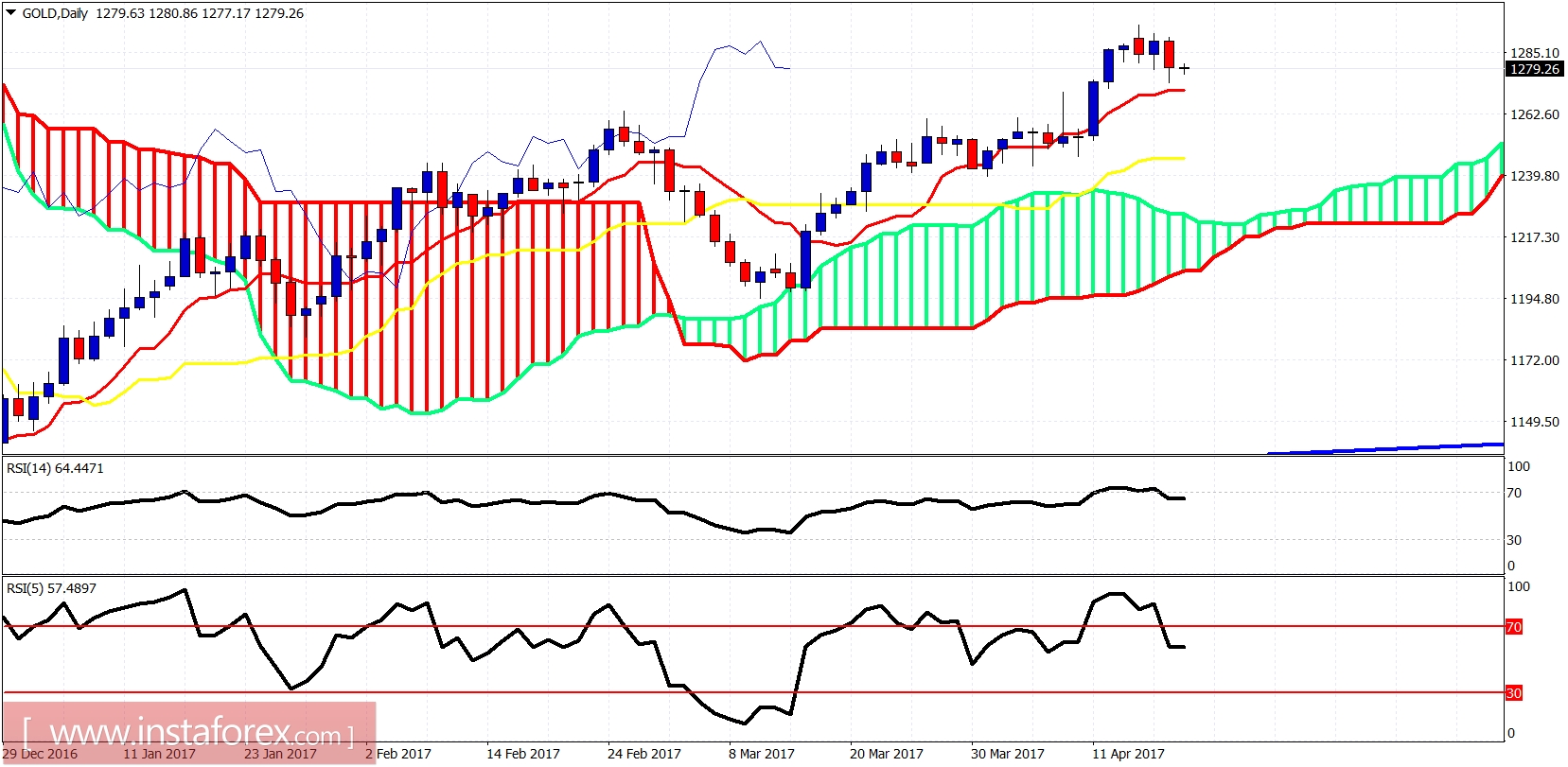

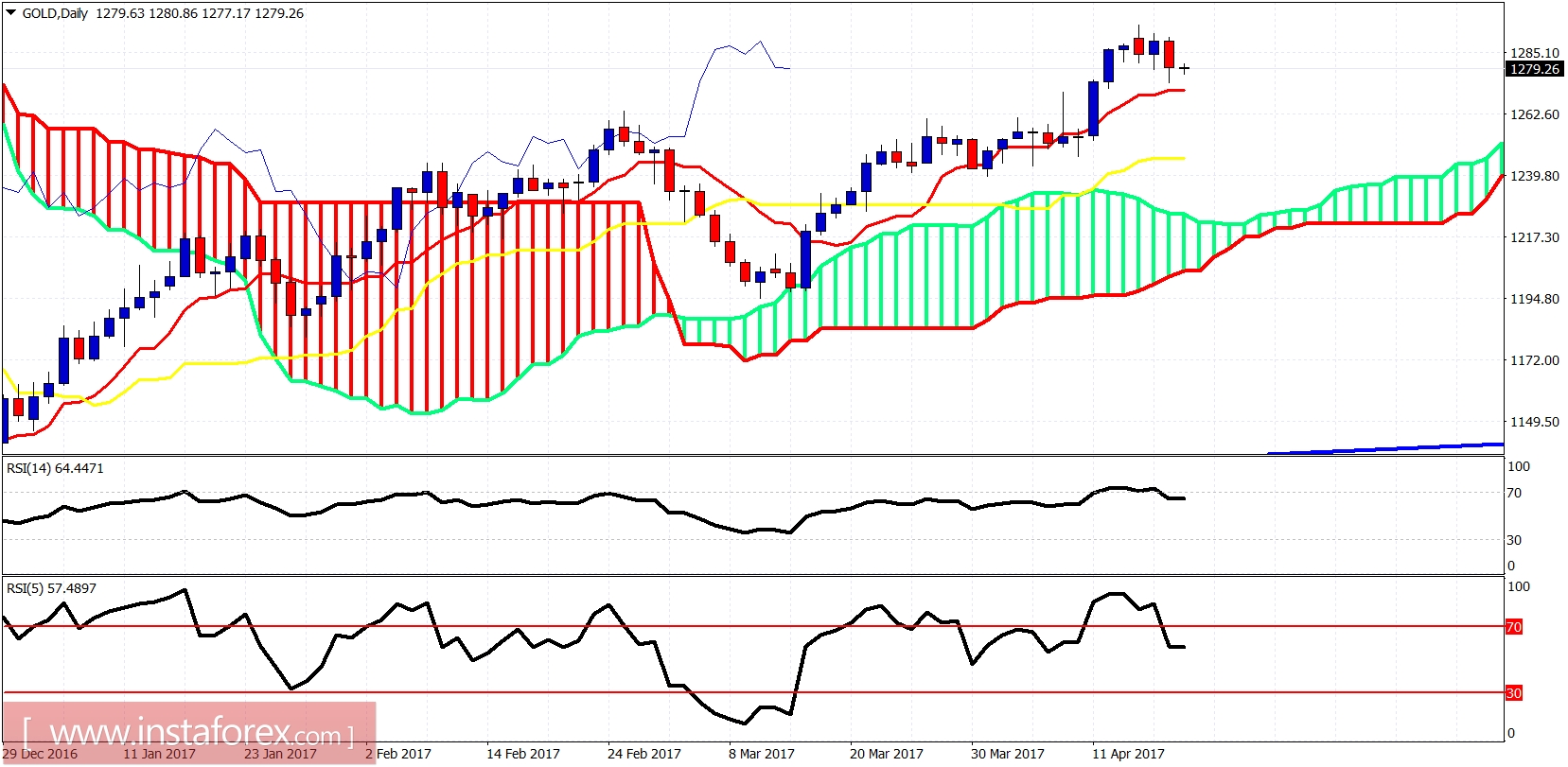

On a daily basis Gold should make a pullback towards at least the kijun-sen (yellow line indicator) at $1,245. A break and daily close below the tenkan-sen (red line indicator) at $1,270 will increase the chances of this happening. This is not the time to adding to longs. A pullback towards $1,245 will be the best opportunity.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română