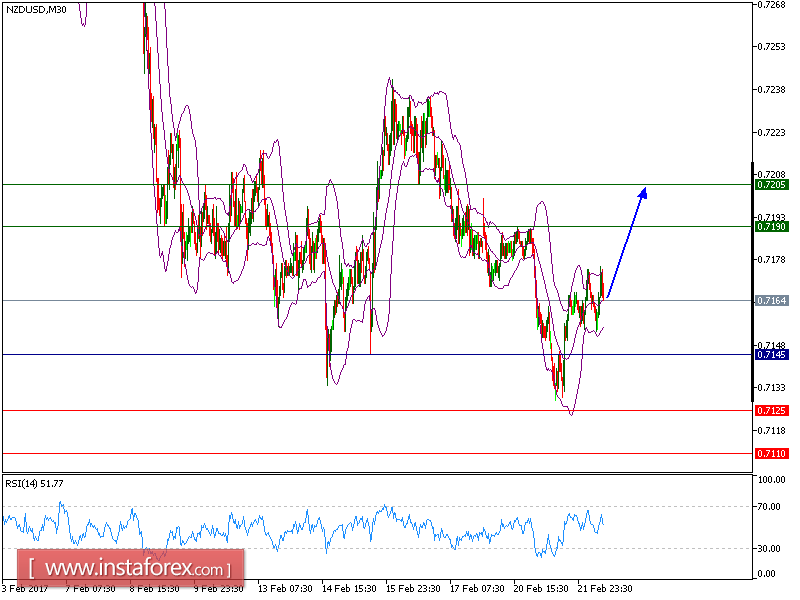

NZD/USD is expected to trade in higher range as the bias remains bullish. The pair is consolidating around its 20-period and 50-period moving averages. Nevertheless, 0.7145 is playing a key support role, which should limit the downside potential. The relative strength index is above its neutrality level at 50 and lacks downward momentum. As long as 0.7145 is support, look for a further upside toward 0.7190 and even 0.7205 in extension.

The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. Therefore, long positions are recommended with the first target at 0.7190 and the second one at 0.7205. In the alternative scenario, short positions are recommended with the first target at 0.7125, if the price moves below its pivot points. A break of this target is likely to push the pair further downwards, and one may expect the second target at 0.7110. The pivot point is at 0.7145.

Resistance levels: 0.7235, 0.7260, and 0.7260

Support levels: 0.7130, 0.7110, and 0.7070

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română