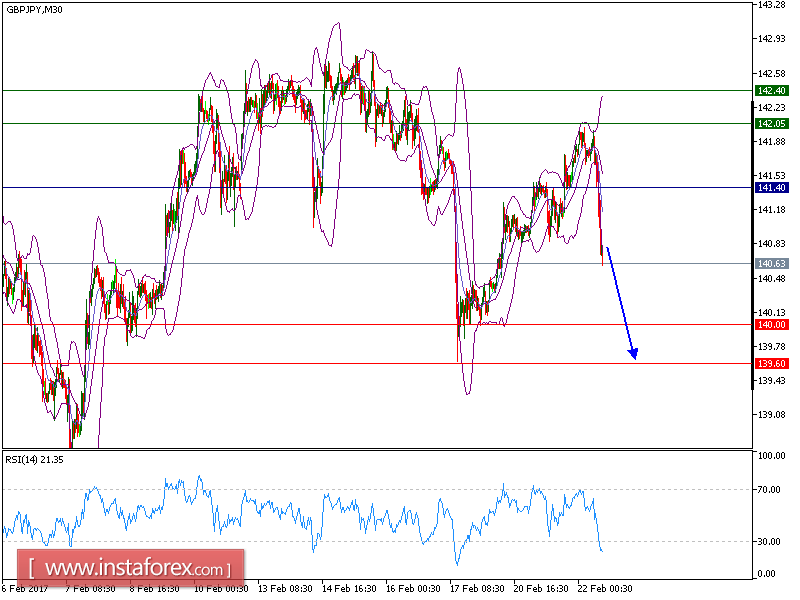

GBP/JPY is under pressure. The pair stays below its horizontal resistance at 141.40, and remains on the downside. The 20-period moving average stays below the descending 50-period moving average, which also maintains a bearish bias. Even though a continuation of the technical rebound cannot be ruled out, its extent should be limited.

As long as 141.40 holds as the key resistance, expect a return to the nearest support at 140.00 at first.

The pair is trading below its pivot point. It is likely to trade in a lower range as long as it remains below the pivot point. Short positions are recommended with the first target at 140.00. A break below this target will move the pair further downwards to 139.60. The pivot point stands at 141.40. If the price moves in the opposite direction and bounces back from the support level, it will move above its pivot point. It is likely to move further to the upside. According to that scenario, long positions are recommended with the first target at 142.05 and the second one at 142.40.

Resistance levels: 142.05, 142.40, and 143.00

Support levels: 140.00,139.60, and 139.00

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română