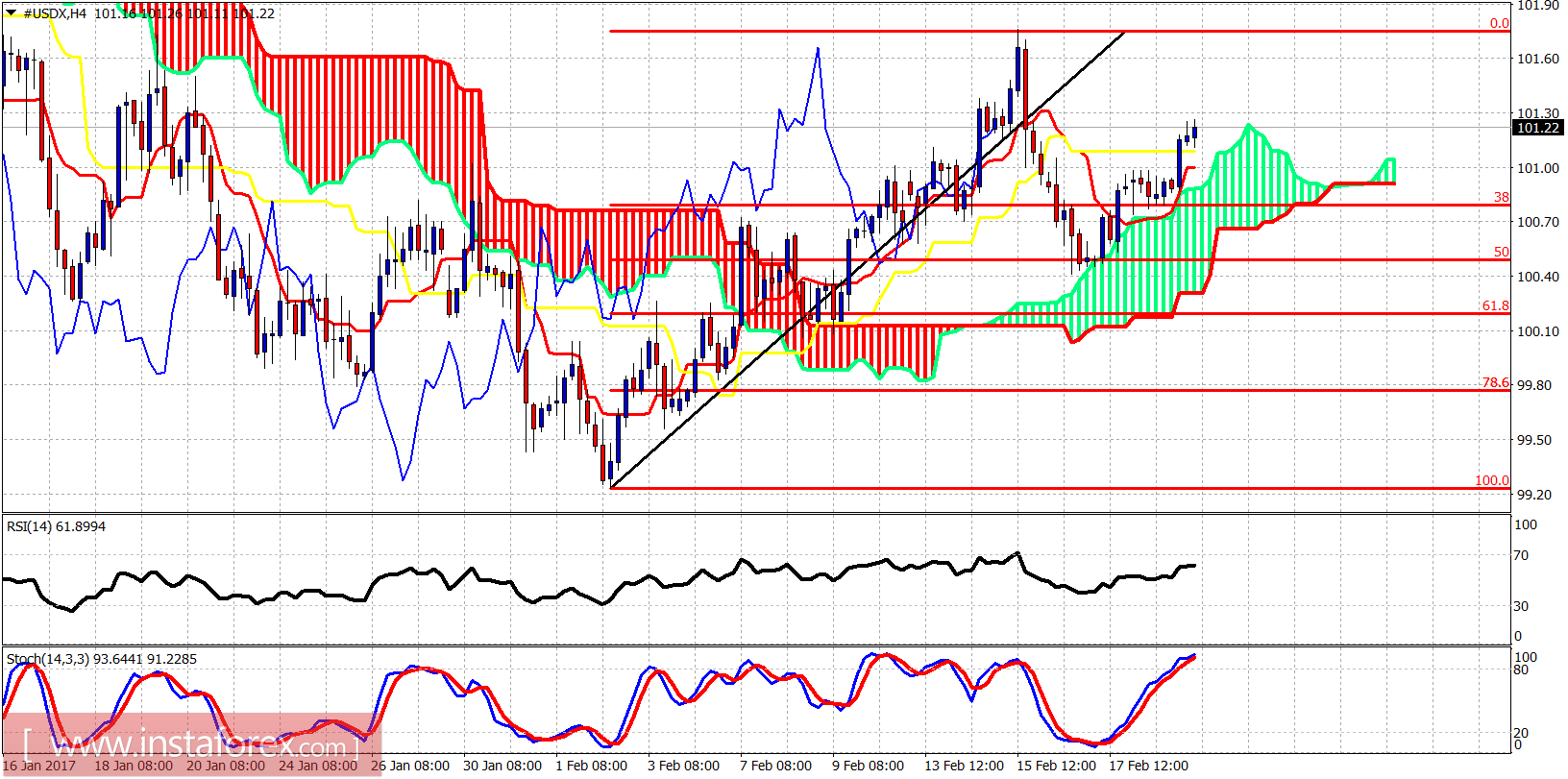

The Dollar index is making higher highs and higher lows in the short term. As explained in the previous analysis there are a lot of chances that the low at 99.25 was a cycle low and a new uptrend has started. Key for this bullish scenario is the level of 99.25.

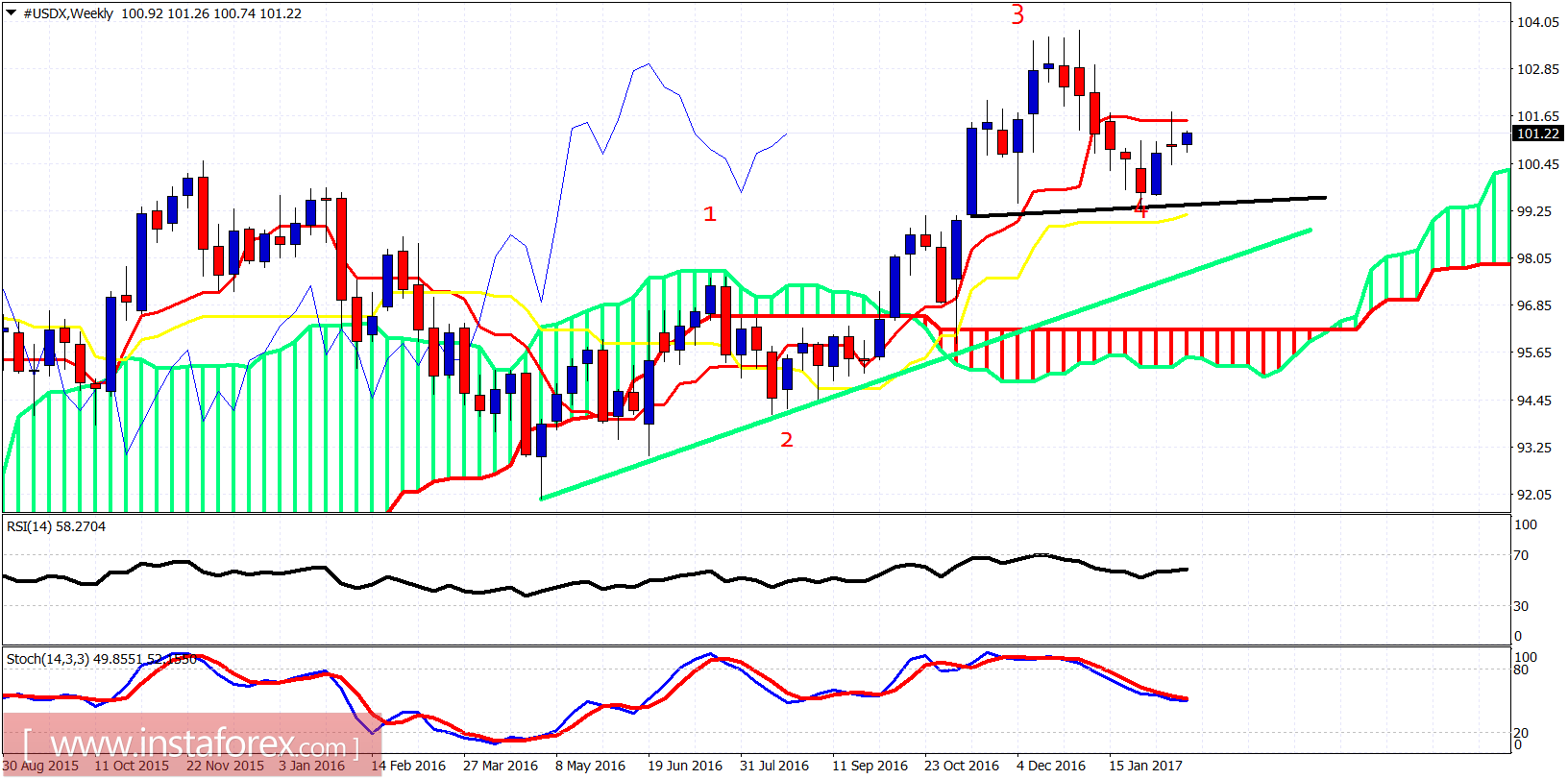

Green line - trendline support

As explained in the previous posts the low at 99.25 is very possible an important long-term low as the wave 4 could already be complete and the next legup can already have started. Resistance is at 101.70 at the tenkan-sen (red line indicator). Last week the prices got rejected there. We could still be forming the right hand shoulder, but the bears will soon need to break below 100.35 in order for this scenario to still be valid.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română