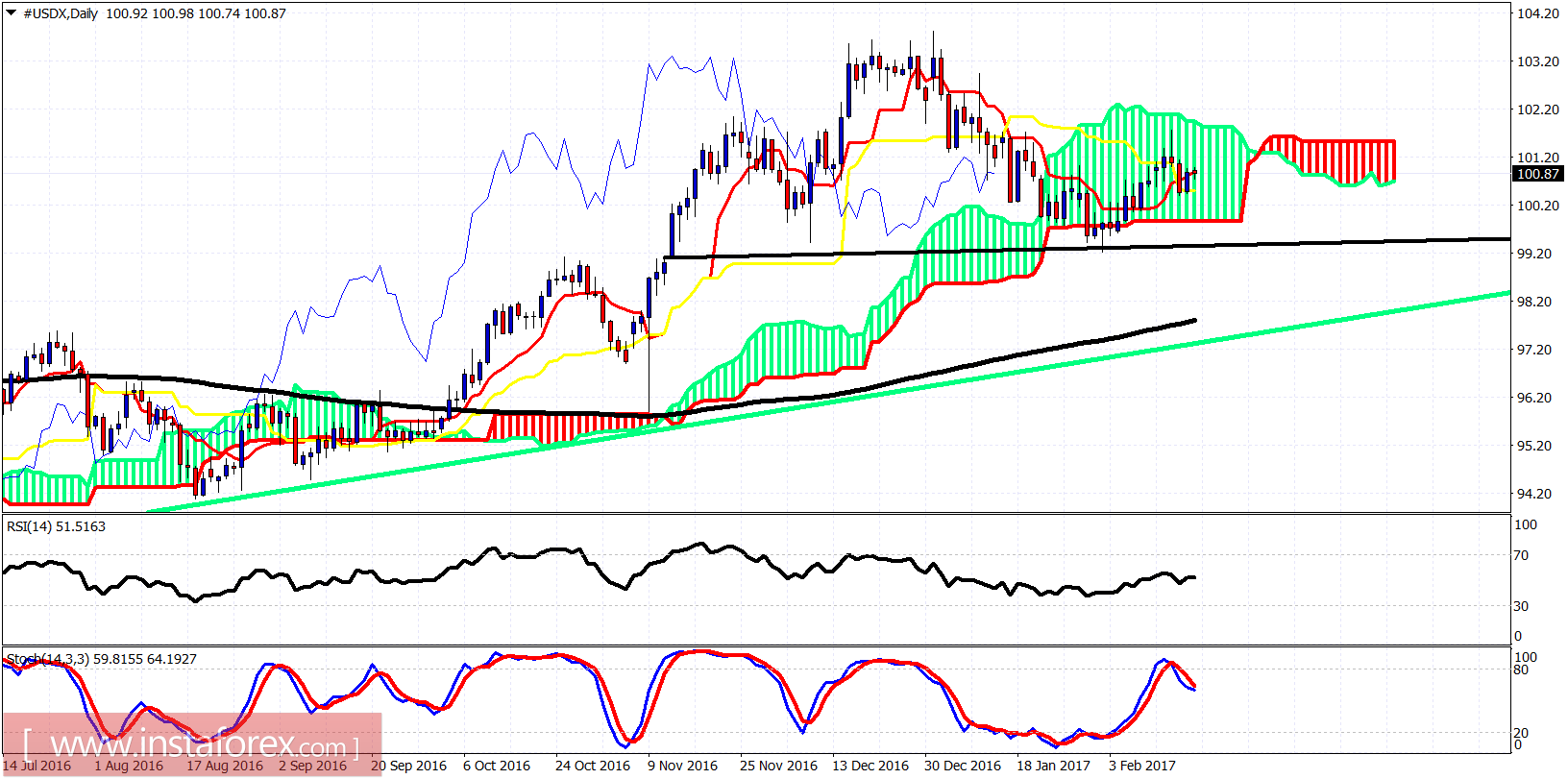

The Dollar index bounced off the cloud support as we expected in our last analysis. The Dollar index needs to break above 101.80 in order to confirm medium-term low at 99.25 and the start of a new uptrend targeting 105-110.

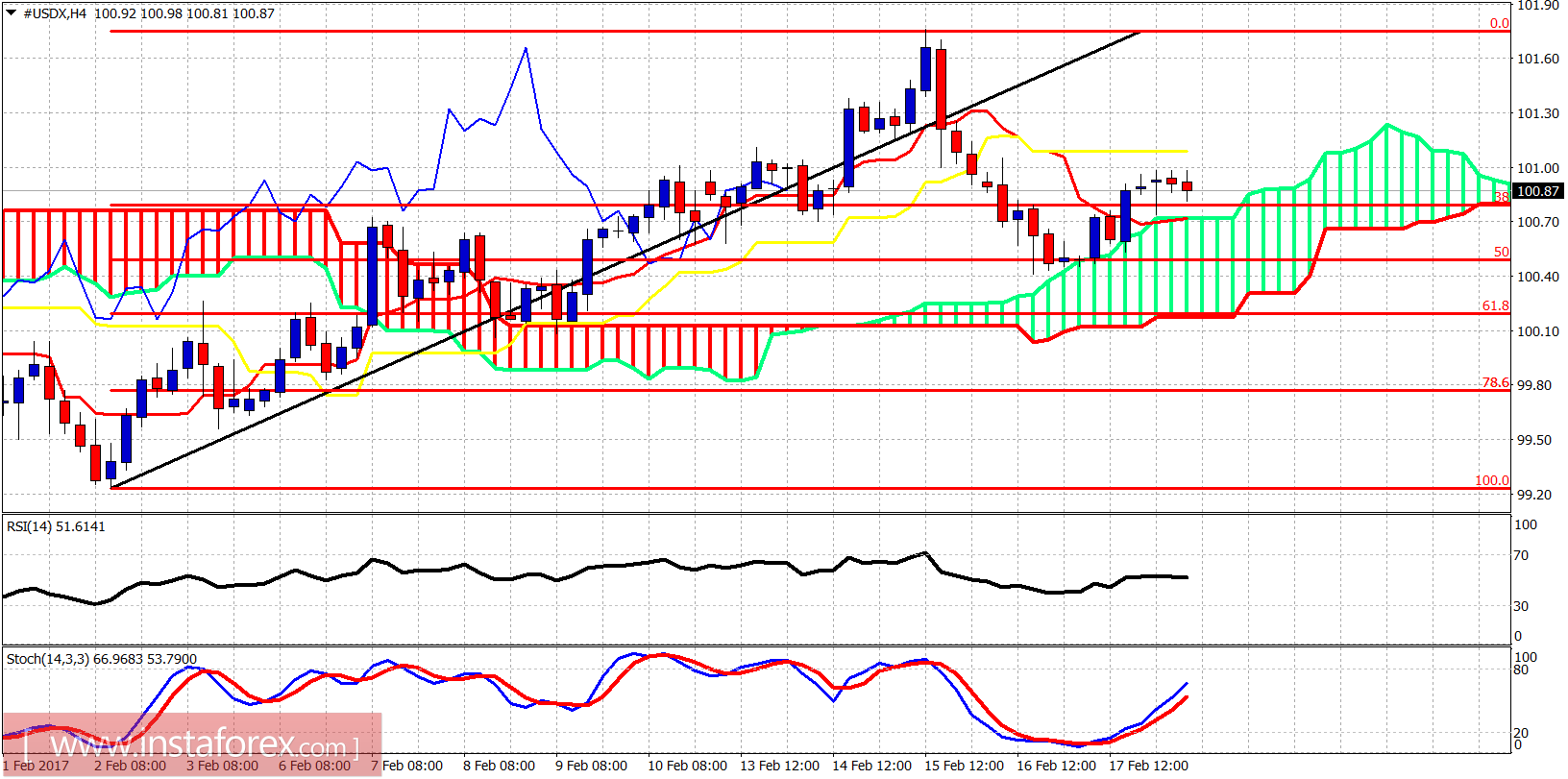

The Dollar index bounced off the 50% retracement and off the 4 hour Ichimoku cloud support. The price is now testing the kijun-sen resistance (yellow line indicator) at 101.10. Breaking above on a 4-hour close, will open the way for a push higher above 101.70. Support is at 100.70. If it is broken we should expect the Dollar index to move towards the 61.8% Fibonacci retracement support.

Black line - neckline support

Black line - neckline support Green line - long-term trendline support

On a daily basis the Dollar index is in neutral trend. The bulls need to break above 102 to regain control, while the bears need to break below the neckline in order to activate the Head and Shoulders pattern we mentioned again in our last analysis.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română