Global macro overview for 12/01/2017:

The fresh report from the US credit agency Moody's has been published recently and there is an interesting review of current and a future political scene in the Eurozone. The Moody's agency sees the political risk to rise as Germany and France are about to hold the elections. Regarding the economic outlook, Moody's sees stable credit outlook for Eurozone sovereigns in 2017 and stable, but subdued GDP growth in the EU by 1.3% in 2017 and 2018. Nevertheless, the economic growth dynamics in 2017/18 will be broadly seen neutral and the growth rates will vary from country to country. And last, but not least, Moody's view on the likelihood of further capital outflow from the Eurozone is very low. In conclusion, Moody's presented a rather optimistic and stable review of the Eurozone with the exception of political tensions before the elections. It seems not much to worry about but no reason to get excited either.

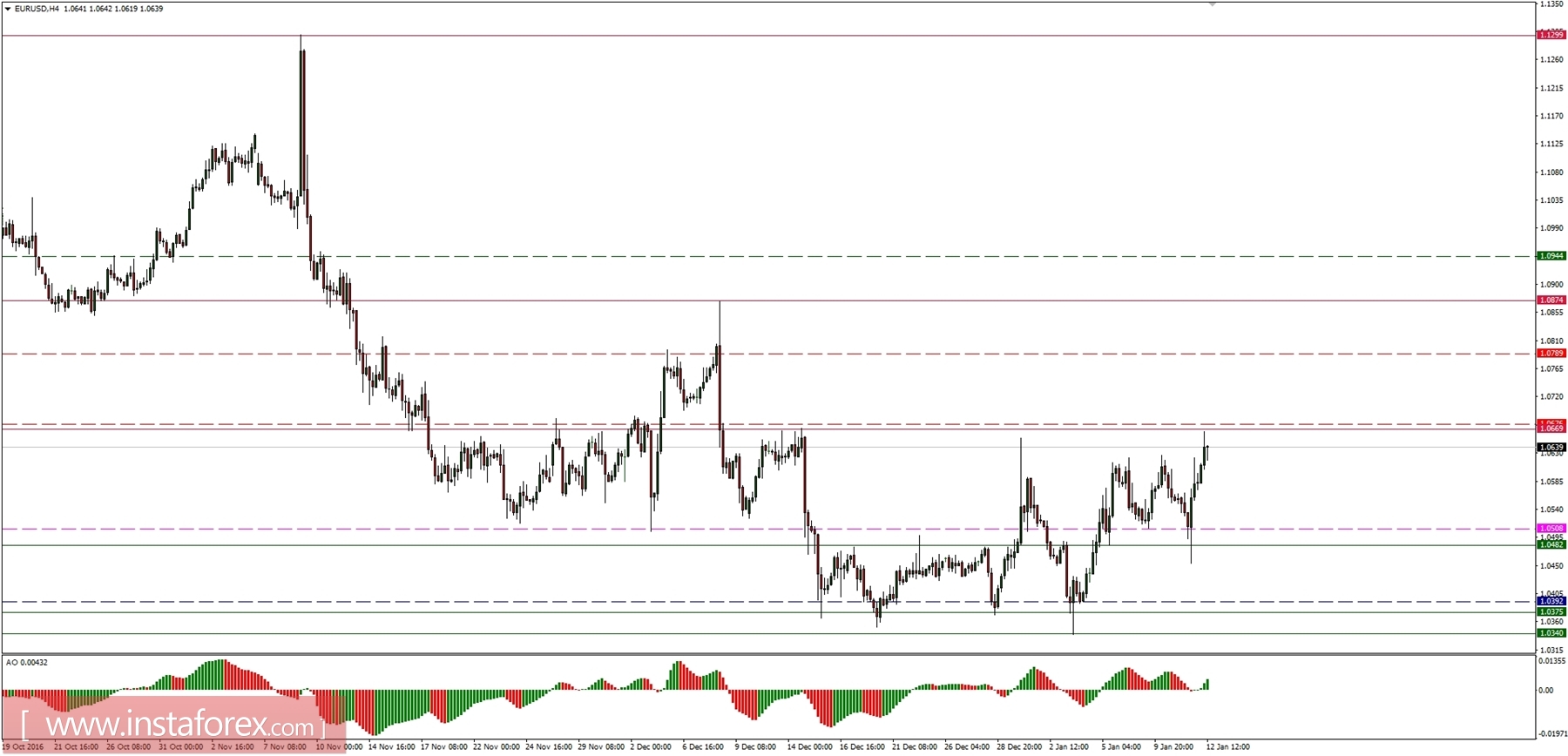

Let's now taka a look at the EUR/USD technical picture in the 4H time frame. After a recent low at the level of 1.3040, the market bounced higher and now is trading just below the technical resistance at the level of 1.0669. Nevertheless, it is still hard to say what side of the market, bulls, or bears, is currently in control as the price keeps trading in the well-defined trading range. Only a sustained breakout above the level of 1.0669 would temporarily move the control to the bullish camp and the next important technical resistance at the level of 1.0875 would have been be tested.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română