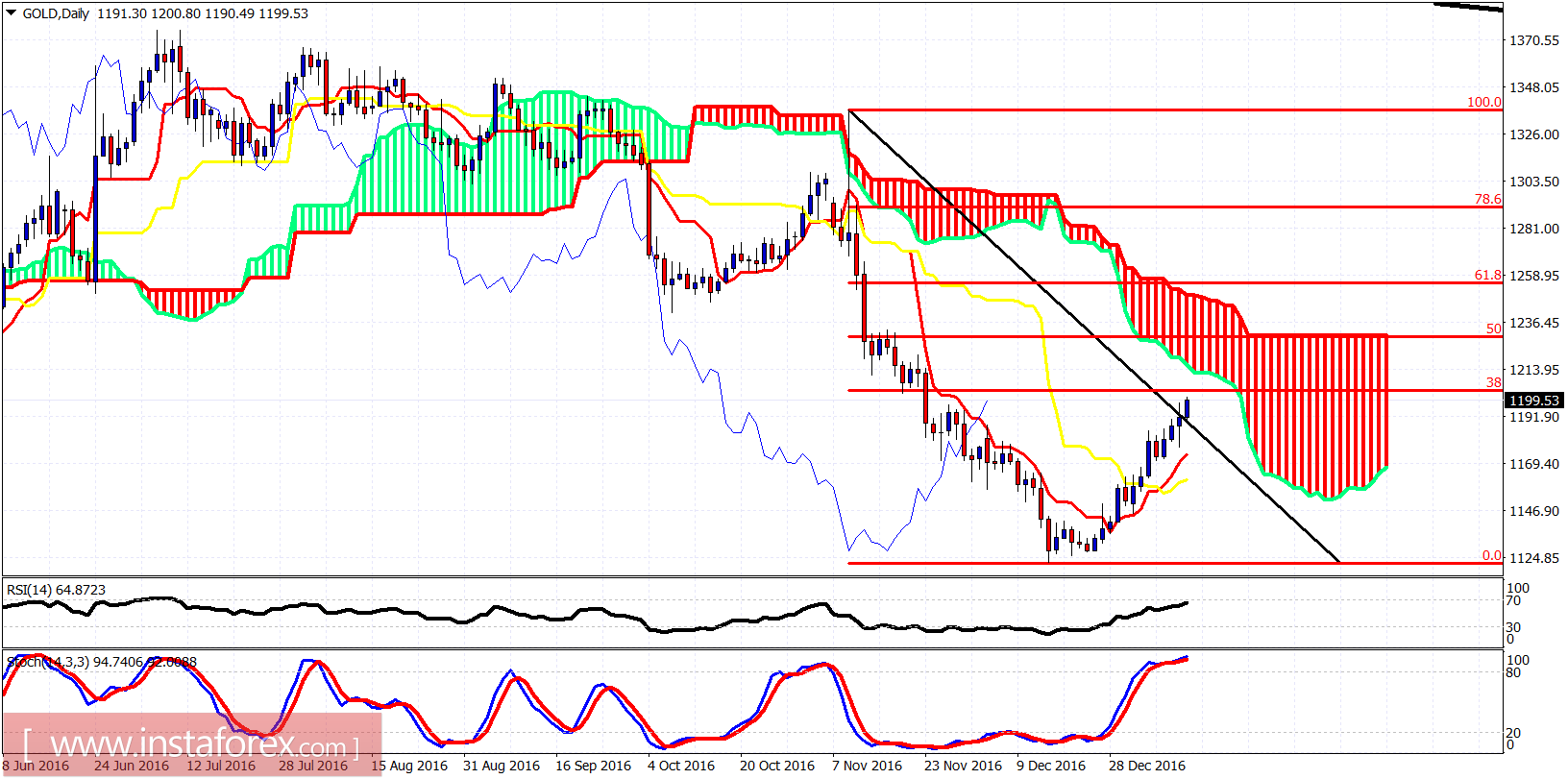

Gold price is making new highs at $1,200 as we have been expecting for some time now. Gold price could continue higher towards $1,220 but Gold bulls need to be very cautious as there are bearish short-term divergence signs. A pullback is justified towards $1,170-60.

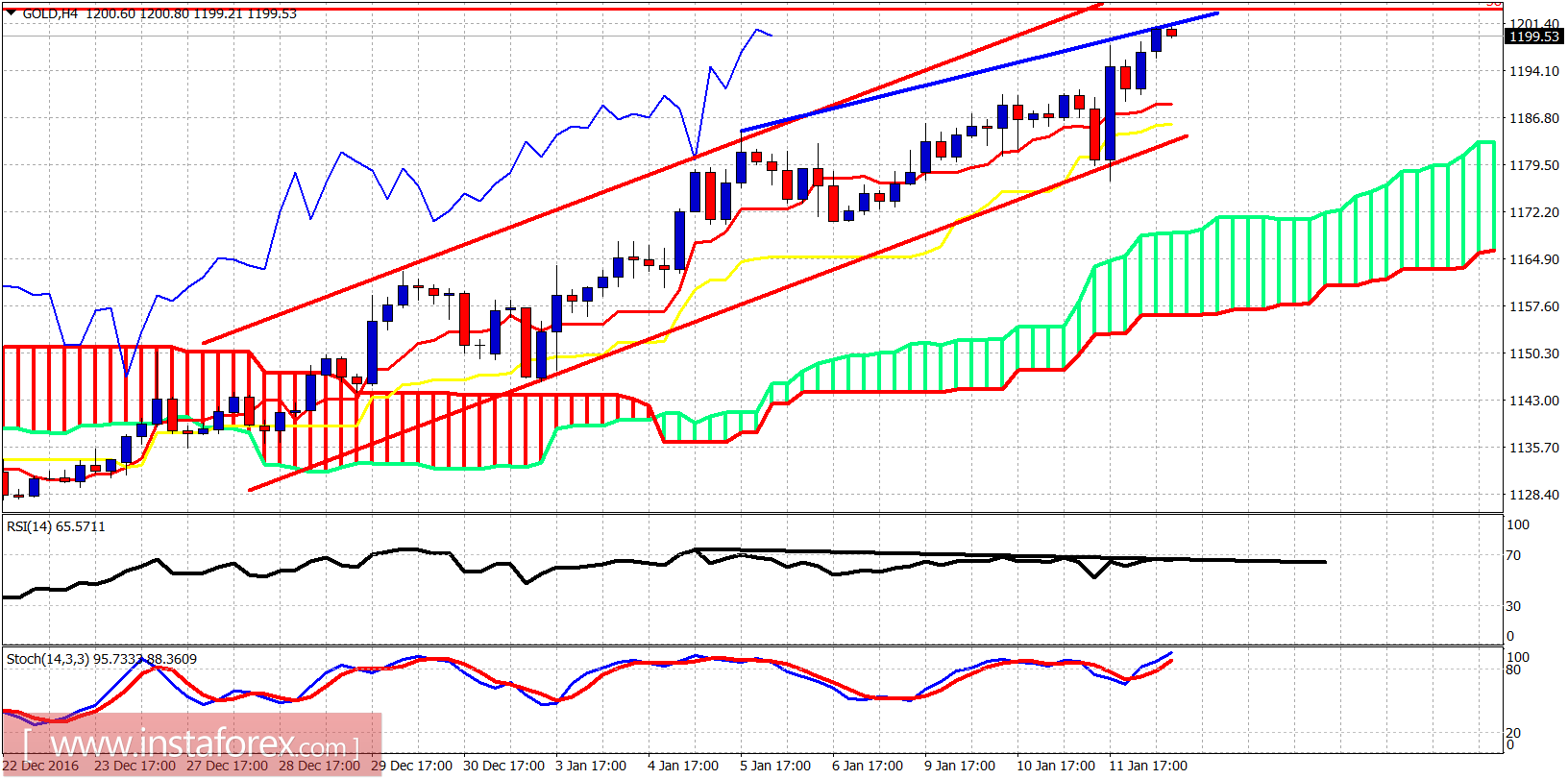

Blue line- new highs

Black line - diverging RSI

Gold price continues to trade above the Ichimoku cloud and inside the red bullish channel. There are divergence signs in the 4-hour RSI and this is an important warning for the short-term momentum. We could see $1,210-20 but Gold bulls should be prepared for a pullback towards at least $1,170 where the 38% Fibonacci retracement is found.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română