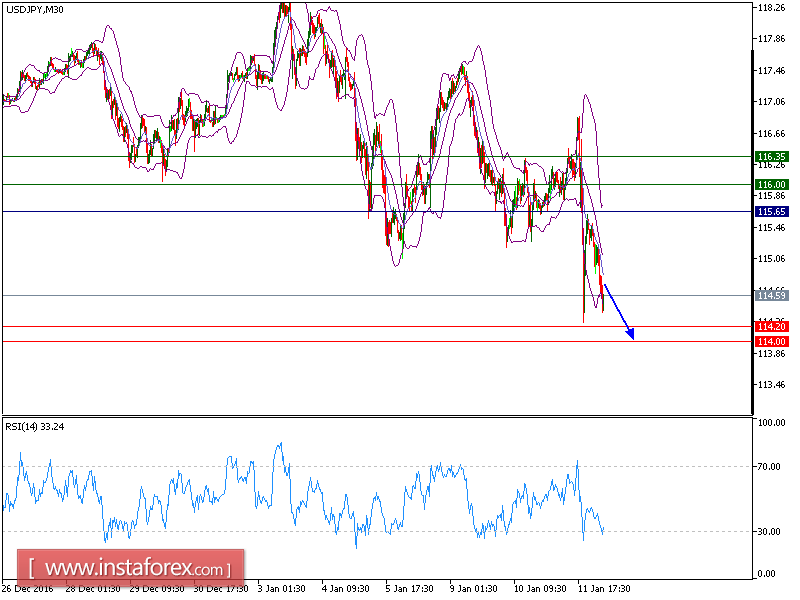

USD/JPY is expected to trade in a lower range as the key resistance is at 115.65. The pair accelerated on the downside last night after the break below its intraday rising trend line. Even though a technical rebound cannot be ruled out at the current stage, its extent should be limited. Besides, the falling 20-period moving average acts as a strong resistance.

Hence, as long as 115.65 is not clearly surpassed, look for a return to 114.20 and 114.00 in extension.

Recommendation:

The pair is trading below its pivot point. It is likely to trade in a lower range as long as it remains below the pivot point. Short positions are recommended with the first target at 114.20. A break below this target will move the pair further downwards to 114.00. The pivot point stands at 115.65. If the price moves in the opposite direction and bounces back from the support level, it will move above its pivot point. It is likely to move further to the upside. According to that scenario, long positions are recommended with the first target at 116.00 and the second one at 116.35.

Resistance levels: 116.00, 116.35, 116.75

Support levels: 114.20, 114.00, 113.70

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română