The euro and the pound managed to maintain an advantage over the dollar despite a strong correction observed in risk assets during the second half of the day.

Yesterday's comments from Federal Reserve officials strengthened the U.S. dollar, but buyers were ultimately unable to hold their positions. The euro still has the potential for further growth, but this will require favorable economic data from the eurozone countries. It seems that today should present no difficulties in that regard. The pound may also respond positively to solid labor market data.

In the first half of the day, we'll see the release of Germany's ZEW Economic Sentiment Index and the ZEW Current Conditions Index. Similar sentiment indicators for the eurozone will also be published alongside industrial production data. The day will conclude with a speech by European Central Bank President Christine Lagarde, who is unlikely to touch on monetary policy prospects ahead of Thursday's ECB meeting, where traders expect more concrete answers.

As mentioned earlier, the UK will publish figures on jobless claims. The number of unemployment benefit claims is an important indicator of the health of the British labor market. An increase signals worsening employment conditions, while a decline indicates improvement. Various factors, including overall economic conditions, changes in employment legislation, and seasonal trends, influence this indicator. The UK unemployment rate will be equally significant. A high unemployment rate may suggest an economic slowdown, putting pressure on the pound. Otherwise, the GBP/USD pair may continue to rise.

The Mean Reversion strategy is preferred if the data matches economists' expectations. The Momentum strategy is more appropriate if the data significantly exceeds or falls short of expectations.

Momentum Strategy (Breakout):

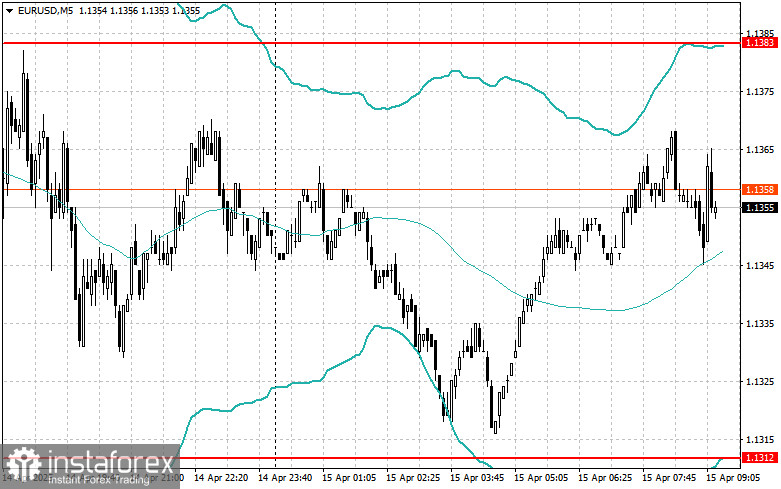

EUR/USD

Buying on a breakout above 1.1377 could lead to growth toward 1.1467 and 1.1562

Selling on a breakout below 1.1299 could result in a decline toward 1.1237 and 1.1167

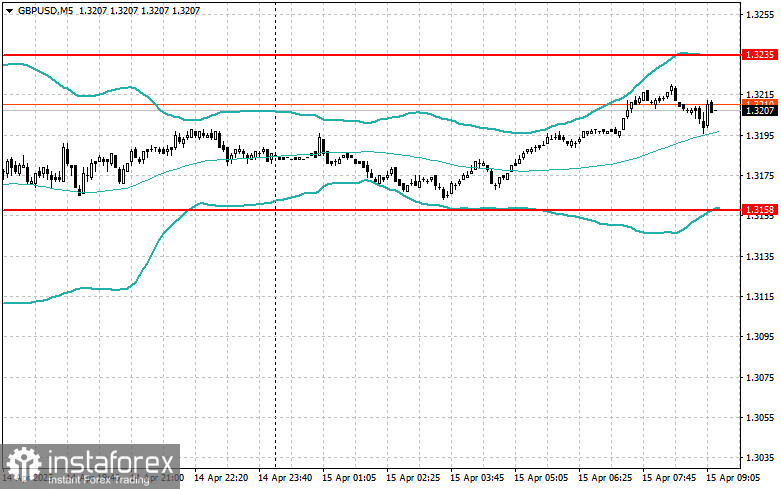

GBP/USD

Buying on a breakout above 1.3210 could push the pound to 1.3262 and 1.3315

Selling on a breakout below 1.3160 could send the pair down to 1.3090 and 1.3030

USD/JPY

Buying on a breakout above 143.29 could lead to growth toward 143.77 and 144.17

Selling on a breakout below 142.86 could lead to dollar sell-offs toward 142.32 and 141.82

Mean Reversion Strategy (Pullbacks):

EUR/USD

Look to sell after a failed breakout above 1.1383 followed by a return below this level

Look to buy after a failed breakout below 1.1312 followed by a return above this level

GBP/USD

Look to sell after a failed breakout above 1.3235 followed by a return below this level

Look to buy after a failed breakout below 1.3158 followed by a return above this level

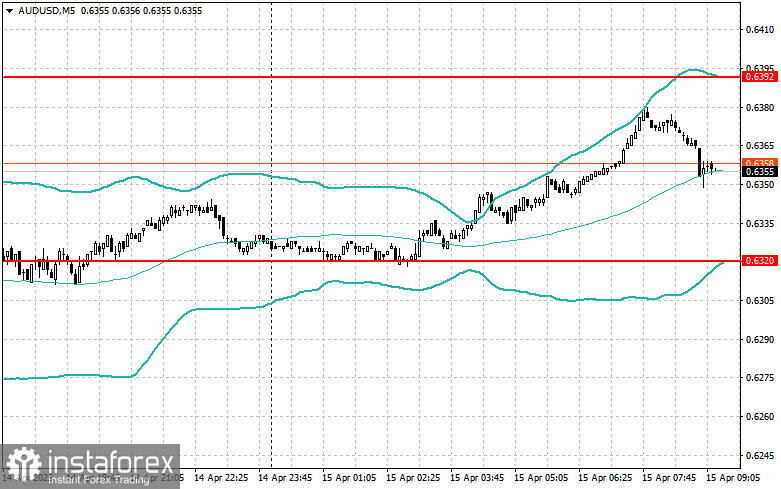

AUD/USD

Look to sell after a failed breakout above 0.6392 followed by a return below this level

Look to buy after a failed breakout below 0.6320 followed by a return above this level

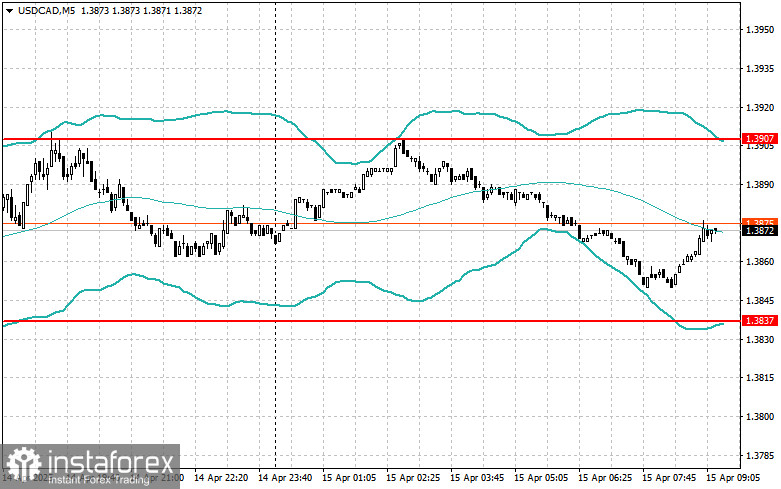

USD/CAD

Look to sell after a failed breakout above 1.3907 followed by a return below this level

Look to buy after a failed breakout below 1.3837 followed by a return above this level

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română