The euro and the pound have shown that no one is ready for a major sell-off. However, there was no active support from big market participants positioned for long positions in risky assets either.

As a result, during the U.S. session, the dollar posted gains, recovering from earlier losses. The market interpreted the released data as a confirmation of the U.S. economy's stability, which reduces the likelihood of a sharp rate cut by the Federal Reserve. The upward revision of Q4 GDP indicates that economic activity in the United States remains relatively high level. This may ease concerns about an impending recession and support the Fed's current stance on interest rates.

Today could bring renewed pressure on the euro, and the reason for such a development lies in the upcoming release of a series of macroeconomic indicators from Germany. The first act of this economic drama will be the publication of the GfK consumer climate index, a forward-looking indicator that is highly sensitive to household sentiment and, consequently, to their willingness to spend. Weak readings from this index may signal broader issues in the economy.

The climax will be the release of data on the change in the number of unemployed people in Germany and the overall unemployment rate. A rise in jobseekers, combined with an increase in the unemployment rate, could seriously undermine confidence in the German economy's resilience, which is Europe's economic engine. Such data may trigger a wave of euro selling as investors reassess the region's growth outlook and anticipate a more dovish stance from the European Central Bank.

The Mean Reversion strategy is recommended if the data aligns with economists' expectations. If the figures deviate significantly (higher or lower) from expectations, the Momentum strategy is preferred.

Momentum Strategy (on breakout):

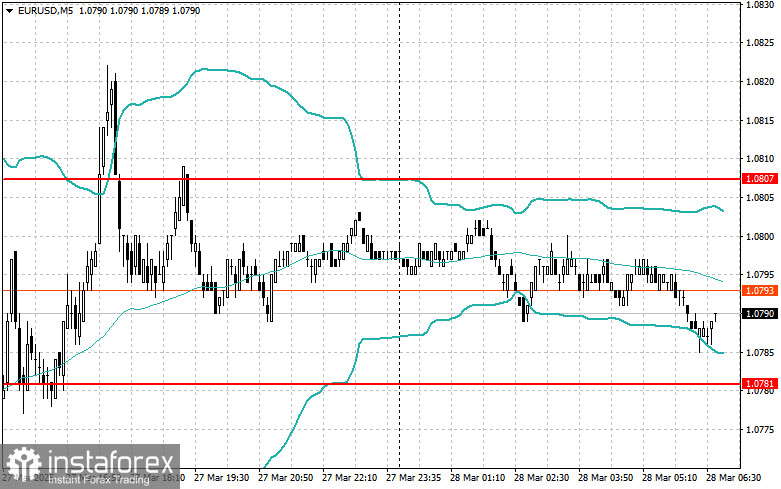

EUR/USD

Buying on a breakout of the 1.0795 level could lead to a rise toward 1.0836 and 1.0852.

Selling on a breakout of 1.0770 could lead to a decline toward 1.0736 and 1.0700.

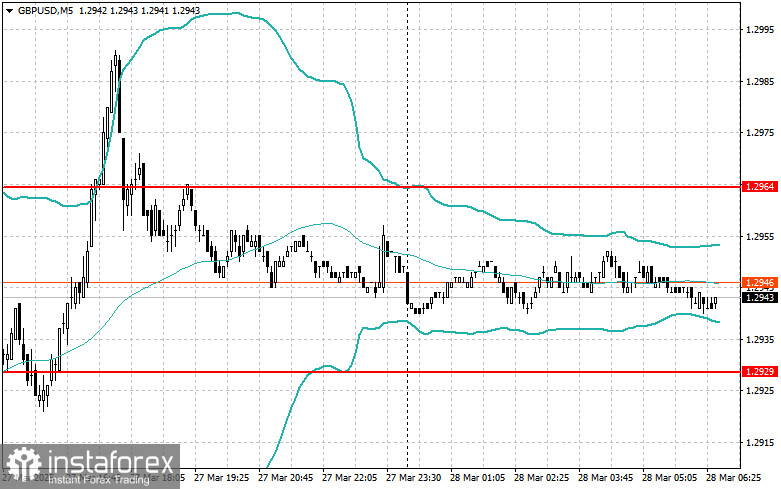

GBP/USD

Buying on a breakout of 1.2960 could push the pound toward 1.2988 and 1.3020.

Selling on a breakout of 1.2935 could lead to a decline toward 1.2910 and 1.2890.

USD/JPY

Buying on a breakout of 151.05 could push the dollar toward 151.35 and 151.75.

Selling on a breakout of 150.70 could trigger a decline toward 150.50 and 150.18.

Mean Reversion Strategy (on pullbacks):

EUR/USD

I will look to sell after a failed breakout above 1.0807 on a return below that level.

I will look to buy after a failed breakout below 1.0781 on a return back above that level.

GBP/USD

I will look to sell after a failed breakout above 1.2964 on a return below that level.

I will look to buy after a failed breakout below 1.2929 on a return back above that level.

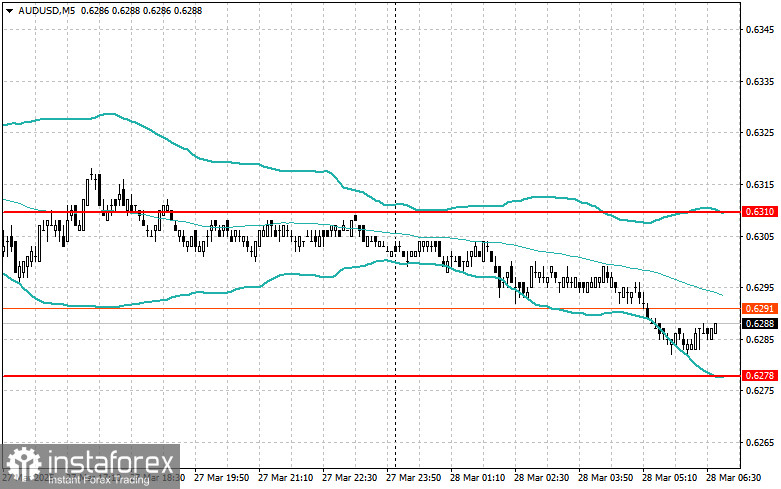

AUD/USD

I will look to sell after a failed breakout above 0.6310 on a return below that level.

I will look to buy after a failed breakout below 0.6278 on a return back above that level.

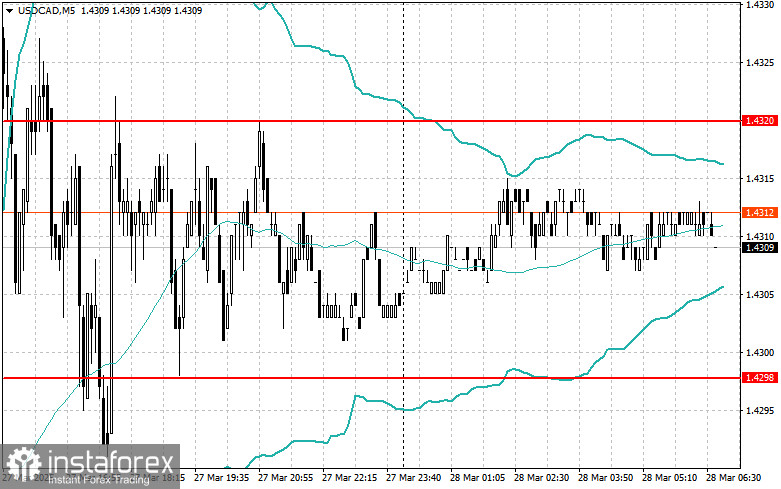

USD/CAD

I will look to sell after a failed breakout above 1.4320 on a return below that level.

I will look to buy after a failed breakout below 1.4298 on a return back above that level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română