The brief rally for the EUR/USD currency pair didn't last long. A slowdown in the Personal Consumption Expenditures (PCE) index—an inflation gauge preferred by the Federal Reserve—to 0.1% month-over-month in November, along with statements from FOMC officials indicating that monetary easing would continue into 2025, seemed to trigger a corrective response for the main currency pair. However, comments from Donald Trump on social media and emerging vulnerabilities in the euro brought the situation back to square one.

The president-elect of the United States does not intend to spare anyone. He initially focused on Mexico, Canada, and China. Then, he turned his attention to BRICS countries. However, he didn't stop there; he announced that if the European Union did not increase its purchases of oil and gas from the U.S., he would impose tariffs on European imports. This decision put additional pressure on the euro, as such tariffs could further slow down an already fragile European economy.

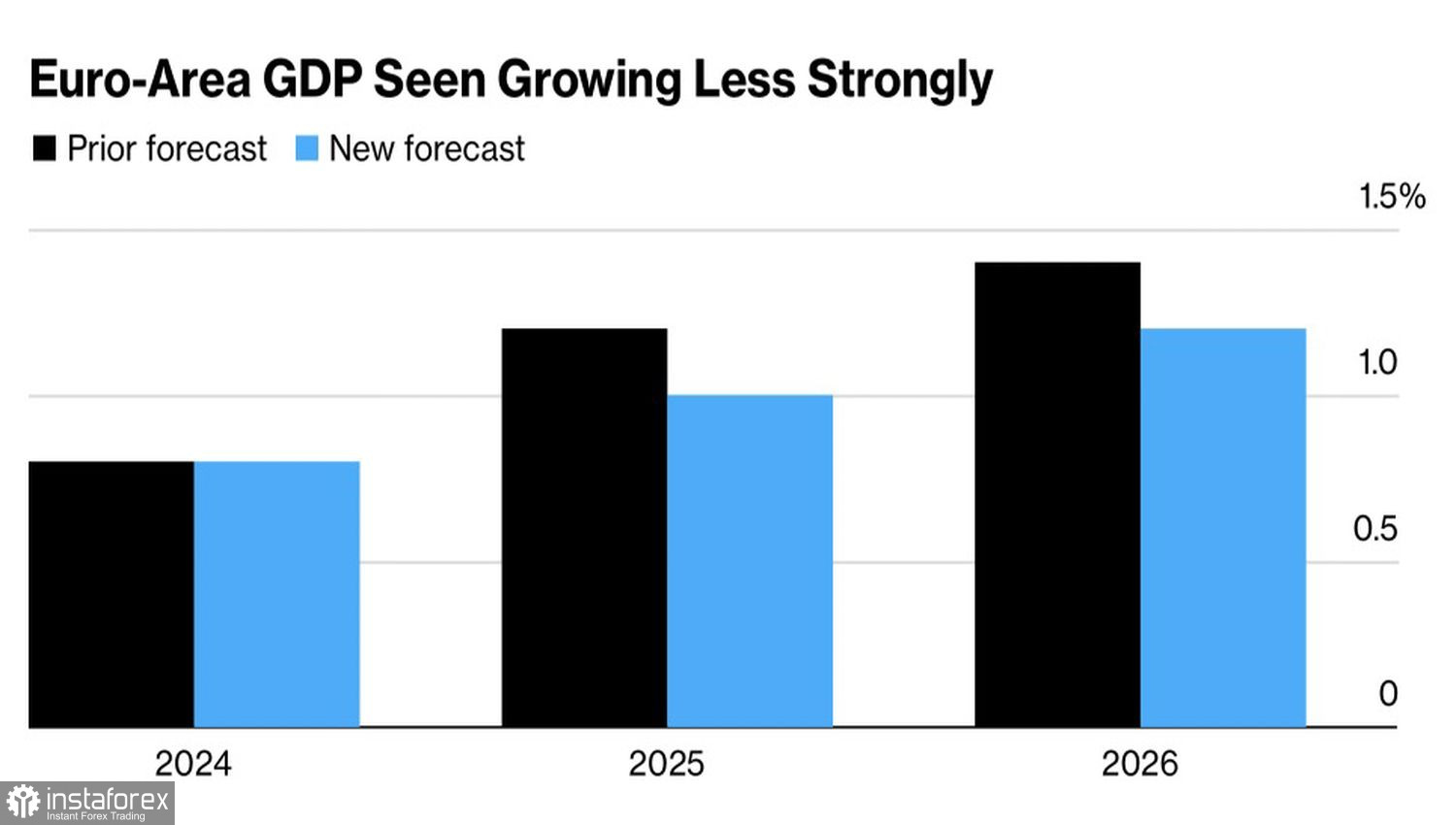

Recent forecasts from Bloomberg experts indicate that the eurozone's GDP is expected to grow by 1% in 2025, a decrease from the previously anticipated 1.2%. In 2026, growth is projected to be 1.2%, lower than the earlier estimate of 1.4%. These revised estimates are below the European Central Bank's projections, which further emphasize the vulnerability of the euro area.

Eurozone Economic Trends and Forecasts

Germany, once considered the growth engine of Europe, is now causing further economic decline. Analysts forecast that its economy will expand by only 0.4% next year, followed by a 1% growth the year after that.

In contrast, the U.S. economy appears to be performing well. The Atlanta Fed's leading indicator suggests a GDP growth of 3.1% in the fourth quarter. Futures markets show a 91% probability that the Fed will pause its monetary easing cycle in January. Meanwhile, the ECB intends to continue reducing interest rates. Christine Lagarde has stated that the ECB is approaching the point where it can assert that inflation has been brought down to the target level of 2%. If this is the case, there would be little reason to maintain high borrowing costs. The increasing interest rate differential favoring the U.S. could lead to a further decline in the EUR/USD exchange rate.

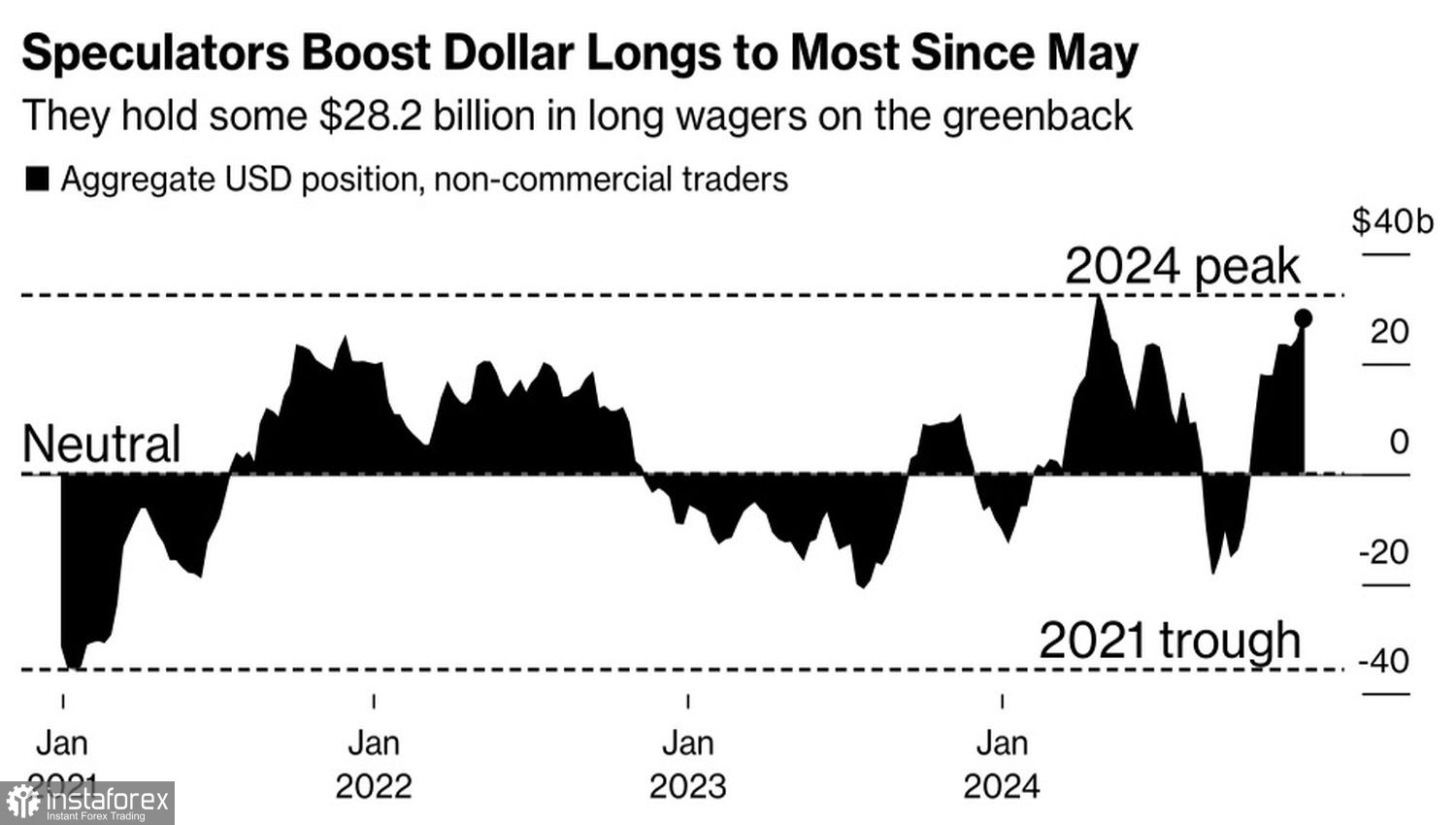

Hedge funds and asset managers are increasingly adopting net long positions on the dollar, reaching their highest levels since May. According to HSBC, the dollar is "hitting all the right notes" and shows no signs of weakening in 2025. Additionally, Wells Fargo suggests that Trump's political agenda, including tariffs, will further boost the USD index rally.

Speculative Positions in the U.S. Dollar

It is highly likely that the U.S. dollar will break tradition and end December in a positive position. This month is typically considered seasonally weak for the American currency, which usually declines at year-end. However, every rule has its exceptions.

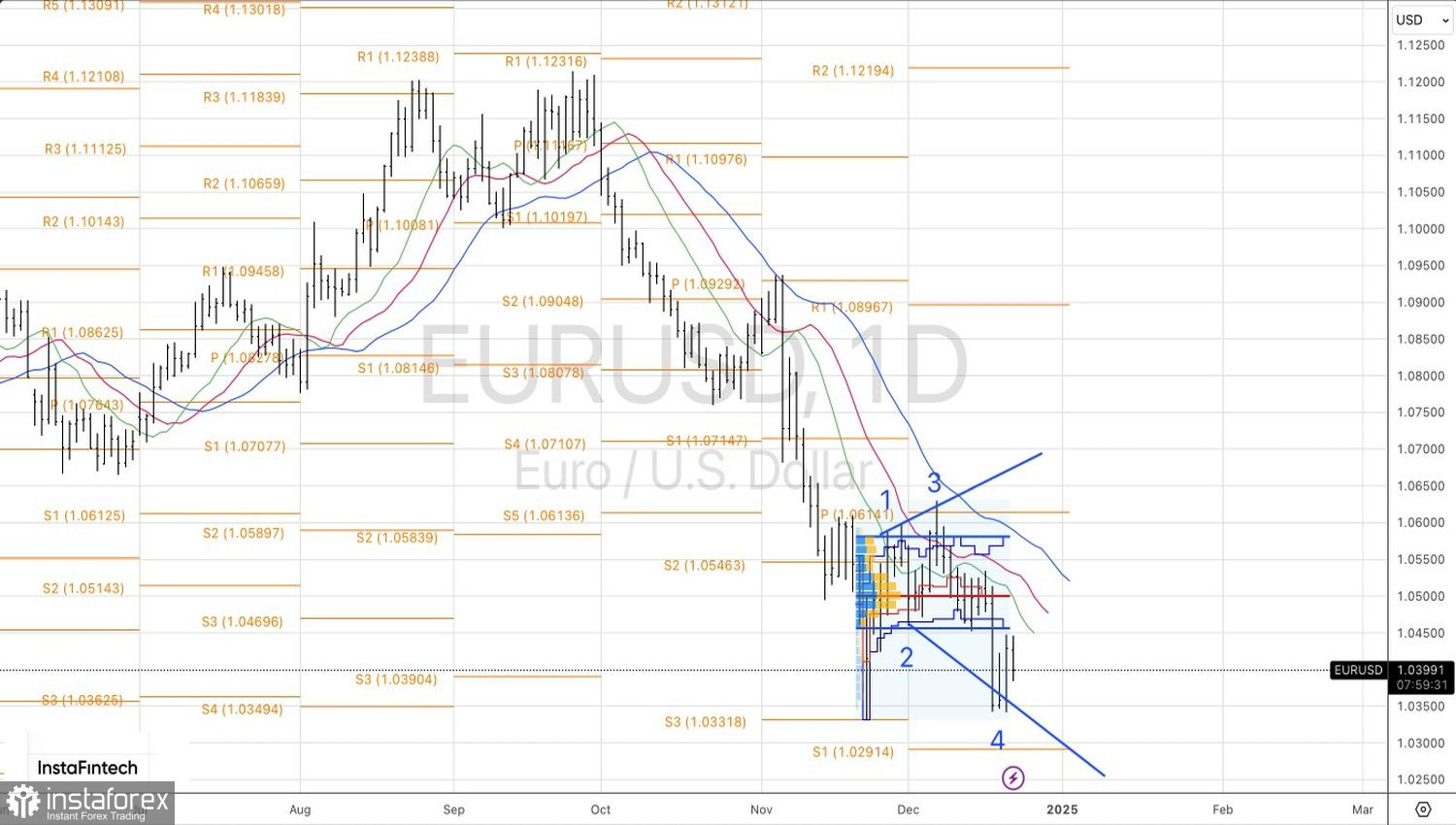

In the daily chart, another attempt by EUR/USD bulls to launch a counterattack has ended in failure, further demonstrating their weakness. The recent retracement offers an opportunity to open or expand previously established short positions, targeting levels of 1.012 and 1.000. Sticking to the current strategy of selling on pullbacks remains the most logical course of action.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română