The GBP/USD currency pair plummeted on Wednesday evening, mirroring the movement of the EUR/USD pair. This is hardly surprising given the nature of the Federal Reserve's meeting. However, on Thursday, the Bank of England held its meeting, and the pound recovered nearly 50% of the previous day's losses before the announcement. The basis for this recovery is unclear, but the British currency demonstrated its resilience—a trait we have frequently highlighted. The pound showed gains where none were expected, but the BoE's meeting results again exerted pressure on it.

The BoE delivered no surprises to the market. The interest rate remained unchanged at 4.75%, as widely anticipated. However, three members of the Monetary Policy Committee (MPC) voted for a rate cut rather than just one, as previously forecasted. This outcome signals a more dovish stance from the BoE than many had expected. We have repeatedly noted in our analyses that the BoE's current hawkish position merely sets the stage for faster and deeper rate cuts in the future. The Bank is still grappling with high inflation, but let us attempt to project the situation into next year.

Andrew Bailey stated that the BoE might lower rates four times by 0.25% each in 2025. We learned Wednesday evening that the Federal Reserve is planning 1–2 rate cuts next year. This implies that the BoE will lower rates at least twice as aggressively as the Fed. Can the British pound initiate a new upward trend under such fundamental conditions? We are highly skeptical.

The BoE's official statement noted that the current and next year GDP growth rates are expected to be lower than previously forecasted. The Bank also acknowledged the latest wage growth report (5.2%). The statement emphasized that monetary policy will remain "restrictive" until inflation sustainably returns to the 2% target. Thus, the market is left to wait for inflation in the UK to reach 2%, after which a rapid and significant easing of the BoE's monetary policy is likely. We believe the pound will continue to decline in the medium term. The decline may be gradual in the near term, as the BoE is still reluctant and infrequent in its rate cuts. However, this process could accelerate in 2025.

The long-term bearish trend for the pound remains intact, with no signs of its conclusion. On the 4-hour timeframe, the price has consolidated below the moving average line, signaling the end of a local correction. If this is accurate, the decline of the British currency will continue over the coming weeks. Before the New Year, market volatility may decrease noticeably, but this would represent another pause. We remain focused solely on the downside.

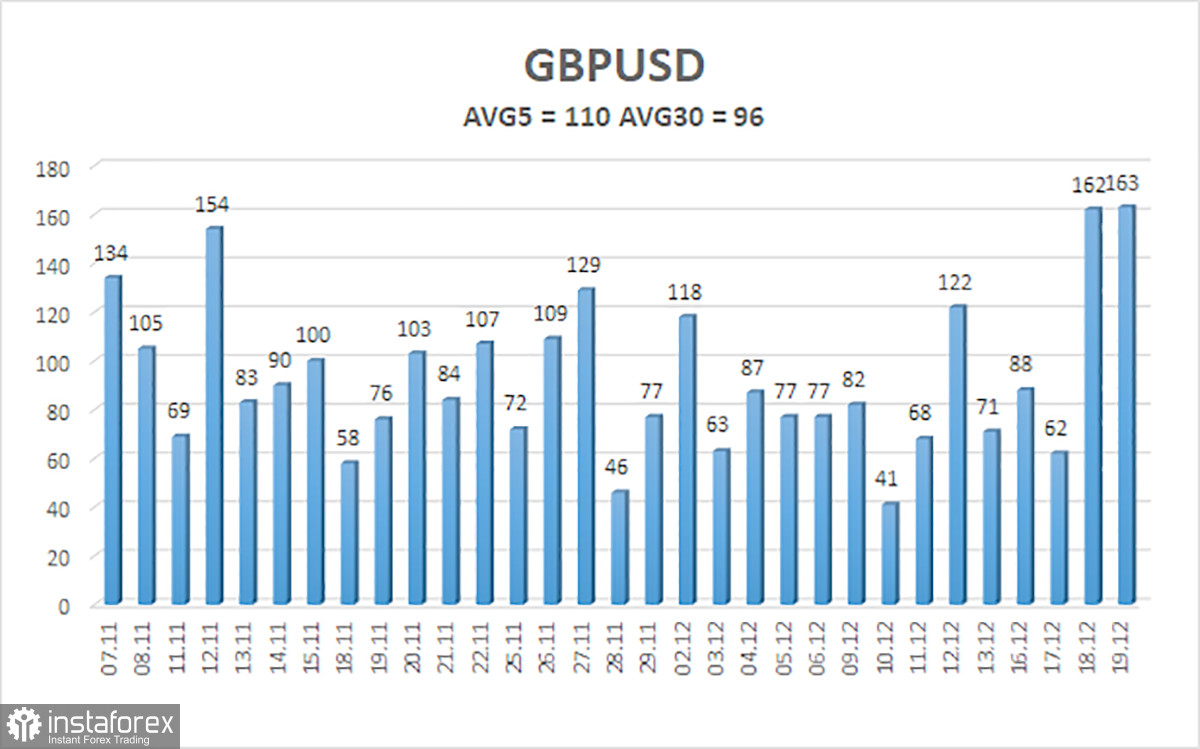

The average volatility of the GBP/USD pair over the past five trading days is 110 pips. For the pound/dollar pair, this value is considered "high." On Friday, December 20, we expect the pair to move within a range limited by the levels of 1.2418 and 1.2638. The higher linear regression channel is pointing downward, signaling a bearish trend. The CCI indicator recently re-entered the oversold zone, but the pound ultimately appears poised to resume its downward trend, as we have repeatedly warned. Any oversold conditions during a downtrend should only be interpreted as a signal for correction.

Closest support levels:

- S1 – 1.2451

Closest resistance levels:

- R1 – 1.2573

- R2 – 1.2695

- R3 – 1.2817

Trading Recommendations:

The GBP/USD currency pair maintains a downward trend but continues to correct itself. We still do not consider long positions, as we believe all the factors driving the growth of the British currency have already been priced in multiple times. If you trade solely on technical analysis, longs are possible with a target of 1.2817, provided the price is above the moving average line. However, short positions remain far more relevant now, with targets at 1.2451 and 1.2418.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română