Trade Analysis and Advice for Trading the British Pound

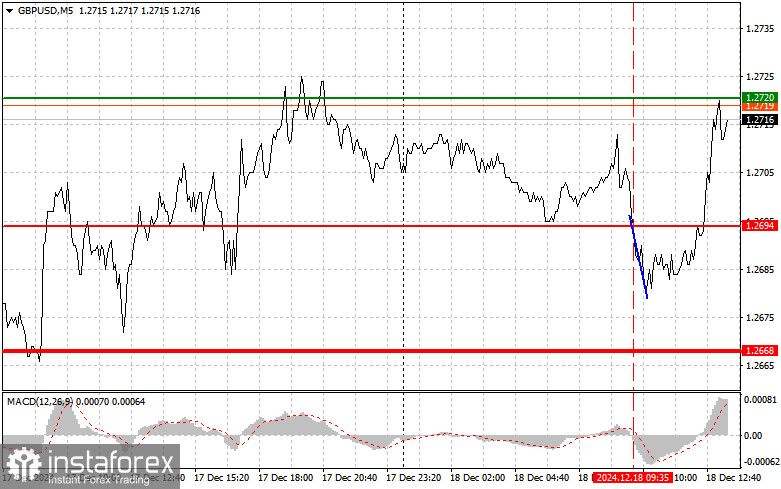

The test of the 1.2694 price level occurred when the MACD indicator was just starting to move down from the zero mark. This confirmed the validity of the entry point for selling the pound. As a result, the pair dropped by 20 points before the selling pressure subsided.

The rise in core inflation in the UK, revealed today, complicates the economic outlook and raises concerns among investors. This heightens uncertainty regarding the potential actions of the Bank of England, as the data confirms that inflationary pressure remains above the target level. It also casts doubt on the longer-term upward prospects for the British pound. Tomorrow's Bank of England meeting is shaping up to be a pivotal event, especially given recent economic indicators. While a rate hike is not expected, discussions of rate cuts in the near term are equally uncertain. A restrictive policy could stifle the UK economy further, presenting a significant dilemma for policymakers.

Later today, attention will also shift to the outcomes of the US Federal Reserve meeting. Jerome Powell may issue statements about pausing the cycle of monetary policy easing, which would strengthen the dollar sharply and lead to a decline in the pound.

For intraday strategies, I will focus on executing Scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy the pound at the 1.2729 level (green line on the chart), targeting growth to the 1.2770 level (thicker green line on the chart). At 1.2770, I plan to exit purchases and open short positions in the opposite direction (expecting a 30-35 point pullback from that level). A rally in the pound today can only be expected following weak US data. Important: Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy the pound in the event of two consecutive tests of the 1.2701 level, while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger a market reversal upward. Growth toward the opposite levels of 1.2729 and 1.2770 can be anticipated.

Sell Signal

Scenario #1: I plan to sell the pound after breaking through the 1.2701 level (red line on the chart), which will likely trigger a sharp decline in the pair. The primary target for sellers will be 1.2659, where I plan to exit sales and immediately open purchases in the opposite direction (expecting a 20-25 point pullback from that level). Sellers will only assert themselves following strong US data. Important: Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline from it.

Scenario #2: I also plan to sell the pound in the event of two consecutive tests of the 1.2729 level, while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a market reversal downward. A decline toward the opposite levels of 1.2701 and 1.2659 can be expected.

Key Chart Levels

- Thin Green Line: Entry price for buying the instrument.

- Thick Green Line: Approximate price for setting Take Profit or manually closing positions, as further growth above this level is unlikely.

- Thin Red Line: Entry price for selling the instrument.

- Thick Red Line: Approximate price for setting Take Profit or manually closing positions, as further declines below this level are unlikely.

- MACD Indicator: When entering the market, it is essential to monitor overbought and oversold zones.

Important Notes

Beginner forex traders should exercise caution when deciding on market entries. It is best to stay out of the market before the release of important fundamental reports to avoid being caught in sharp price fluctuations. If you choose to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss orders, you risk quickly losing your entire deposit, especially when trading large volumes without proper money management.

Remember, successful trading requires a clear trading plan, such as the one outlined above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for intraday traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română