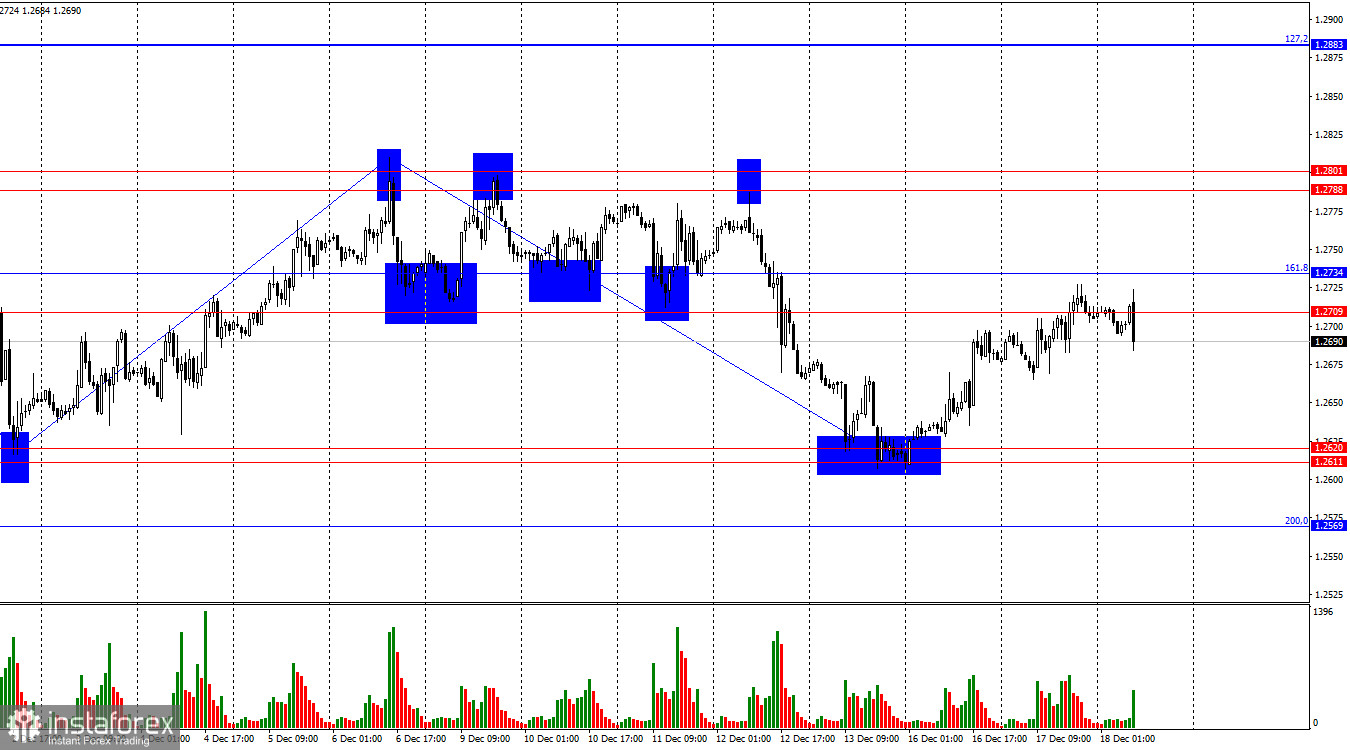

On the hourly chart, the GBP/USD pair rebounded from the resistance zone of 1.2709–1.2734 on Tuesday, turning in favor of the US dollar. This initiated a new downward movement toward the support zone of 1.2611–1.2620.

The wave structure does not raise any questions. The last upward wave broke above the peak of the previous wave, while the latest downward wave has yet to breach the previous low. Thus, the current bullish trend remains formally intact. However, I believe this bullish trend could be weak and may already be coming to an end. Over the past few days, numerous precise signals have been received. To confirm the start of a new bearish trend, a close below the 1.2611–1.2620 level is required.

On Tuesday, the fundamental backdrop for the pound was relatively positive. The unemployment rate remained unchanged (arguably a positive sign), the number of unemployed grew only slightly (which could also be viewed as positive), and the average wage level increased more than traders expected (definitely a positive). Consequently, most traders interpreted these reports favorably, allowing bulls to effectively test the 1.2709–1.2734 level. However, today's UK inflation report, while positive for the pound, is less so for other economic actors. Inflation rose to 2.6%, as expected, while core inflation accelerated to 3.5%, slightly below forecast. Despite inflation rising less than anticipated, bears have activated, likely driven by a strong technical sell signal that might carry more weight than the inflation report itself. Regardless, today's FOMC decision and tomorrow's Bank of England decision will largely determine the GBP/USD pair's short-term behavior.

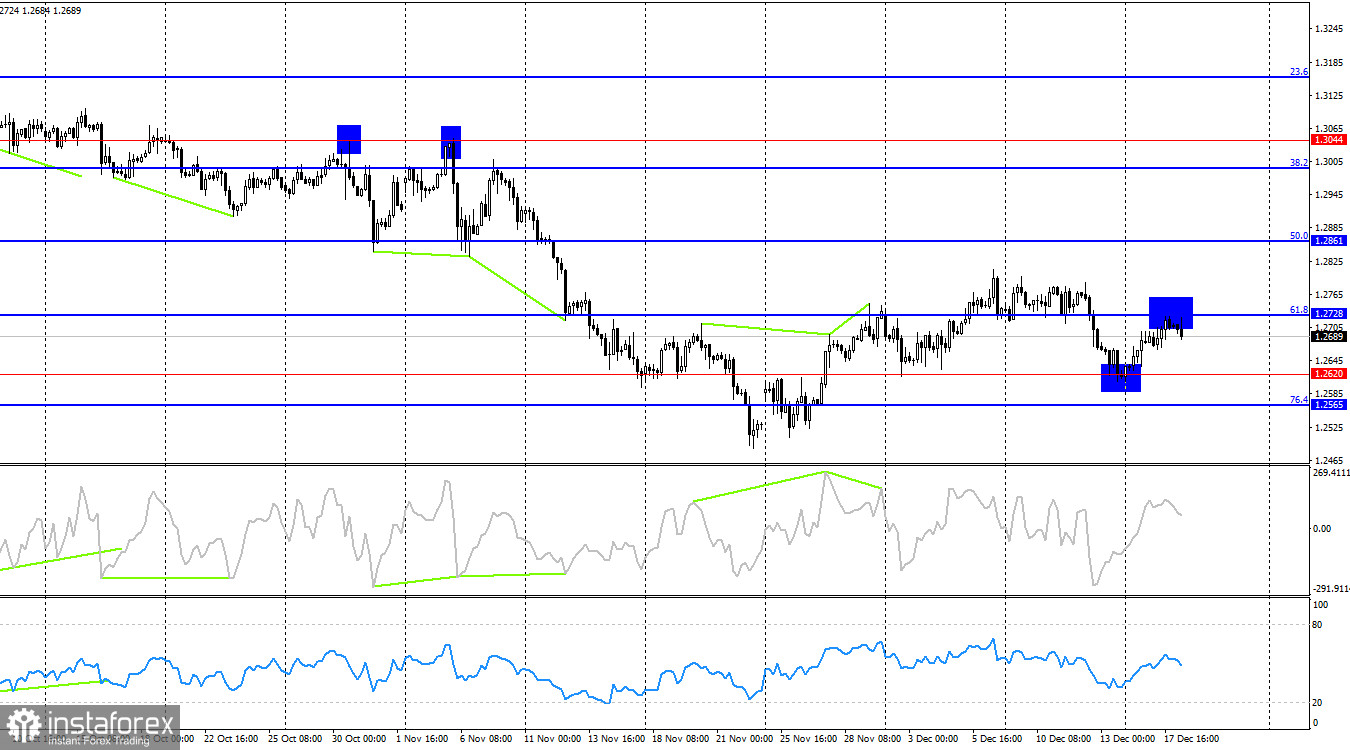

On the 4-hour chart, the pair made a new reversal in favor of the US dollar after rebounding from the 61.8% retracement level at 1.2728. Overall, the trend on the 4-hour chart remains bearish, providing grounds to expect further declines toward the 1.2432 level. No imminent divergences are observed on any indicators today.

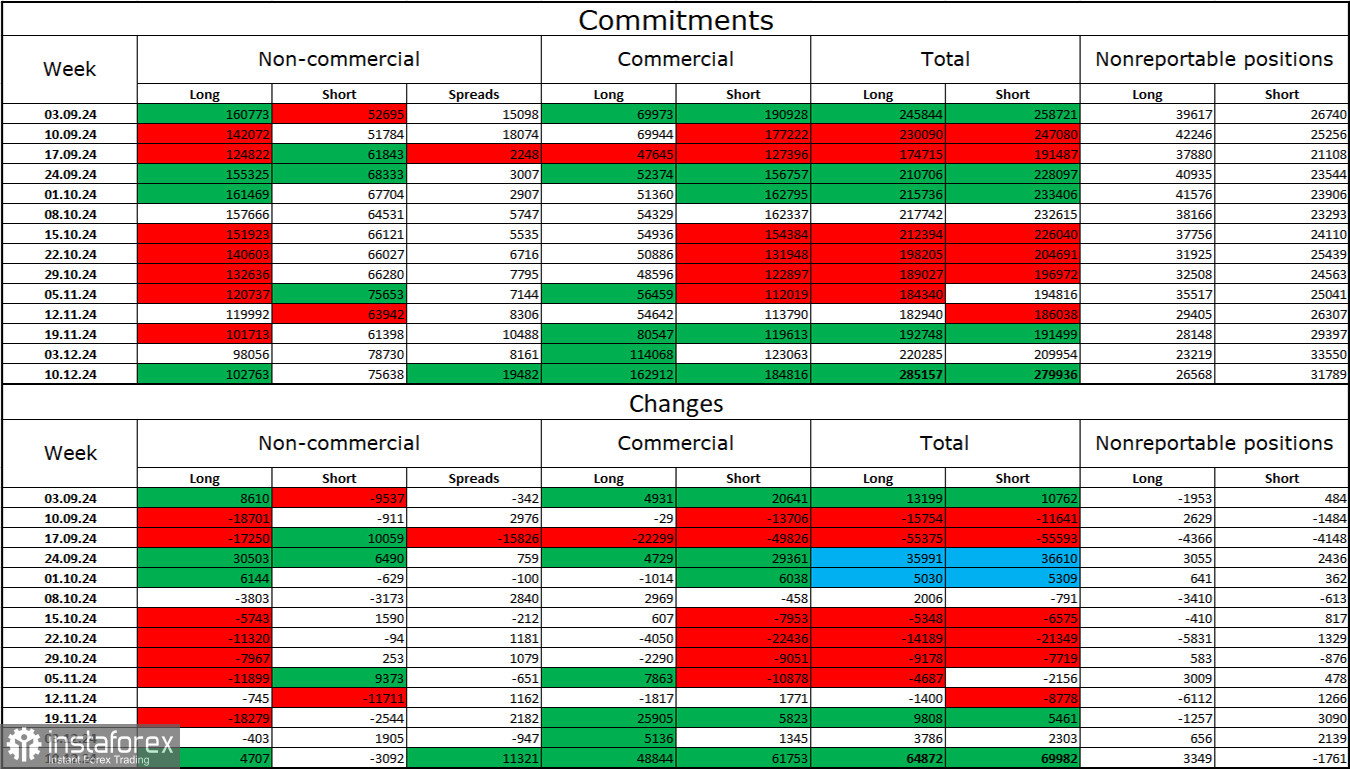

Commitment of Traders (COT) Report

The sentiment among "Non-commercial" traders showed little change during the latest reporting week. The number of long positions held by speculators increased by 4,707, while short positions decreased by 3,092. Bulls still hold the advantage, but this has been steadily diminishing over recent months. The gap between long and short positions is now just 27,000: 102,000 vs. 75,000.

In my view, the pound still faces downward prospects, and COT reports indicate growing bearish sentiment almost every week. Over the past three months, long positions have declined from 160,000 to 102,000, while short positions have risen from 52,000 to 75,000. I expect professional players to continue shedding long positions or building short ones as all potential factors supporting the pound seem to have already been priced in. Technical analysis also supports further declines for the pound.

News Calendar for the US and UK

- UK: Consumer Price Index (07:00 UTC)

- US: Building Permits (13:30 UTC)

- US: Housing Starts (13:30 UTC)

- US: FOMC Interest Rate Decision (19:00 UTC)

- US: Dot Plot (19:00 UTC)

- US: FOMC Press Conference (19:30 UTC)

Wednesday's economic calendar includes six notable events, each significant in its own way. The impact of this news on trader sentiment could be substantial throughout the day.

Forecast and Trading Advice for GBP/USD

Short positions could have been opened after a rebound from the 1.2709–1.2734 zone on the hourly chart, targeting 1.2611–1.2620. These trades can remain open. I previously recommended considering long positions after a rebound from 1.2611–1.2620, with the nearest zone already tested. However, I would advise against opening new long positions at this time.

Fibonacci retracement levels were constructed from 1.3000–1.3432 on the hourly chart and 1.2299–1.3432 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română