Analysis of Trades and Trading Tips for the Japanese Yen

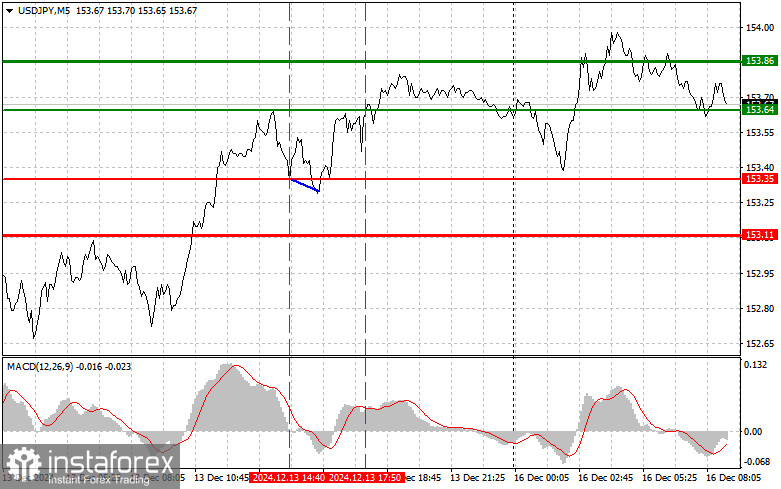

The test of the 153.35 price level in the second half of the day occurred when the MACD indicator started moving downward from the zero line, which seemed like a good opportunity to sell the dollar. However, the trade resulted in a loss as the pair rose. The test of the 153.64 price level during the middle of the U.S. session happened after the MACD had already moved significantly above the zero line, so I refrained from buying the dollar.

Today's weak manufacturing PMI data from Japan and strong service sector PMI helped keep the composite index above the 50-point mark, signaling sustained growth in activity within the country. The weak manufacturing PMI, which came in below expectations, highlights structural issues within the sector. However, the positive results in the services sector provided a balancing effect, reflecting steady consumer demand and business confidence. The services PMI showed solid growth, indicating continued consumer demand and a resilient business environment supported by improved processes and adaptation to post-pandemic economic realities. The composite index above 50 underscores that Japan's economy continues growing, albeit with varying dynamics across sectors.

Despite these mixed data, they did not bolster the yen's position against the U.S. dollar. As for the intraday strategy, I will focus on executing Scenario #1 and Scenario #2.

Buy Signal

Scenario #1:

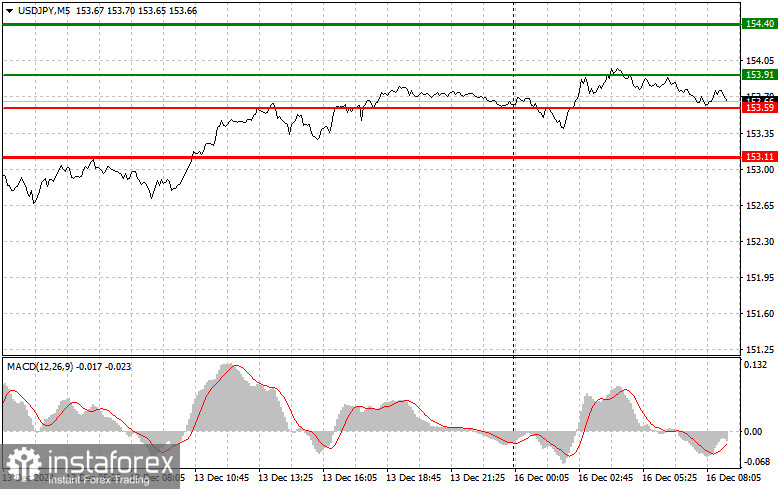

Today, I plan to buy USD/JPY upon reaching the 153.91 entry point (green line on the chart), targeting a rise to 154.40 (thicker green line). At 154.40, I plan to exit purchases and open sell positions in the opposite direction, aiming for a 30-35-pip retracement. Given the upward trend, trading in line with the trend is advisable.

Important! Before buying, ensure the MACD indicator is above the zero line and starting to rise.

Scenario #2:

I also plan to buy USD/JPY if there are two consecutive tests of the 153.59 level, provided the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to an upward market reversal. Growth can be expected toward the opposite levels of 153.91 and 154.40.

Sell Signal

Scenario #1:

I plan to sell USD/JPY after the price updates the 153.59 level (red line on the chart), likely triggering a sharp decline in the pair. The main target for sellers will be 153.11, where I plan to exit sales and immediately open buy positions in the opposite direction, aiming for a 20-25-pip rebound. Selling is recommended after a failed update of the daily high.

Important! Before selling, ensure the MACD indicator is below the zero line and starting to decline.

Scenario #2:

I also plan to sell USD/JPY if there are two consecutive tests of the 153.91 level, provided the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline can be expected toward the opposite levels of 153.59 and 153.11.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română