USD/JPY

Higher Timeframes

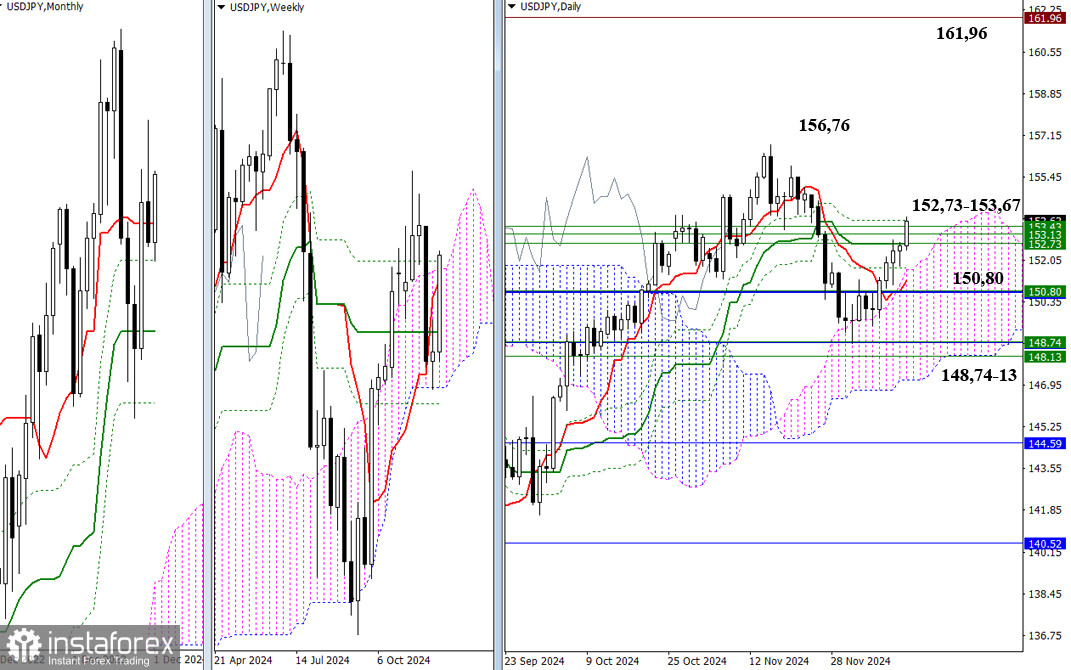

Previously, the weekly and monthly supports combined their efforts around the 148.74 area to halt the downward movement. During last week, initial stalling and consolidation transitioned into an active recovery led by bullish players. Bulls tested the weekly resistance zone (152.73 – 153.13-43), raising questions about eliminating the daily Ichimoku dead cross (152.73 – 153.67). Successfully overcoming and escaping the pull of these obstacles would open the path toward higher targets. These include the peak highs on this chart section, allowing for the recovery of the weekly (156.76) and monthly (161.96) uptrends through their breakout.

If the bullish players fail to meet these objectives, the market may return to previously tested levels, which now serve as supports: 150.80 (weekly medium-term trend + monthly short-term trend) and 148.74-13 (lower boundary of the weekly cloud + weekly and monthly Fibo Kijuns).

***

EUR/JPY

Higher Timeframes

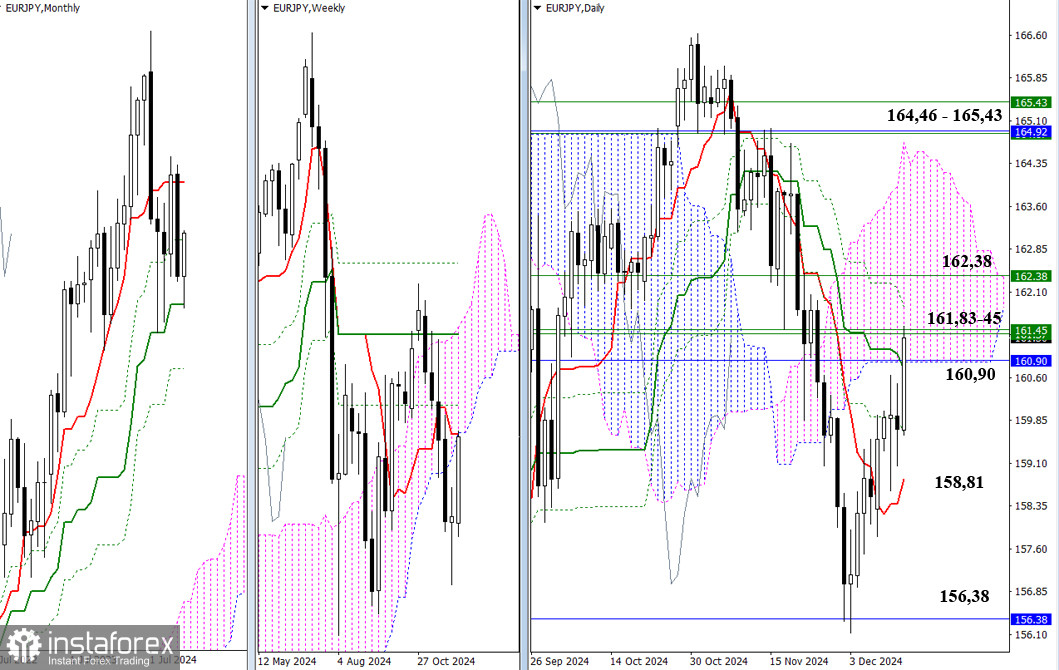

After ending November with a bearish sentiment, bearish players faced the monthly medium-term trend support at 156.38 at the beginning of December. Failing to break it, they ceded the initiative to their opponents. On lower timeframes, bullish players initiated a corrective rise, which has now brought them to the point of potentially eliminating the daily Ichimoku dead cross (161.02 – 161.83), entering the daily bullish Ichimoku cloud (160.87), and achieving a weekly correction to the first target at 161.38 (weekly Tenkan).

If bullish players manage to eliminate the daily cross and continue the weekly upward correction, their next target will be the cluster of levels across multiple timeframes at 164.56 – 164.92 – 165.43 (upper boundary of the daily cloud + weekly medium-term trend + upper boundary of the weekly cloud + monthly short-term trend). Securing a position above these levels will open new prospects for bullish players.

If the resistance around 160.87 – 161.45 stops the bullish rise and shifts market sentiment, the rejection could end the upward correction on the daily and weekly timeframes, redirecting the market toward a potential resumption of the downtrend. The nearest supports on the way down are 158.81 (daily Tenkan) and 156.38 (monthly medium-term trend).

***

Technical Analysis Components:

- Higher Time Frames – Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română