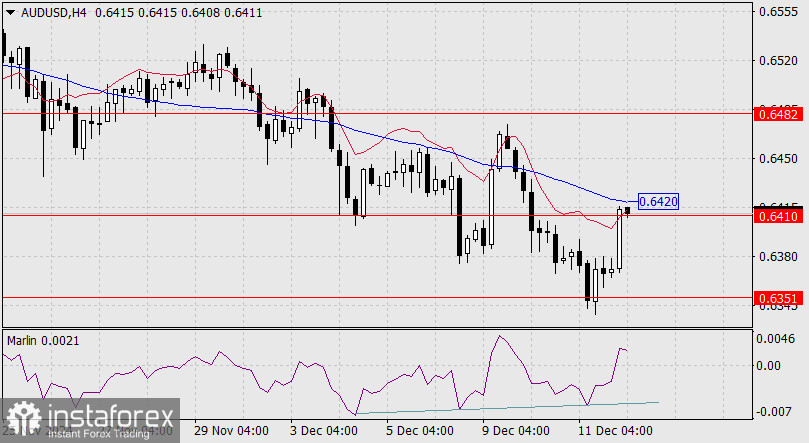

Today's report on the decline in Australia's unemployment rate from 4.1% to 3.9% has lifted the Australian dollar above the resistance level of 0.6410, bringing it closer to the upper boundary of the descending price channel on the daily chart. A double convergence between the price and the Marlin oscillator has formed.

Since the Australian dollar has been declining over the past 10 days, outpacing other currencies (e.g., European ones), it has a solid buffer for a counter-market rebound, especially if our expectation of euro and pound declines following the European Central Bank meeting materializes. The first target is 0.6482, which aligns with the 23.6% retracement level. The second target is 0.6570, coinciding with the 38.2% retracement level and nearing the MACD line indicator.

The H4 chart also shows a double convergence between price and the oscillator. The Marlin oscillator is now in positive territory, assisting the price in breaking above the resistance of the MACD line (0.6420). Consolidation above this level opens the path to the first target of 0.6482.

If the price reverses and consolidates below 0.6351, the pair will likely resume its downward movement toward the target level of 0.6273 or even deeper to the lower boundary of the descending price channel on the daily chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română