Analysis of Trades and Trading Recommendations for the British Pound

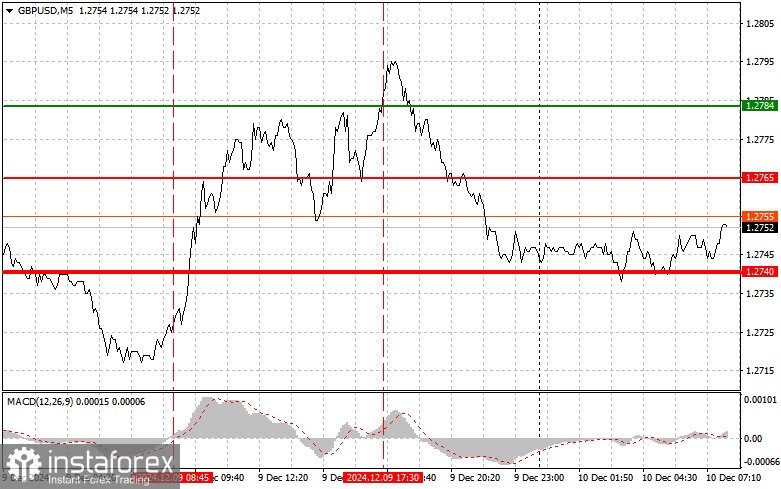

The test of the 1.2784 level occurred when the MACD indicator was significantly above the zero mark, which limited the pair's upward potential. For this reason, I did not buy the pound. No other suitable entry points were formed. Yesterday's lack of UK data prevented the pair from consolidating at weekly highs, although buyers regained control after Friday's sell-off.

Today's first half is likely to follow a similar pattern: demand for the pound will persist, but a more significant bullish momentum will require strong data, which is unlikely. Regarding the intraday strategy, I will primarily rely on executing Scenario #1 and Scenario #2.

Buy Scenarios

Scenario #1:

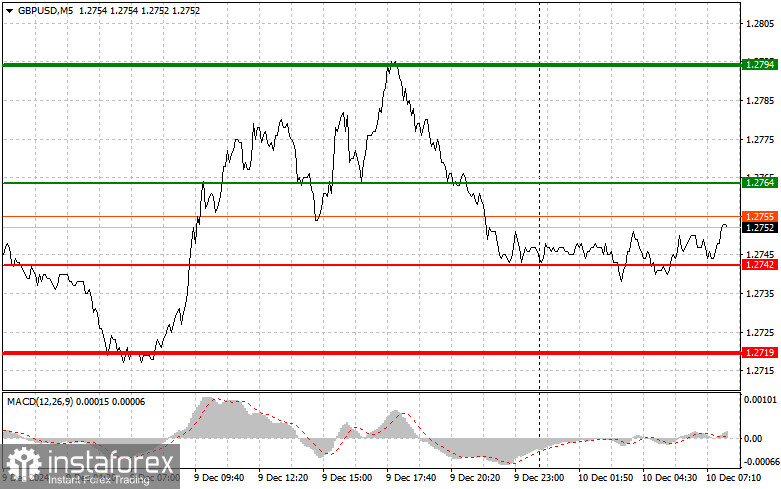

I plan to buy the pound today at an entry point near 1.2764 (green line on the chart), targeting a rise to 1.2794 (thicker green line on the chart). Around 1.2794, I intend to exit buy positions and open sell positions in the opposite direction, aiming for a 30-35 pip movement downward from that level. The pound's growth today can be expected as part of the ongoing upward trend.

Important! Before buying, ensure the MACD indicator is above the zero mark and is just beginning its upward movement.

Scenario #2:

I also plan to buy the pound today if the price tests 1.2742 twice in succession while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger a market reversal to the upside. A rise to the opposing levels of 1.2764 and 1.2794 can then be expected.

Sell Scenarios

Scenario #1:

I plan to sell the pound today after the 1.2742 level is broken (red line on the chart), likely leading to a quick decline in the pair. The key target for sellers will be 1.2719, where I plan to exit sell positions and immediately open buy positions in the opposite direction, aiming for a 20-25 pip movement upward from that level. Selling the pound is possible, but it is better to sell at higher levels.

Important! Before selling, ensure the MACD indicator is below the zero mark and just beginning its downward movement from there.

Scenario #2:

I also plan to sell the pound today if the price tests 1.2764 twice in succession while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a market reversal to the downside. A decline to the opposing levels of 1.2742 and 1.2719 can be expected.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română