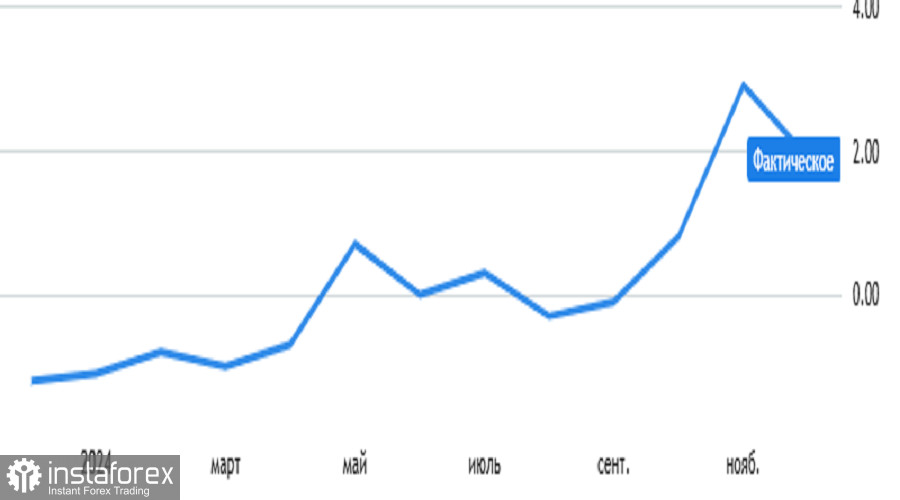

Eurozone retail sales growth slowed significantly from 3.0% to 1.9%, much worse than even the most pessimistic forecasts. Yet, the euro still managed to gain ground. It is impossible to attribute it to the data on unemployment benefits applications because the total number of claims decreased by 14k against a forecast of 1k, making the data slightly better than expected.

The primary reason for this market behavior lies in today's anticipated U.S. Department of Labor report. Recent labor market data prompted investors to revise their forecasts, expecting the unemployment rate to rise from 4.1% to 4.2%. This expectation has fueled the euro's rally. However, the euro could weaken significantly if unemployment remains unchanged and over 200k new jobs are created in nonfarm sectors.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română