Today, USD/CAD is declining amid U.S. dollar weakness; this interrupts a three-day winning streak. However, significant drops in the pair are unlikely ahead of Friday's crucial monthly employment data from both the U.S. and Canada.

Major Factors Impacting USD/CAD

1. U.S. Dollar Weakness:

- The primary driver of USD/CAD pressure is a slight decline in the U.S. dollar.

2. U.S. Treasury Yields:

- A recovery in U.S. Treasury yields, driven by expectations of less dovish Federal Reserve policy, provides support for the dollar.

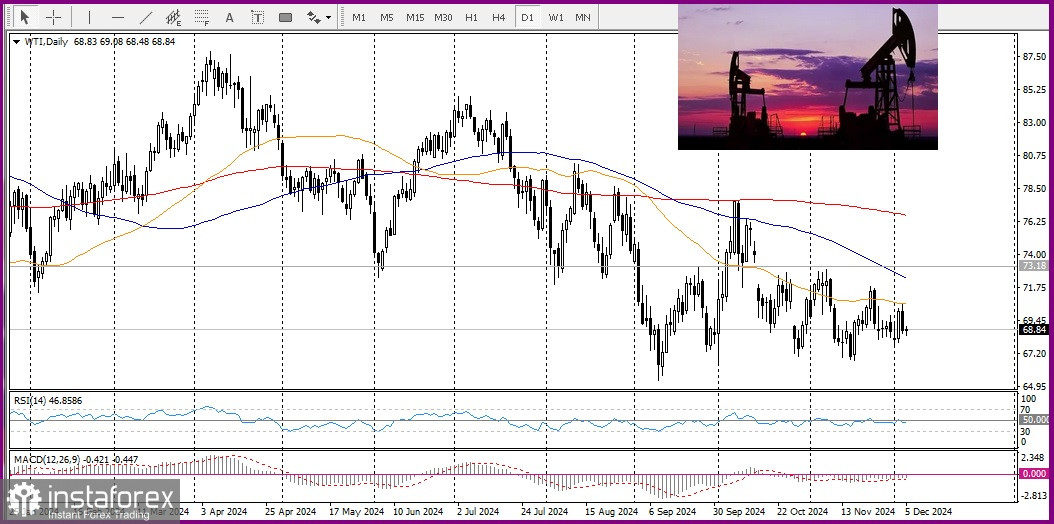

3. Oil Prices and the Canadian Dollar:

- Subdued oil prices ahead of the OPEC+ meeting may weaken the oil-reliant Canadian dollar.

- However, geopolitical tensions and potential delays in OPEC+ production hikes until Q2 2025 are adding support to oil prices, indirectly aiding the Canadian dollar.

4. Federal Reserve Outlook:

- Hawkish comments from Federal Reserve officials, including Chair Jerome Powell, signal a cautious stance on rate cuts.

- Expectations that current U.S. policies could reignite inflation suggest the Fed might pause rate reductions or consider hikes, boosting Treasury yields.

5. Crude Oil Dynamics:

- Concerns about slowing demand in China, the world's largest oil importer, are weighing on crude oil prices.

- Nonetheless, geopolitical tensions and expectations of delayed production increases are offering support to oil markets, which benefits the Canadian dollar.

Key Events to Watch Today

- U.S. Initial Jobless Claims:

- Combined with U.S. bond yields, these figures are likely to influence dollar demand and drive USD/CAD movement.

- Oil Price Movements:

- Fluctuations in crude oil prices may present short-term trading opportunities for the pair.

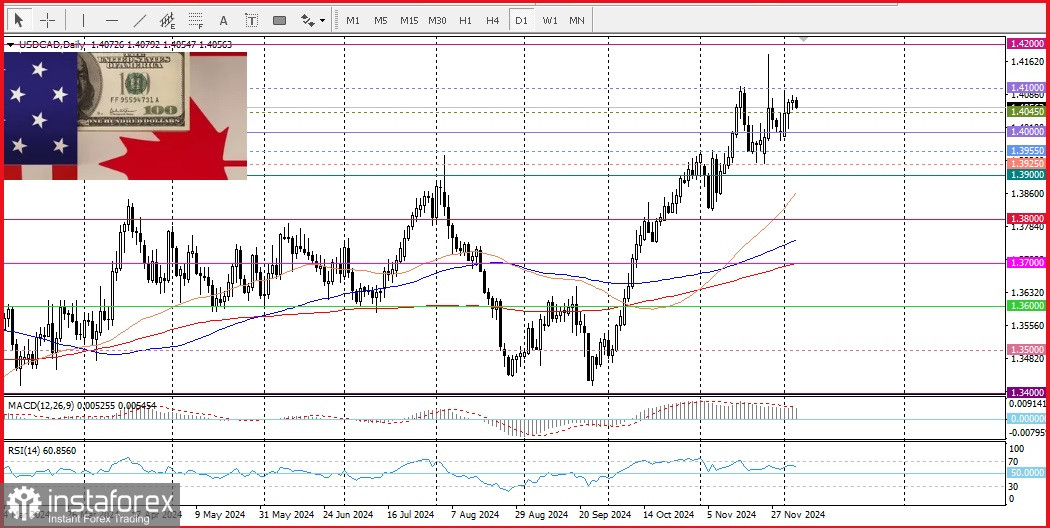

Technical Outlook

- Oscillators:

- Daily chart oscillators remain positive, suggesting a correction rather than a full decline for USD/CAD.

- Key Support Levels:

- 1.4050: Expected to limit near-term declines.

- 1.4000: A psychological level providing additional support.

Summary

The overall mixed fundamental backdrop calls for caution when considering new positions. While USD/CAD faces some downward pressure, the interplay of supportive factors for both the U.S. dollar and Canadian dollar suggests limited volatility until further clarity emerges from upcoming economic data and market dynamics.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română