Analysis of Wednesday's Trades

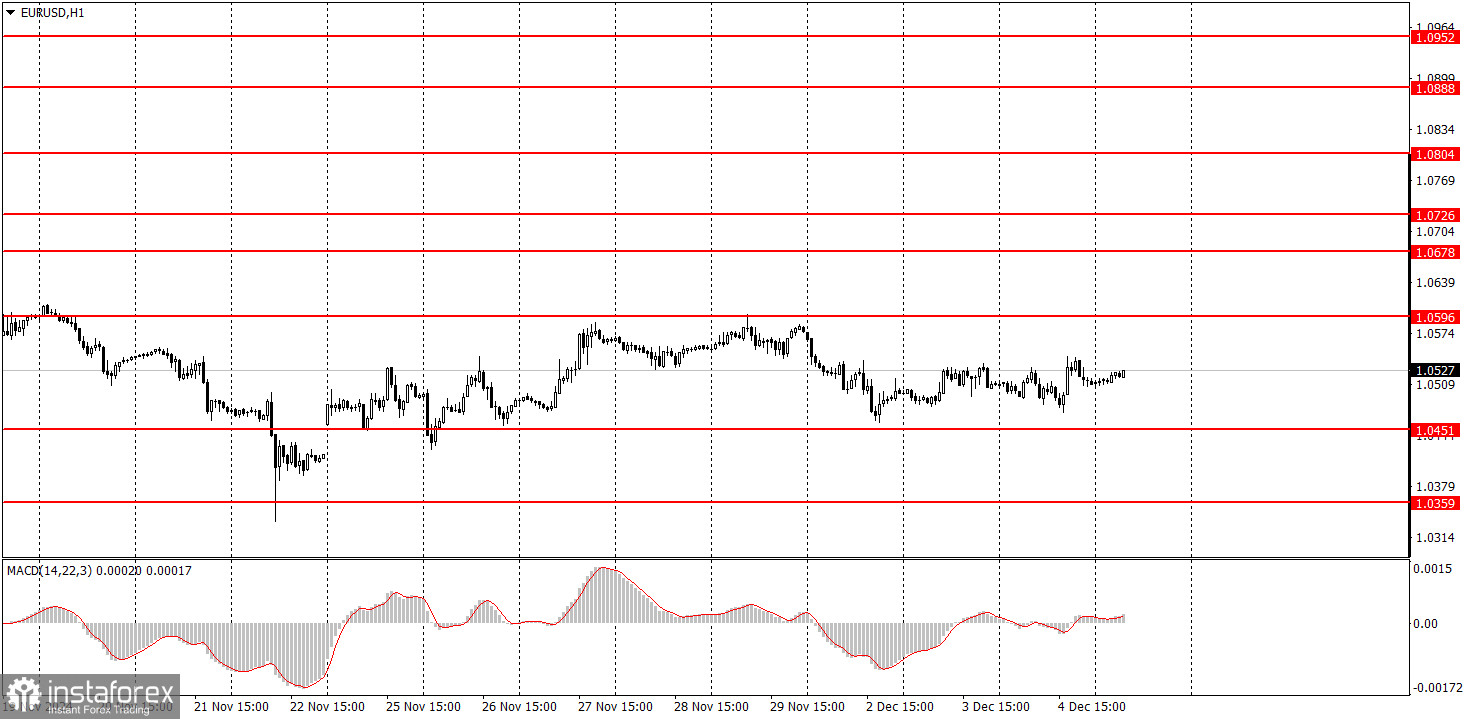

1H Chart of EUR/USD

On Wednesday, the EUR/USD currency pair continued to trade within the range of 1.0451–1.0596. The price has been stuck in a flat for the past two weeks. While the horizontal channel is quite wide—around 150 pips—it is still flat, which doesn't have to be narrow. Instead of an upward correction, we are currently observing a sideways movement. This week has been disappointing so far. Despite a seemingly sufficient number of significant events and reports, only a few have managed to provoke any noticeable market reaction. Essentially, the market has paid attention only to the ISM business activity indices in the U.S. on Monday and Wednesday. That was not enough to break the flat. The speeches by Christine Lagarde and Jerome Powell yesterday provided no new information. The ADP and JOLTs reports were practically ignored. As we warned, the upward correction could take quite some time, which is precisely what we are witnessing now.

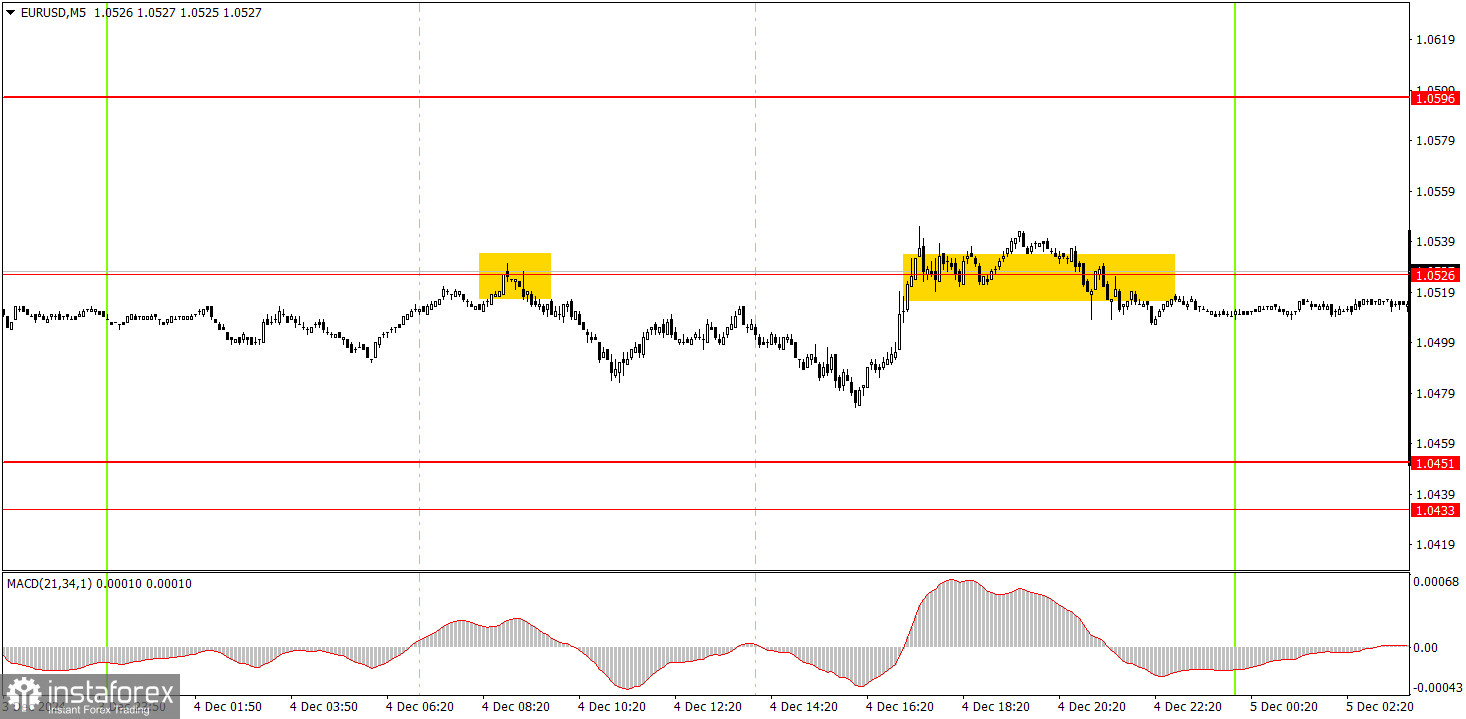

5M Chart of EUR/USD

On the 5-minute timeframe, Wednesday produced two rather mediocre trading signals. Notably, trading within a flat is not ideal since its movements can be highly chaotic. Yesterday, the price rebounded twice from the 1.0526 level. In the first instance, it moved down by about 35 pips, ensuring no loss on the trade. The second signal came very late in the day and could have been skipped.

Trading Strategy for Thursday:

On the hourly chart, the EUR/USD pair is still attempting a correction, but the euro is likely to achieve only small or slow upward movements. We've seen the pair trade within the 1.0451–1.0596 channel for the past couple of weeks. Even after a two-month decline, there is no rush to buy the euro.

On Thursday, we believe a resumption of the downward trend is possible. However, movements in a flat are typically highly random, which traders should consider.

On the 5-minute timeframe, monitor the following levels: 1.0269–1.0277, 1.0334–1.0359, 1.0433–1.0451, 1.0526, 1.0596, 1.0678, 1.0726–1.0733, 1.0797–1.0804, 1.0845–1.0851, 1.0888–1.0896. For Thursday, scheduled reports include a relatively unimportant retail sales report in the Eurozone and jobless claims data in the U.S. These reports are unlikely to trigger significant market reactions.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română