Analysis of Trades and Trading Recommendations for the British Pound

The test of the 1.2659 level occurred when the MACD indicator began its downward movement from the zero mark, confirming it as a valid entry point for selling the pound. As a result, the pair fell by 20 pips.

Recently, active buying of the pound has been observed during corrections. This is driven by traders seeking entry opportunities at more favorable levels, anticipating further growth. However, this strategy may face risks following the release of today's data.

The PMI index for the services sector plays a critical role in understanding the dynamics of the UK economy. Since services account for more than 70% of the country's GDP, any weakening in this sector could signal a decline in economic activity, with negative consequences for the pound.

The Composite PMI index, which combines data from the services and manufacturing sectors, will also attract close attention from investors. If these indices show a decline, it could trigger a wave of pound sell-offs as traders rush to lock in profits. Concerns about slowing economic growth may lead market participants to question the reliability of the pound, potentially resulting in further declines in its exchange rate.

Additionally, attention should be paid to the Governor of the Bank of England's speech. Andrew Bailey will likely emphasize the importance of current economic data in shaping monetary policy. Inflation trends remain a key factor influencing decisions on interest rates. Bailey will likely highlight that while a reduction in inflation is a positive signal, monitoring domestic and external risks remains essential. Sustained economic growth is only possible with a balanced policy approach. Thus, definitive answers regarding the central bank's course of action at its final meeting of the year are unlikely to be provided.

I will primarily rely on executing Scenario #1 and Scenario #2 for today's trading.

Buy Scenarios

Scenario #1:

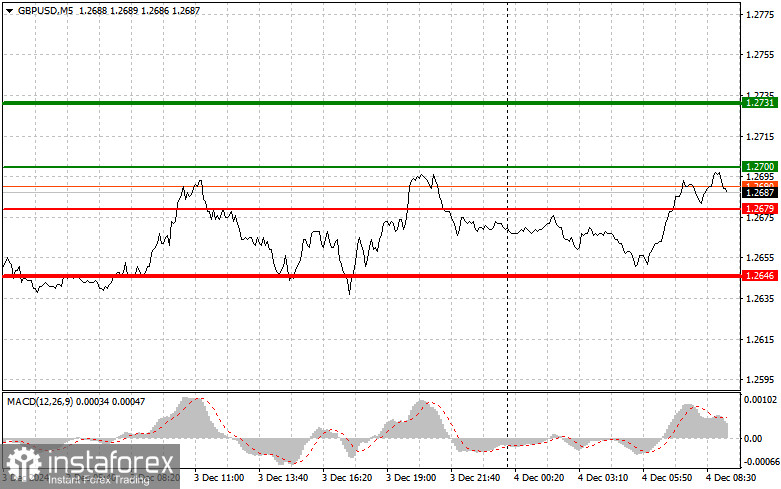

I plan to buy the pound today if the price reaches the 1.2700 level (green line on the chart), aiming for growth toward the 1.2731 level (thicker green line). At the 1.2731 level, I intend to close the purchases and open sell positions in the opposite direction (targeting a movement of 30-35 pips away from the level). Expecting the pound to rise today is only reasonable if strong data is released.

Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise.

Scenario #2:

I also plan to buy the pound today if the price tests the 1.2679 level twice consecutively while the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to an upward market reversal. A rise toward the opposite levels of 1.2700 and 1.2731 can be expected.

Sell Scenarios

Scenario #1:

I plan to sell the pound today after breaking below the 1.2679 level (red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be the 1.2646 level, where I plan to exit sales and open buy positions in the opposite direction (targeting a movement of 20-25 pips away from the level). Selling the pound is feasible, but doing so at the highest possible levels is better.

Important! Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline.

Scenario #2:

I also plan to sell the pound today if the price tests the 1.2700 level twice consecutively while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline toward the opposite levels of 1.2679 and 1.2646 can be expected.

What's on the Chart:

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Notes for Beginner Forex Traders:

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română