Analysis of Tuesday's Trades

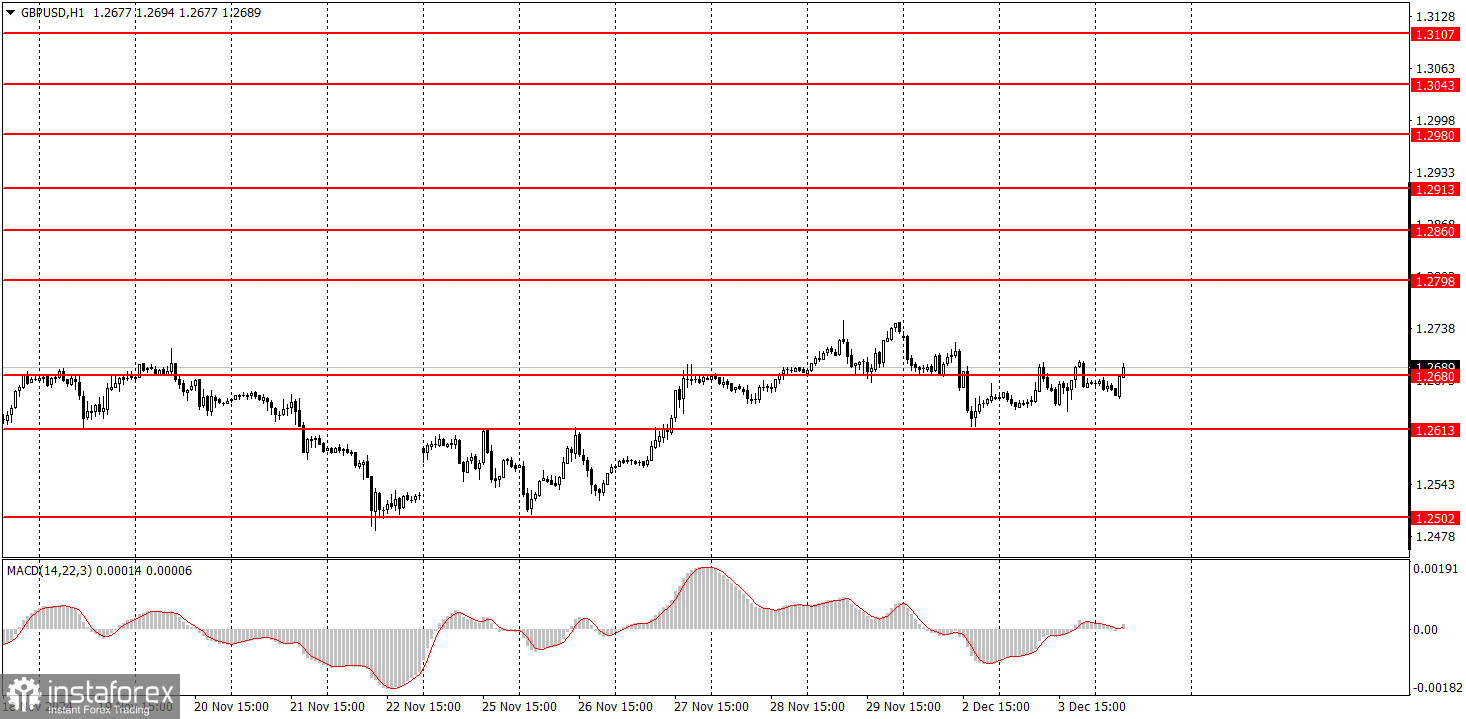

1H Chart of GBP/USD

The GBP/USD pair showed minimal trading activity on Tuesday. During the day, only one event could have influenced the pair's movement, but it didn't. The JOLTs report on U.S. job openings in October exceeded forecasts, which could have strengthened the U.S. dollar. However, the market ignored this data.

As a result, GBP/USD remains in a weak upward correction (unlike EUR/USD) and may continue this trend for some time. Today, a parade of significant events begins in the U.S., which could lead to increased volatility. The pair's direction will entirely depend on the nature of the data released through the end of the week. In the medium term, we still anticipate a decline in the British currency, although it may continue to correct in the short term.

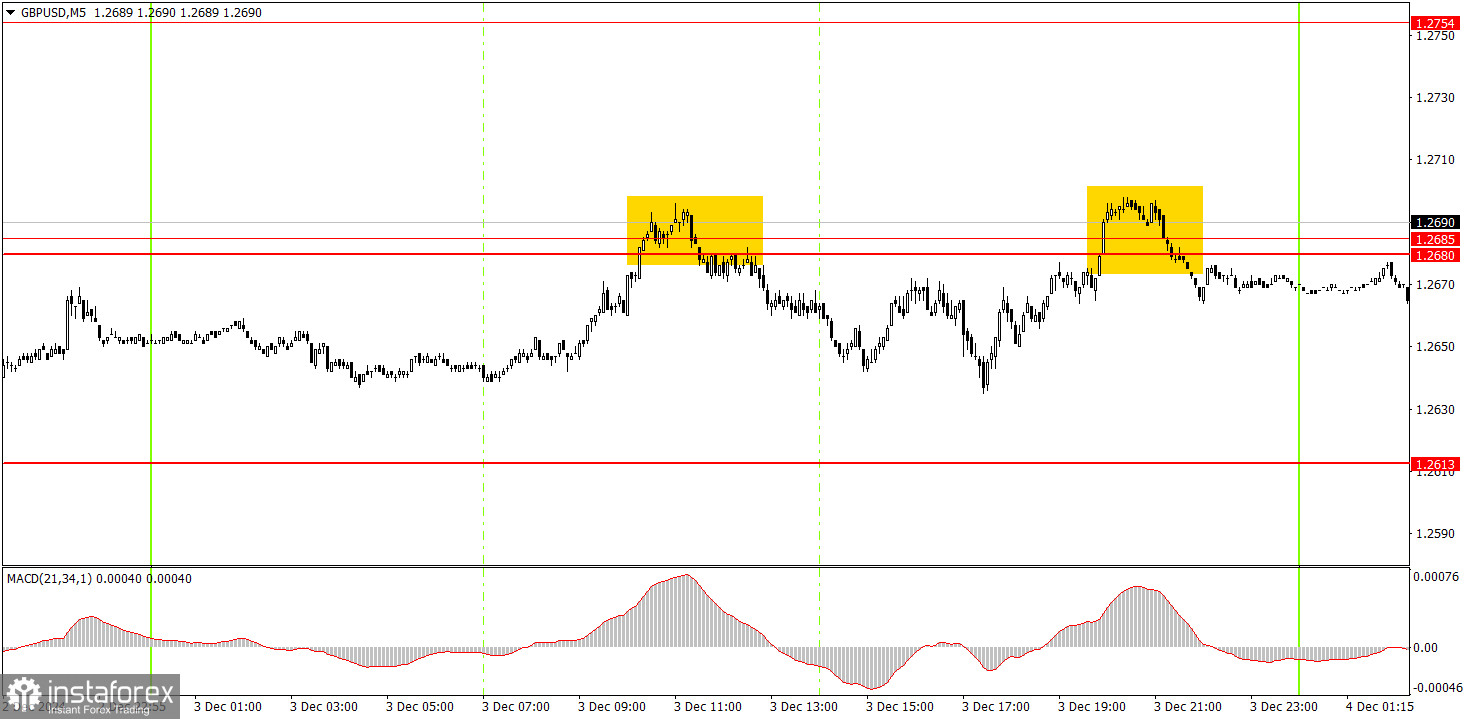

5M Chart of GBP/USD

Two very inaccurate sell signals were formed on Tuesday in the 5-minute timeframe. The previously reliable trading area was ignored by the market yesterday. It seemed as though major players deliberately drove the price higher to trigger retail traders' Stop-Loss orders. In any case, profiting from these signals was unlikely.

Additionally, although the JOLTs report was expected to boost the dollar, the U.S. currency fell rather than rose in the second half of the day, which was equally puzzling. Overall, it was an unpredictable trading day.

Trading Strategy for Wednesday:

On the hourly timeframe, the GBP/USD pair remains inclined toward decline. In the medium term, we fully support the notion of a falling pound, as we consider it the only logical scenario. The pound continues to correct, and this process may take some time. However, it's essential to remember that the current rise in the British currency is driven purely by technical factors.

On Wednesday, novice traders can anticipate a renewed decline in the British pound, given that the 1.2680–1.2685 zone was not breached and the pair showed unusual growth yesterday.

On the 5-minute TF it is now possible to trade at 1.2387, 1.2445, 1.2502-1.2508, 1.2547, 1.2633, 1.2680-1.2685, 1.2754, 1.2791-1.2798, 1.2848-1.2860, 1.2913, 1.2980-1.2993. Andrew Bailey, Governor of the Bank of England, will deliver a speech in the UK. Jerome Powell, Chair of the Federal Reserve, will also speak in the U.S. Pay attention to the ISM Services PMI report from the U.S., which could drive significant market movements.

Core Trading System Rules:

- Signal Strength: The strength of a signal is measured by the time it takes to form (a rebound or level breakthrough). The shorter the time, the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, all subsequent signals from that level should be ignored.

- Flat Markets: Pairs may generate numerous false signals or none during a flat market. Stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session. Close all trades manually afterward.

- MACD Signals: Trade MACD signals on the hourly timeframe only when there is good volatility and a trend confirmed by trendlines or channels.

- Close Levels: If two levels are close (5–20 pips apart), treat them as a support or resistance area.

- Stop Loss: Place a Stop Loss at breakeven after the price moves 20 pips in the intended direction.

Key Chart Elements:

Support and Resistance Levels: Target levels for opening or closing positions. Take Profit orders can also be set here.

Red Lines: Channels or trendlines that show the current trend and the preferred trading direction.

MACD Indicator (14,22,3): A histogram and signal line that serve as supplementary trading signals.

Important Events and Reports: Found in the economic calendar, these can strongly influence price movements. During their release, trade cautiously or exit the market to avoid sharp reversals against the preceding trend.

Forex beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are critical for long-term success in trading.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română