Analysis of Trades and Trading Tips for the Japanese Yen

No tests of the specified levels occurred during the first half of the day, so all significant activity is deferred to the US session. Traders' cautious approach to new yen purchases and dollar sales is understandable, given the Federal Reserve's mixed signals regarding future rate cuts in the US.

Yesterday's statements from central bank officials were open to interpretation, making today's comments from FOMC members Adriana D. Kugler and Austan D. Goolsbee uncertain. While their opinions may not have the same market impact as speeches by Fed Chair Jerome Powell, the current macroeconomic conditions ensure that market participants will carefully analyze every word and tone. Even subtle hints of monetary policy changes could trigger significant fluctuations in the currency market.

For the intraday strategy, I will focus on implementing Scenarios 1 and 2.

Buy Signal

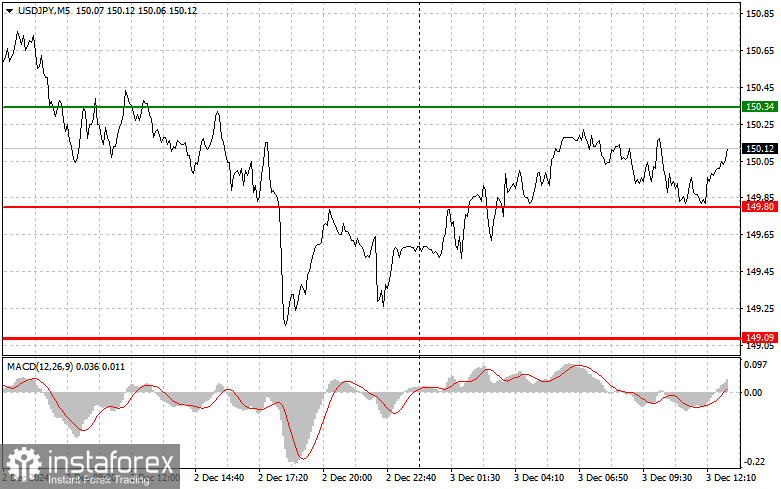

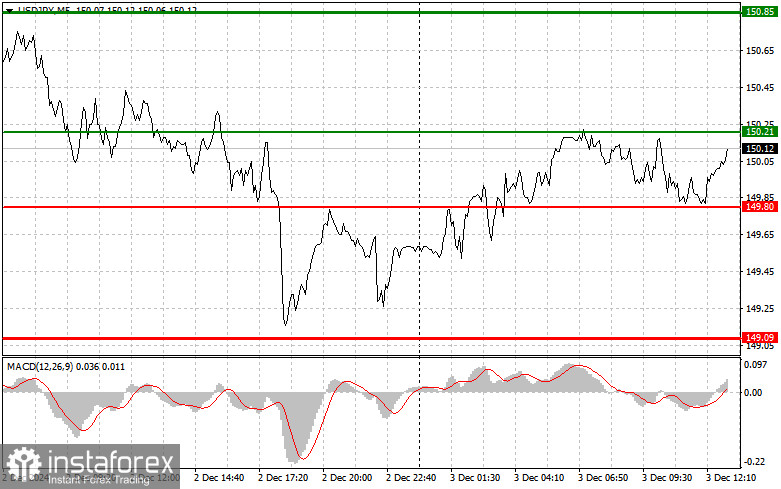

Scenario 1: Plan to buy USD/JPY at 150.21 (green line on the chart) with a target of 150.85 (thicker green line on the chart). At 150.85, I will exit purchases and open sales in the opposite direction, aiming for a 30–35 point movement downward. The pair's upward movement is likely to happen only as part of a correction.Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise from it.

Scenario 2: I also plan to buy USD/JPY in case of two consecutive tests of the 149.80 level, provided the MACD is in the oversold zone. This will limit the pair's downward potential and lead to an upward market reversal. Expect a rise toward 150.21 and 150.85.

Sell Signal

Scenario 1: Plan to sell USD/JPY after a break below the 149.80 level (red line on the chart), which will likely result in a quick decline. The key target for sellers will be 149.09, where I will exit sales and consider buying in the opposite direction, depending on market conditions.Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline from it.

Scenario 2: I also plan to sell USD/JPY after two consecutive tests of the 150.21 level, provided the MACD is in the overbought zone. This will limit the pair's upward potential and lead to a downward market reversal. Expect a drop to 149.80 and 149.09.

Chart Explanation

- Thin Green Line: Entry price for buying the instrument.

- Thick Green Line: Expected price for Take Profit or manual profit booking, as further growth above this level is unlikely.

- Thin Red Line: Entry price for selling the instrument.

- Thick Red Line: Expected price for Take Profit or manual profit booking, as further declines below this level are unlikely.

- MACD Indicator: Entry into the market should be guided by overbought and oversold zones.

Important Reminder for New Traders

- Exercise caution when making market entry decisions, especially ahead of key reports.

- Refrain from trading during news releases to mitigate the risk of sharp price fluctuations.

- Always use stop-loss orders to minimize losses. Failure to set stops can quickly deplete your deposit, particularly when trading large volumes without proper money management.

- For successful trading, a well-defined trading plan is essential. Spontaneous decisions based on current market conditions are inherently a losing strategy for intraday traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română