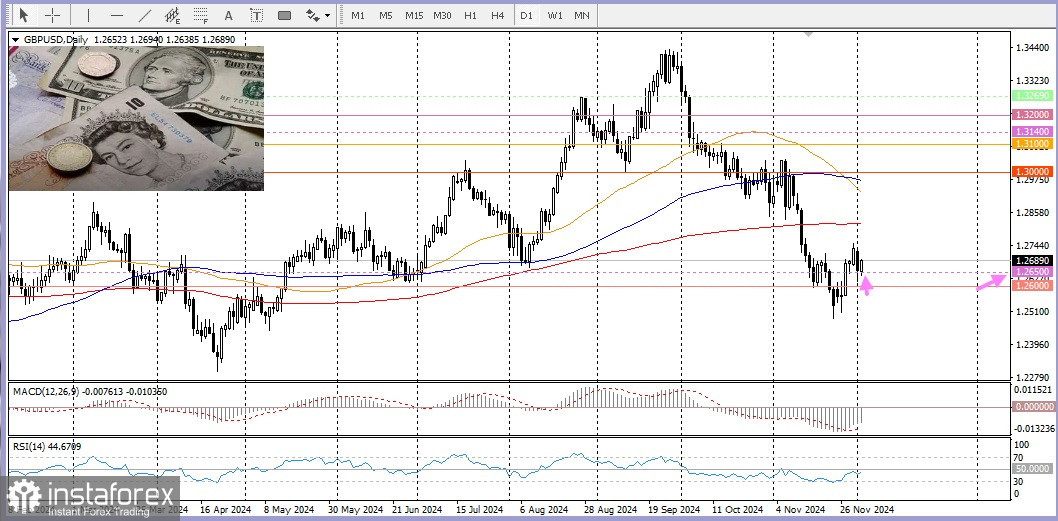

Today, the GBP/USD pair is struggling to attract buyers amid weak retail sales in the UK and a modest recovery in the US dollar. The pair remains under pressure, holding defensively just above the 1.2650 level

The market dynamics between the British pound and the US dollar reflect several influencing factors. Below are the key points:

1. Retail Sales in the UK

According to the British Retail Consortium (BRC), UK retail sales volumes for the 12 months leading up to November declined by 3.3%. This decline is largely due to changes in the timing of sales events, as early Black Friday promotions affected consumer spending habits. Weak consumer confidence, combined with the modest growth of the US dollar, continues to act as a limiting factor for GBP/USD growth.

2. State of the US Dollar

The US Dollar Index (DXY), which tracks the dollar's performance against a basket of currencies, is showing signs of recovery after approaching a three-week low. This rebound is driven by expectations that the Federal Reserve will maintain high interest rates for an extended period.

Investor concerns over potential trade wars, sparked by the new US President's tariff policies, add to the market's complexity. Additionally, Donald Trump's expansionary fiscal policies could drive up inflation, which may restrict the Federal Reserve's ability to pursue further monetary easing.

3. Geopolitical Instability

Ongoing geopolitical uncertainties continue to weigh on financial markets, enhancing the dollar's appeal as a safe-haven currency. This creates additional challenges for the pound. However, traders speculate that the Bank of England (BoE) may refrain from cutting interest rates further this year. Recent data from October showed accelerated core price growth in the UK, providing some support to limit the pair's decline.

Upcoming Data to Watch

Before taking aggressive directional positions, traders should keep an eye on upcoming macroeconomic releases:

- Nonfarm Payrolls (NFP): This key US jobs report will offer insights into the strength of the labor market.

- Fed Chair Jerome Powell's Speech: His commentary could provide guidance on future monetary policy and interest rate plans.

JOLTS Job Openings Report: The release of these figures may present additional trading opportunities depending on the labor market outlook.

Technical Outlook

Oscillators on the daily chart remain in negative territory, signaling that GBP/USD bulls currently lack strength. Traders should exercise caution and incorporate both economic indicators and technical analysis when planning their positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română