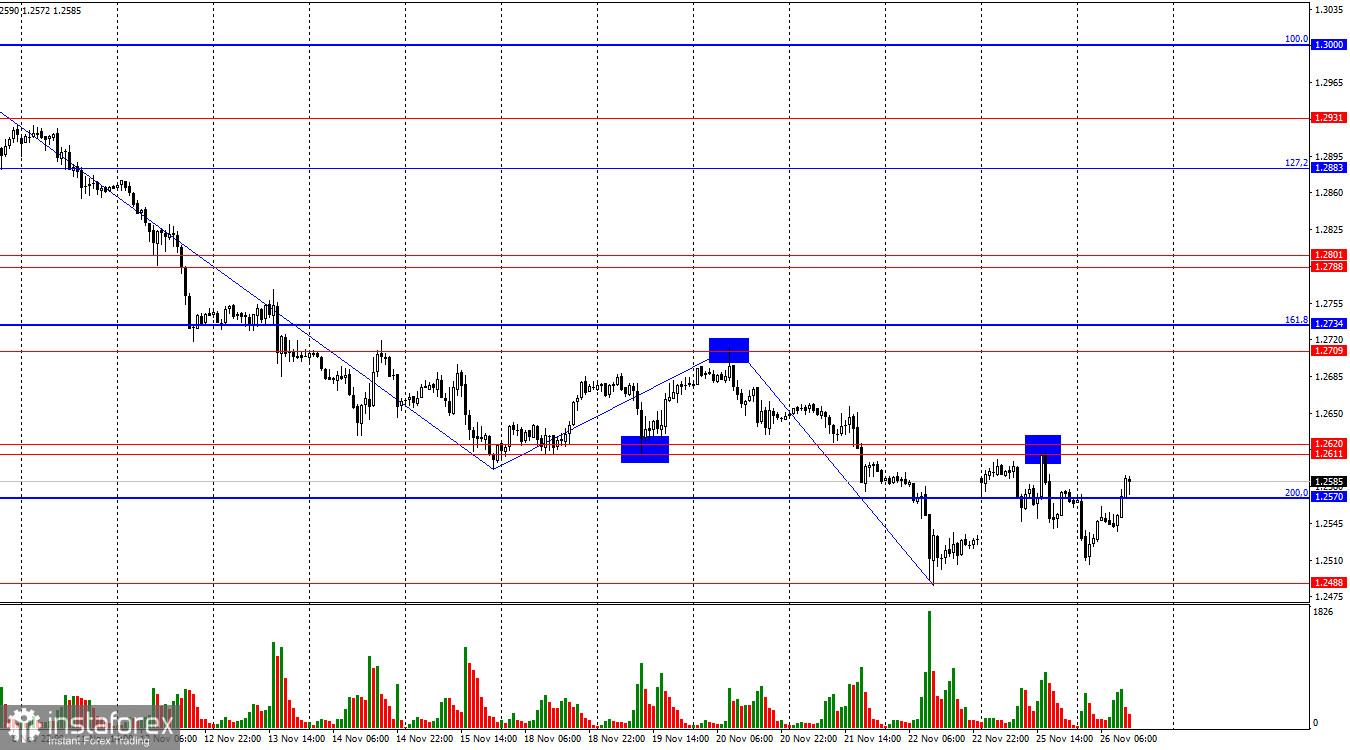

On the hourly chart, the GBP/USD pair fell close to the 1.2488 level on Tuesday but has since begun recovering toward the resistance zone of 1.2611–1.2620. A new rebound from this zone would support the US dollar and lead to a decline toward the 1.2488 level. However, if the pair consolidates above the 1.2611–1.2620 zone, further growth toward the 1.2709–1.2734 zone is likely.

The wave structure is straightforward. The most recent upward wave failed to break the previous peak, while the latest downward wave broke the previous low. This confirms that a "bearish" trend is still forming. To signal the end of this trend, the pair would need to return to 1.2710 and close above the latest peak.

On Tuesday, no significant events occurred in either the UK or the US. Throughout the day, bulls attempted to form a new upward wave but encountered significant resistance around the 1.2611–1.2620 zone. They may try to break through this zone again today or tomorrow, but the lack of supportive fundamentals will likely hinder their success. In my view, bulls will need either positive news from the UK or negative news from the US to regain momentum. However, neither is expected today.

For the remainder of the week, the US will release a few reports that could push the pair up or down, while the UK has no notable events scheduled. Therefore, I expect the GBP/USD pair to trade within the 1.2488–1.2611 range for the remainder of the week.

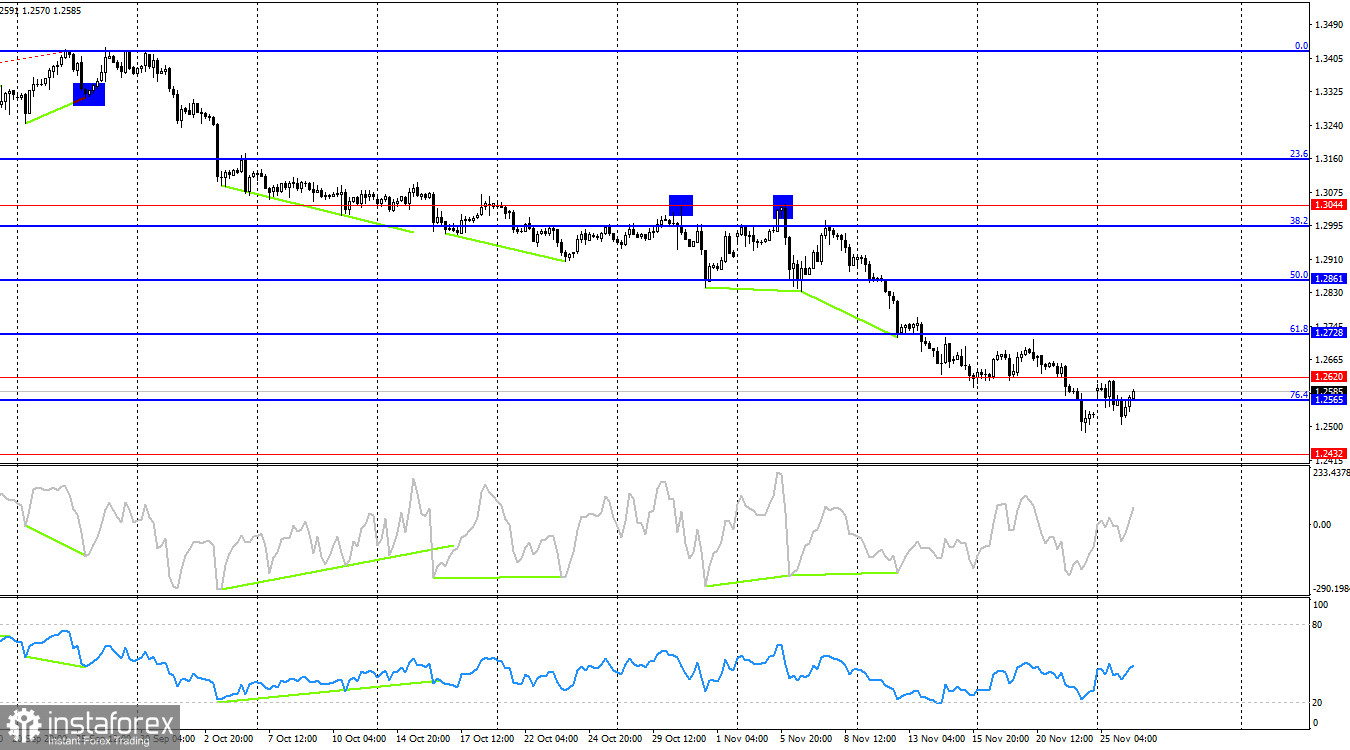

On the 4-hour chart, the pair returned to the 1.2620 level and closed above 1.2565, suggesting potential for continued growth. However, the hourly chart shows significant resistance, and I would currently rely more on it for signals of a possible break in the "bearish" structure.

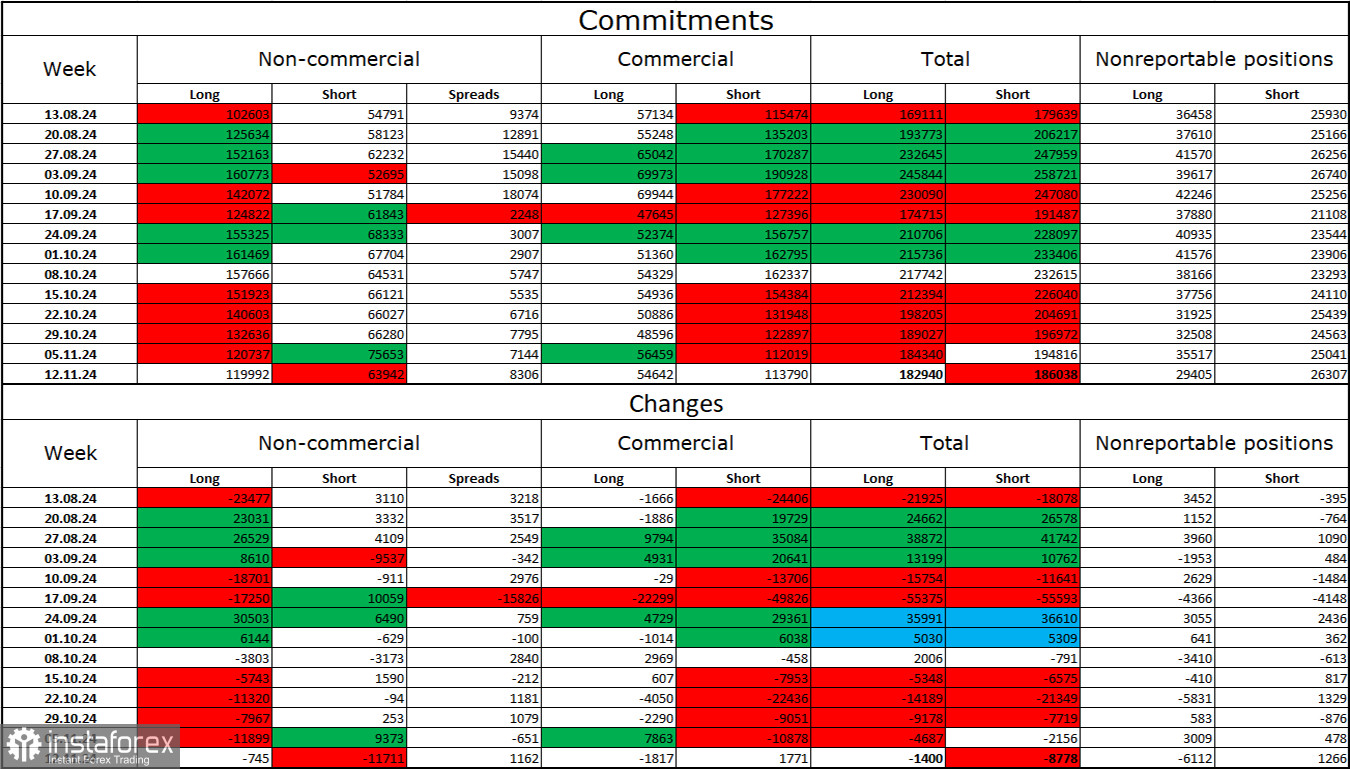

Commitments of Traders (COT) Report

The sentiment of "Non-commercial" traders became more "bullish" last week. Speculators reduced their long positions by 745 contracts and short positions by 11,711 contracts. Bulls still hold a significant advantage, with 120,000 long positions compared to 64,000 short positions—a gap of 56,000.

In my view, the pound remains under pressure, as the COT report suggests a strengthening of bearish positions. Over the past three months, long contracts have grown from 102,000 to 120,000, while short contracts have risen from 55,000 to 64,000. I believe professional traders will continue to reduce long positions or increase short positions over time, as most of the factors supporting pound purchases have already played out. Graphical analysis also supports a decline in the pound.

Economic Calendar for the US and UK

- US: New Home Sales (15:00 UTC)

- US: FOMC Minutes (19:00 UTC)

Tuesday's economic calendar includes two reports, neither of which is particularly significant. Tomorrow, the informational backdrop is expected to have minimal influence on traders' sentiment.

GBP/USD Forecast and Trading Tips

- New sales of the pair are possible if it rebounds from the 1.2611–1.2620 zone on the hourly chart, targeting 1.2488.

- Purchases can be considered if the pair consolidates above the 1.2611–1.2620 zone on the hourly chart, targeting 1.2709. Testing the 1.2709 level would likely signal a break in the "bearish" structure.

Fibonacci Levels:

- Hourly chart: 1.3000–1.3432

- 4-hour chart: 1.2299–1.3432

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română