Analysis of Trades and Tips for Trading the British Pound

The test of the 1.2563 level occurred as the MACD indicator began rising from the zero mark, validating an entry point for buying the pound. As a result, the pair rose by more than 40 points.

Today's UK data supported the pound's recovery, and the next movements will largely depend on US statistics. The minutes of the Federal Reserve's November meeting are expected to adopt an aggressive tone, potentially signaling that policymakers may delay a rate cut in December.

A cautious tone in the minutes could strengthen investor expectations for more conservative interest rate adjustments in 2025. If the Fed determines that inflation remains high, it may even consider further rate increases, making the dollar more attractive to buyers.

Additionally, clarity on economic indicators, such as the Consumer Confidence Index and new home sales, will be critical. Positive data could boost investor confidence in the US economy's long-term prospects and strengthen the dollar. Conversely, if the Federal Reserve highlights risks of an economic slowdown, this could increase uncertainty and weaken the dollar.

Amid heightened global market volatility, several potential outcomes could unfold. Market participants' reactions to the news will hinge on their expectations of how the Fed might respond to economic changes, making today's minutes highly significant. For intraday trading, I will focus on implementing Scenarios #1 and #2.

Buy Signal

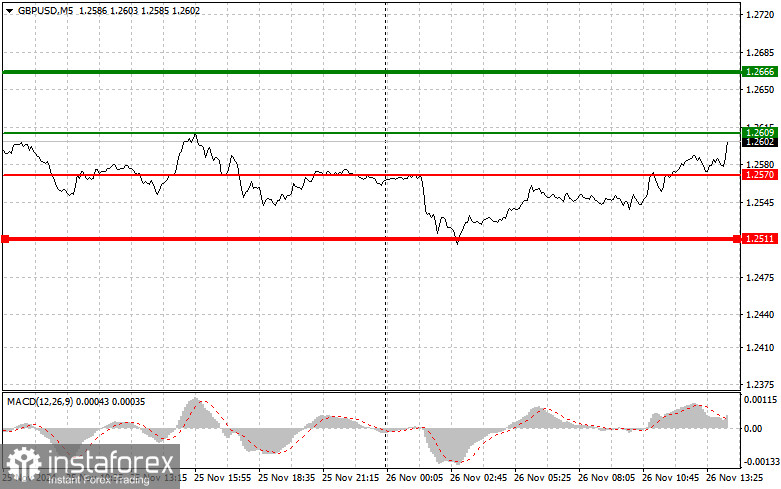

Scenario #1: I plan to buy the pound at the entry point near 1.2609 (green line on the chart), targeting a rise to the 1.2666 level (thicker green line on the chart). At 1.2666, I plan to exit purchases and open short positions, aiming for a pullback of 30-35 points. A rise in the pound is expected today only if the Fed minutes adopt a dovish tone.Note: Before buying, ensure that the MACD indicator is above the zero mark and just beginning its upward movement.

Scenario #2: I also plan to buy the pound if the price tests 1.2570 twice in succession while the MACD indicator is in the oversold zone. This should limit the pair's downward potential and prompt a reversal toward 1.2609 and 1.2666.

Sell Signal

Scenario #1: I plan to sell the pound after the pair breaks below the 1.2570 level (red line on the chart), which could trigger a rapid decline. The primary target for sellers will be 1.2511, where I will exit short positions and open long positions, expecting a rebound of 20-25 points. Sellers are likely to become active if the pair retests the daily high.Note: Before selling, ensure that the MACD indicator is below the zero mark and just beginning its downward movement.

Scenario #2: I also plan to sell the pound if the price tests 1.2609 twice in succession while the MACD indicator is in the overbought zone. This should cap the pair's upward potential and prompt a reversal toward 1.2570 and 1.2511.

Chart Key

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: Suggested price to set Take Profit or manually fix profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: Suggested price to set Take Profit or manually fix profits, as further decline below this level is unlikely.

- MACD Indicator: Key for identifying overbought and oversold zones when entering the market.

Important Notes

Beginner Forex traders should exercise caution when deciding to enter the market. Before the release of key economic reports, it is often safer to stay out of the market to avoid sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly deplete your deposit, especially if you trade large volumes without proper money management.

Remember, successful trading requires a clear trading plan, like the one outlined above. Making impulsive trading decisions based on short-term market conditions is generally an ineffective strategy for intraday traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română