Weak demand, increased production outside OPEC+, and Donald Trump's victory in the U.S. presidential election with his slogan "Drill, baby, drill" have firmly turned the oil market bearish. Thanks to geopolitics and rumors that the cartel might revise its December plan to phase out the 2.2 million barrels per day (bpd) production cut, oil is holding on. Unfortunately, according to Iran, OPEC+ has limited options. Extending the cuts would deprive the alliance of flexibility and allow competitors to increase production without fear.

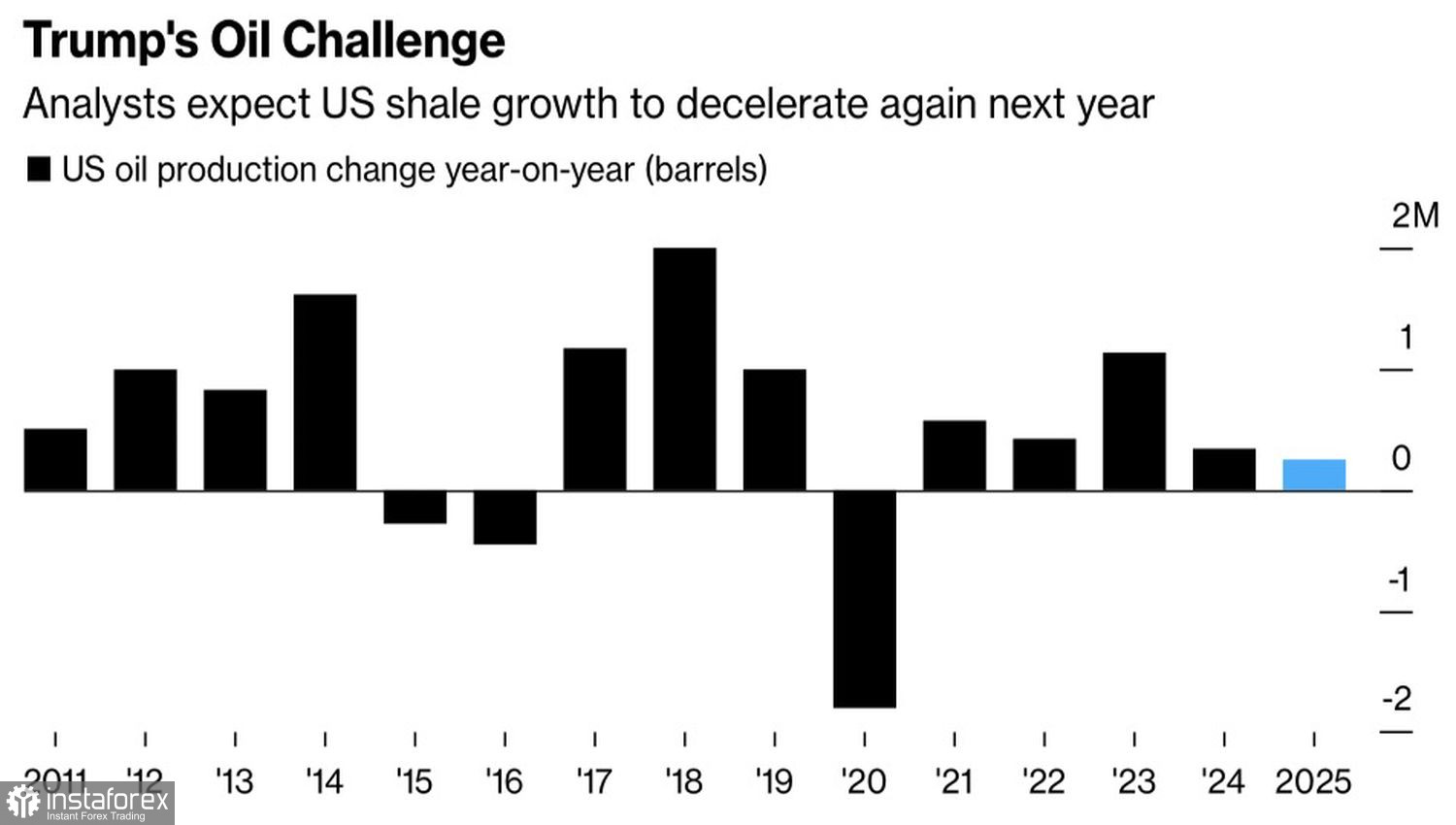

Pressure on Brent also came from reports that Lebanon and Israel are close to a ceasefire deal with Hezbollah and Trump's intent to appoint Scott Bessent as Treasury Secretary. The Wall Street veteran and hedge fund manager adheres to a "3-3-3" policy: reducing the budget deficit to 3%, boosting GDP to 3%, and increasing oil production by 3 million bpd. Current production is already at record levels, and Bloomberg experts predict a modest growth of 251,000 bpd in 2025. If the Treasury implements this plan, Brent bulls will face significant challenges.

U.S. Oil Production Trends

Under the preliminary terms of the agreement between Israel and Lebanon, the U.S. will oversee a 60-day truce, Hezbollah will refrain from bringing more Iranian weapons into Lebanon, and Israel reserves the right to resume hostilities if it observes any violations. The geopolitical conflict in the Middle East appears to be nearing de-escalation, enabling Brent bears to renew their offensive.

However, some believe the market's reaction to the upcoming ceasefire is exaggerated. The Israel-Hezbollah conflict has never caused supply disruptions, so is aggressively selling oil justified? In reality, the ceasefire reduces the risk of new U.S. sanctions against Iran, which supports the terrorist organization. Iran produces about 3.2 million bpd, and if Trump's administration resumes its "maximum pressure" policy, exports could drop by 1 million bpd.

De-escalation in the Middle East, potential acceleration in U.S. oil production, and mixed signals from OPEC+ about increasing output provide solid ground for Brent bears. Citigroup and JP Morgan foresee a market surplus that could push Brent prices down to $60 per barrel. Moreover, Trump's protectionist policies threaten global GDP and oil demand with economic slowdowns.

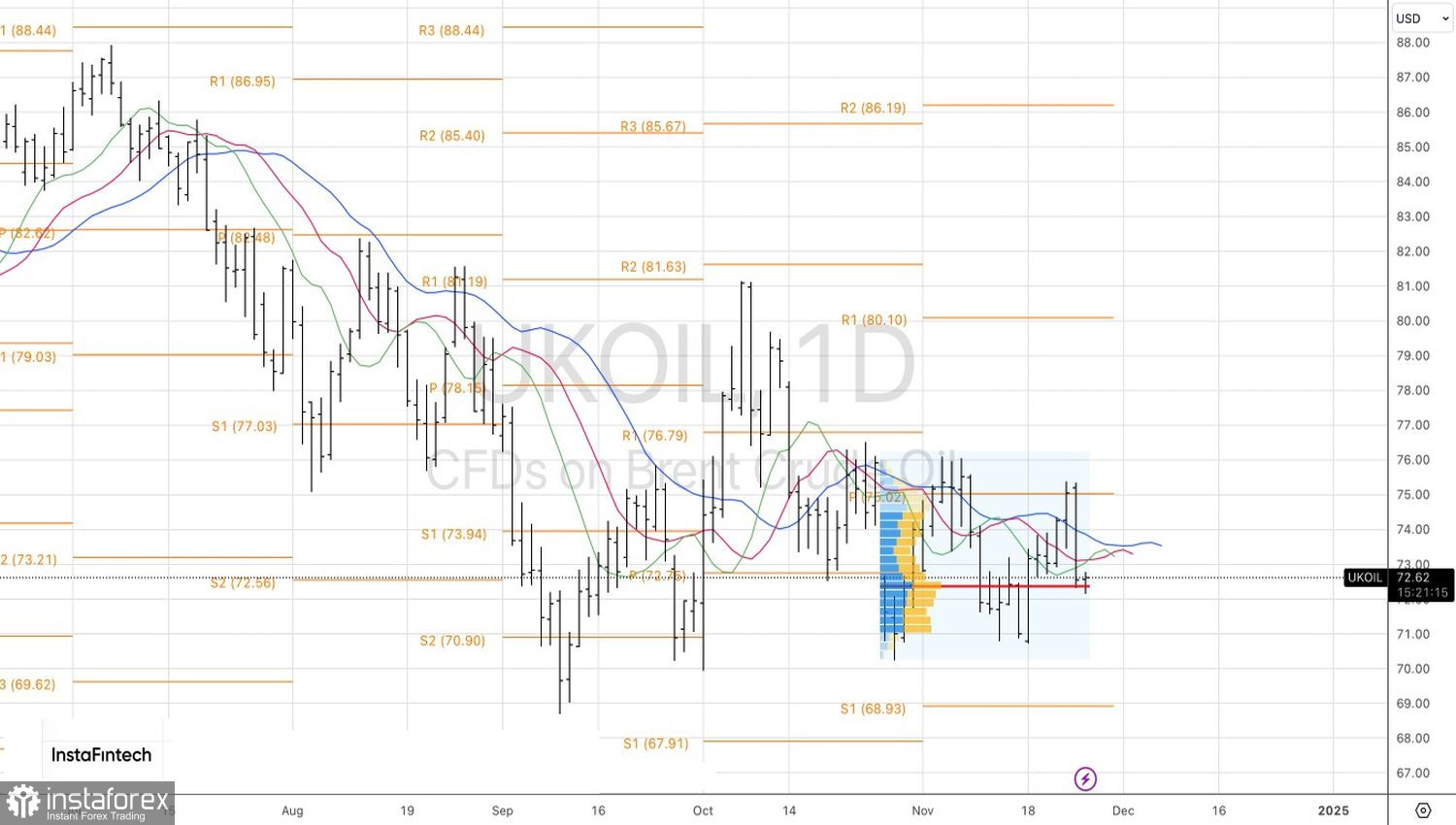

Technically, on the daily chart, Brent tested its fair value near $72.3 per barrel. While the bears' first attempt to breach this critical level was unsuccessful, it's unlikely to deter sellers. A breakout would provide grounds for further oil sales.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română