Analysis of Trades and Trading Recommendations for the Euro

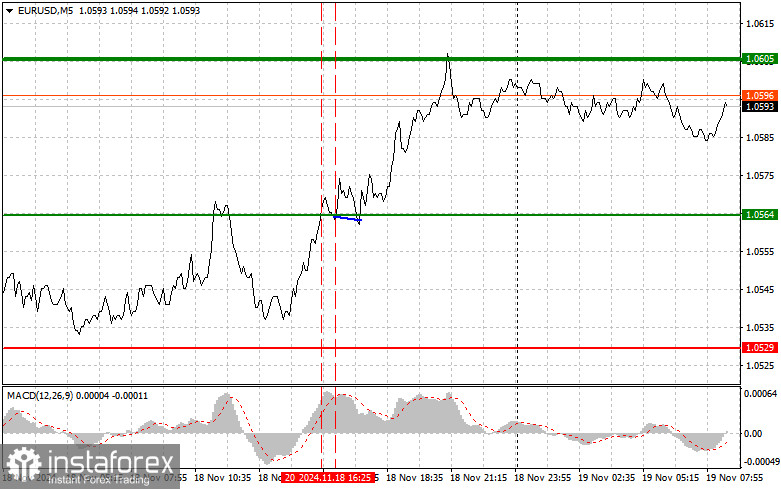

The test of the 1.0564 level coincided with the moment when the MACD indicator had moved significantly above the zero mark, which limited the pair's upward potential. For this reason, I did not buy the euro. Shortly after, a second test of the 1.0564 level led to the execution of Scenario #2 for selling, as by that time, the MACD was already in the overbought zone. However, as you can see on the chart, the pair failed to decline.

Yesterday's trade balance data did not support the euro, nor did the speeches by European Central Bank representatives. The lack of important US data led to euro growth in the second half of the day, but the pair's further direction entirely depends on today's data. Expected reports include data on the eurozone Consumer Price Index (CPI), core inflation (even more significant), and the ECB current account balance. A speech by ECB Executive Board member Frank Elderson will take a back seat. Only an increase in eurozone inflation will help the euro recover against the US dollar. As for the intraday strategy, I will focus more on implementing Scenarios #1 and #2.

Buy Signal

Scenario #1: Today, buying the euro is possible at the 1.0602 level (green line on the chart) with a target of 1.0642. At the 1.0642 level, I plan to exit the market and also sell the euro in anticipation of a pullback of 30–35 pips from the entry point. A rise in the euro today in the first half of the day is only likely following very strong data and as part of a corrective movement. Important! Before buying, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.0577 level while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger an upward reversal. A rise toward the 1.0602 and 1.0642 levels can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after breaking below the 1.0577 level (red line on the chart). The target will be 1.0539, where I intend to exit the market and immediately buy in the opposite direction (anticipating a rebound of 20–25 pips from the level). Selling pressure on the pair can return at any moment, but it is better to sell from as high a level as possible. Important! Before selling, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I also plan to sell the euro if there are two consecutive tests of the 1.0602 level while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a reversal downward. A decline toward the 1.0577 and 1.0539 levels can be expected.

What's on the Chart:

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Notes for Beginner Forex Traders:

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română