Analysis of Monday's Trades

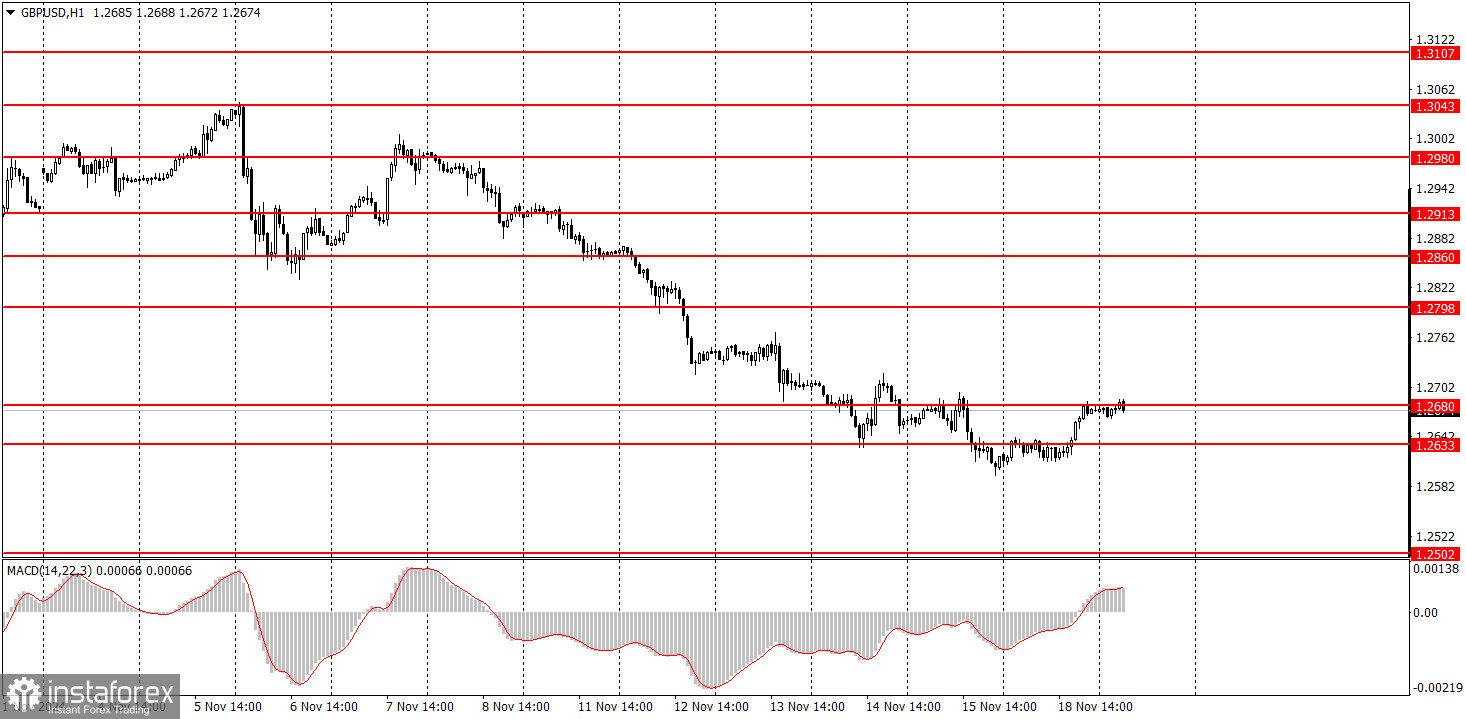

1H Chart of GBP/USD

On Monday, the GBP/USD pair also attempted a correction but failed to break even the nearest resistance level at 1.2680. Thus, the latest correction could end before it has truly begun. Yesterday, the British currency lacked any fundamental reasons for growth apart from the technical need for a correction. No matter how oversold the pound sterling is, occasional corrections or pullbacks are inevitable.

We allow for the possibility of a continued correction, which could last for some time. However, in the medium term, we expect the pound to continue its decline. Tuesday will be crucial for the pound, as the Consumer Price Index (CPI) report—arguably the most significant data release of the week in the UK—will be published. This report directly impacts how quickly the Bank of England will reduce interest rates soon.

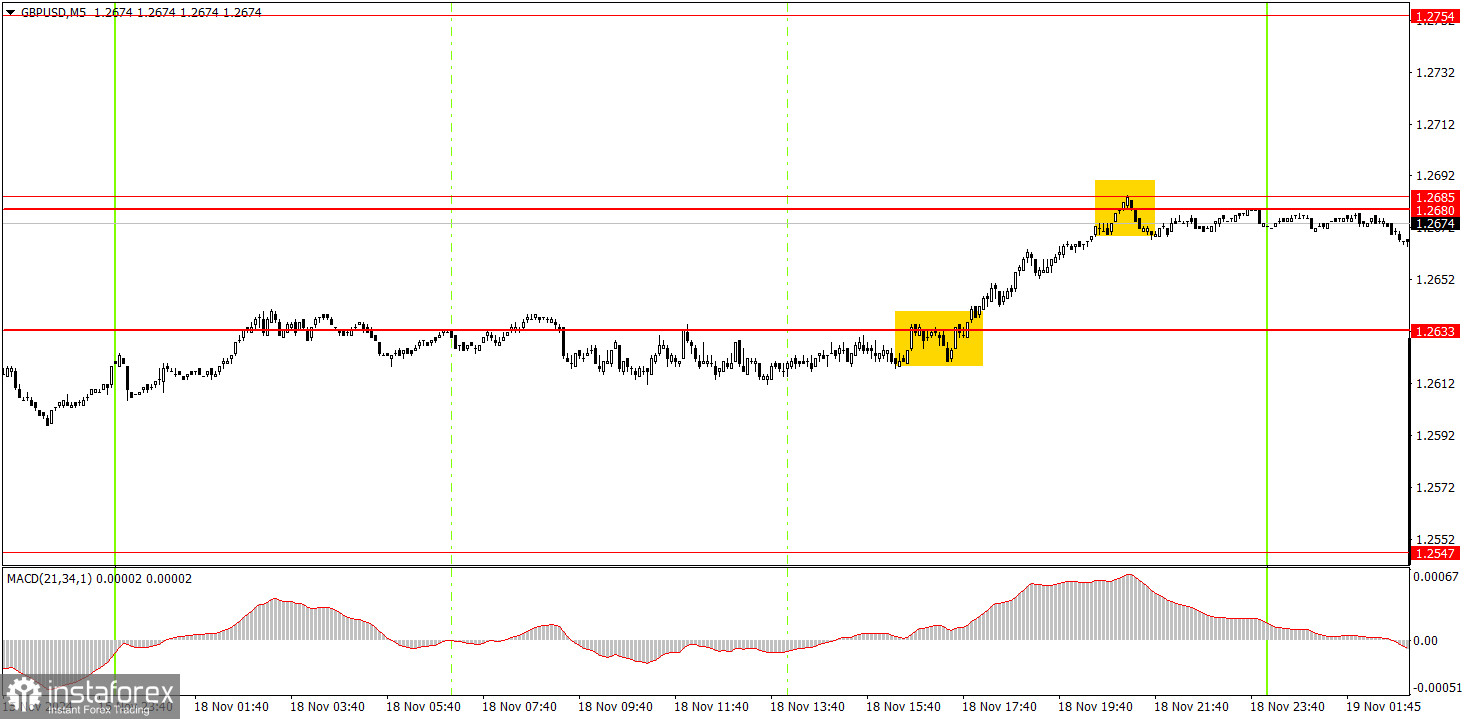

5M Chart of GBP/USD

On the 5-minute timeframe, Monday provided one buy signal near the 1.2633 level. Breaking through this level allowed novice traders to open long positions. By the end of the day, the nearest resistance at 1.2680 had been reached. Currently, the price has failed to break through the 1.2680-1.2685 area, suggesting the possibility of a rebound and the start of a new wave of downward movement.

Trading Strategy for Tuesday:

The GBP/USD pair continues to lean toward a downward trend in the hourly timeframe. We fully support the pound's decline in the medium term, as we believe this is the only logical outcome. The pound may attempt another correction soon but will need significant support to sustain it. Last Thursday, Jerome Powell's comments provided no such support, nor did Friday's macroeconomic data. On Wednesday, the pound will seek help from the inflation report.

Novice traders can expect a continuation of the downward movement on Tuesday, as the price has yet to solidify above the 1.2680-1.2685 area.

On the 5-minute TF, the levels of 1.2502-1.2508, 1.2547, 1.2633, 1.2680-1.2685, 1.2754, 1.2791-1.2798, 1.2848-1.2860, 1.2913, 1.2980-1.2993 can now be traded. On Tuesday, the UK calendar remains empty, while the US will release reports on building permits and housing starts, which are far from critical data. As such, these reports are unlikely to significantly impact market sentiment.

Core Trading System Rules:

- Signal Strength: The strength of a signal is measured by the time it takes to form (a rebound or level breakthrough). The shorter the time, the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, all subsequent signals from that level should be ignored.

- Flat Markets: Pairs may generate numerous false signals or none during a flat market. Stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session. Close all trades manually afterward.

- MACD Signals: Trade MACD signals on the hourly timeframe only when there is good volatility and a trend confirmed by trendlines or channels.

- Close Levels: If two levels are close (5–20 points apart), treat them as a support or resistance area.

- Stop Loss: Place a Stop Loss at breakeven after the price moves 20 points in the desired direction.

Key Chart Elements:

Support and Resistance Levels: Target levels for opening or closing positions. Take Profit orders can also be set here.

Red Lines: Channels or trendlines that show the current trend and the preferred trading direction.

MACD Indicator (14,22,3): A histogram and signal line that serve as supplementary trading signals.

Important Events and Reports: Found in the economic calendar, these can strongly influence price movements. During their release, trade cautiously or exit the market to avoid sharp reversals against the preceding trend.

Forex beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are critical for long-term success in trading.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română