While the Bundesbank warns of risks of global economic fragmentation, Germany is sliding into a recession. Besides, rising political risks in the country weigh heavily on EUR/USD. According to recent polls, the opposition conservatives maintain a strong lead. If parliamentary elections scheduled for February were held today, the Christian Democratic Union would secure 32.3% of the vote, compared to 18.8% for Alternative for Germany and 15.8% for Social Democrats led by Olaf Scholz.

The euro has shown high vulnerability to France's snap elections, fearing that left- or right-wing parties might violate the EU's fiscal deficit rules. If similar instability arises in Germany, political risks could grow exponentially, adding further pressure on EUR/USD.

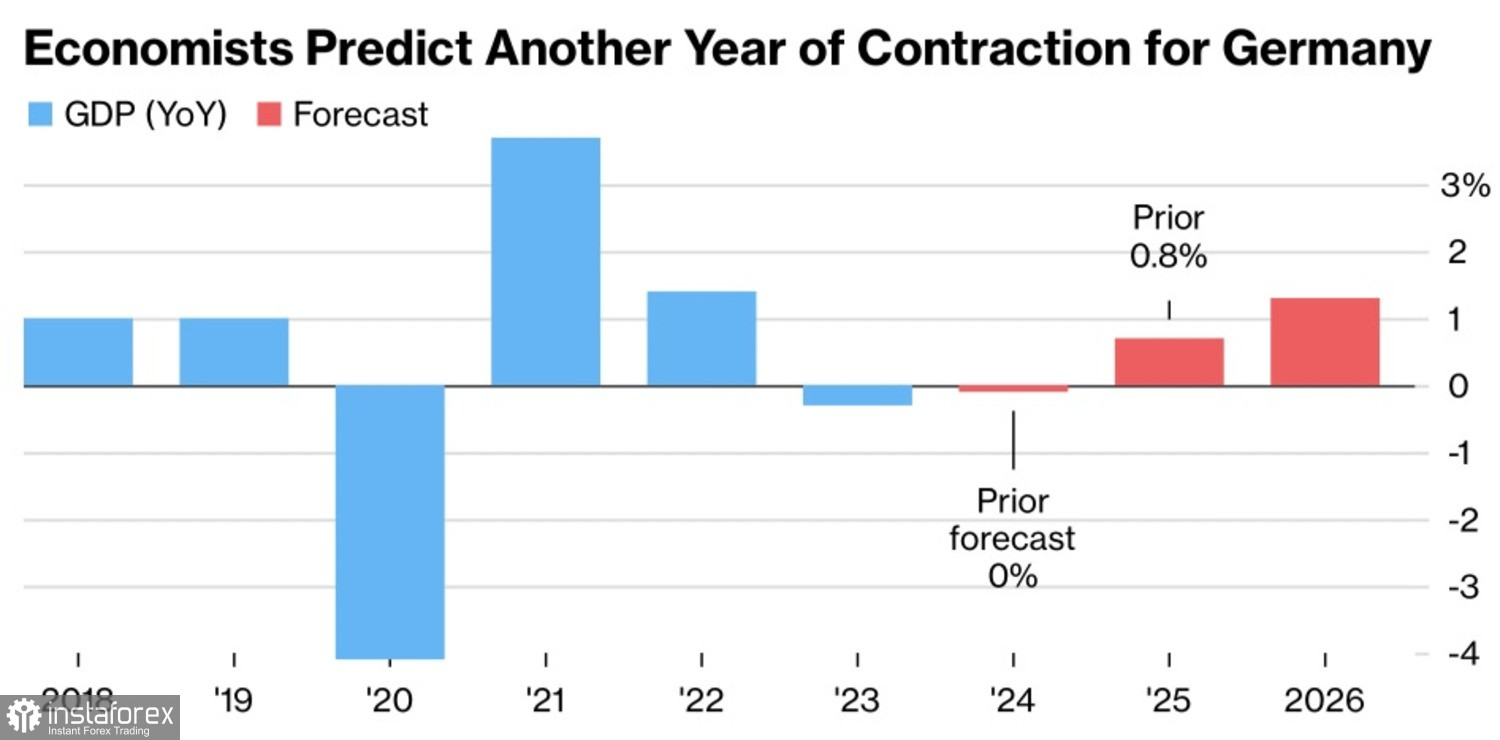

On the other hand, Germany's economy is ripe for fiscal stimulus. According to Bloomberg's latest expert poll, GDP is expected to shrink by 0.1% in 2024 after contracting by 0.3% in 2023. Growth is projected at a modest 0.7% in 2025 and 1.3% in 2026. Notably, only the 2026 figure remains unchanged from the previous forecast, while the rest have been revised downward.

Dynamics of Germany's economy

Against Germany's challenges, the US appears to shine. October retail sales highlighted the robust domestic demand despite rising inflation. If sluggish employment in the US proves temporary, the fourth quarter could still see a 3% GDP growth rate. Fiscal stimulus from Donald Trump threatens to accelerate GDP growth even further, widening the economic growth divergence with the eurozone and pushing EUR/USD closer to parity.

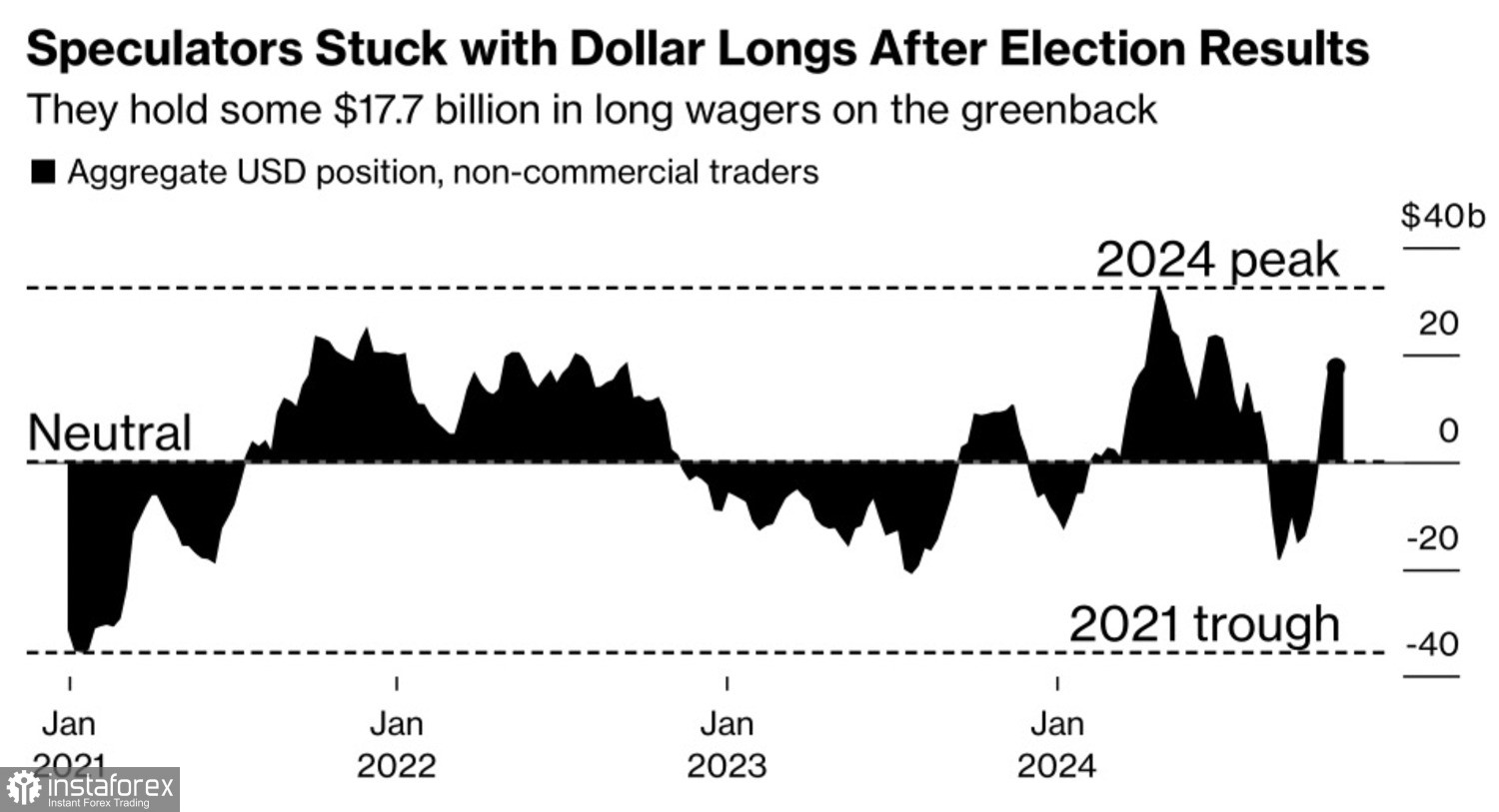

It's no surprise that hedge funds and asset managers continue to increase net-long positions on the US dollar. The "Trump trade" and America's economic resilience bolster the long-term bullish outlook for the USD index.

Speculative positioning in USD

Upcoming data on European business activity could add fuel to the EUR/USD sell-off. The manufacturing PMI for the eurozone is expected to remain in contraction territory, while the services PMI may slightly decline to 51.5. The economy's weakness already forced the ECB to take an emergency step toward monetary easing in October. Currently, the derivatives market expects a December deposit rate cut from 3.25% to 3%, with a roughly 30% probability of a rate cut by 50 basis points.

In summary, Germany's economic fragility, escalating political risks, and the US economic strength underpin the euro's downward trend against the dollar.

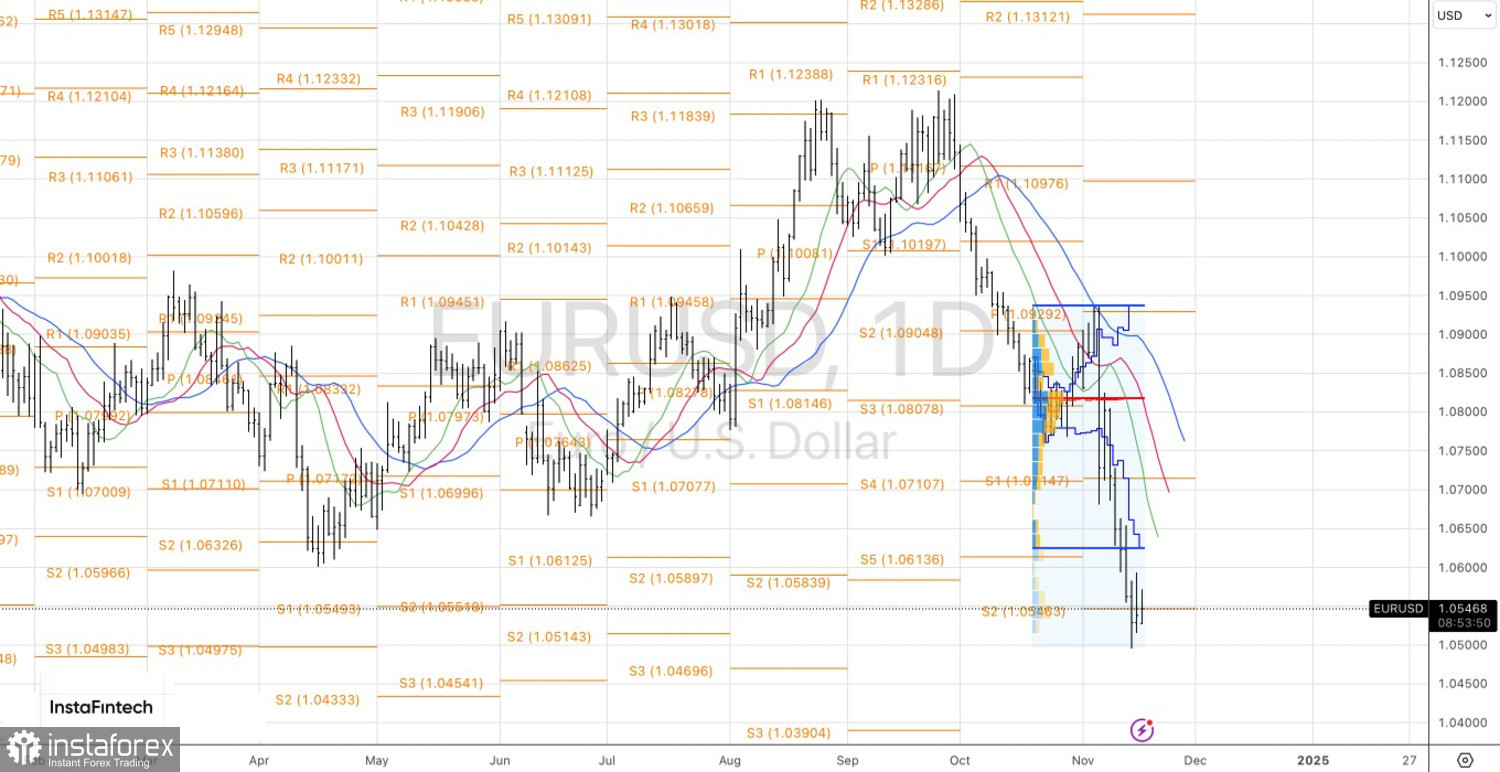

Technical outlook for EUR/USD

On the daily chart, EUR/USD is locked in a fierce battle for the pivot level at 1.0545 for the second consecutive day. If bulls hold this level, the pair could retrace to 1.0610–1.0625. Dominance of the bears would justify adding short positions from 1.0515.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română