Gold prices remain under pressure, reaching levels last seen in September. However, the decline has slowed today due to a correction in the US dollar.

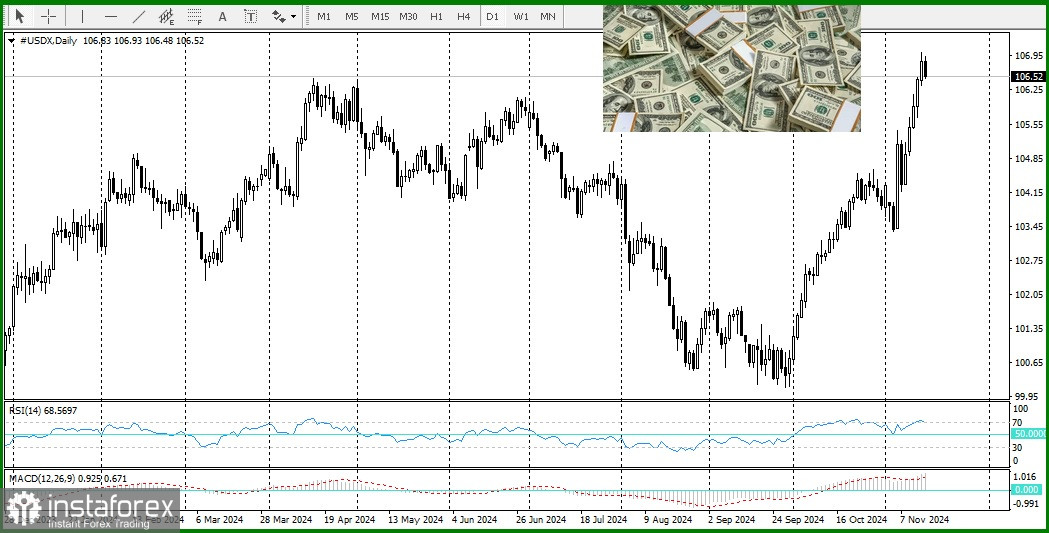

Donald Trump's proposed increases in import tariffs may accelerate inflation, potentially prompting the Federal Reserve to pause its monetary easing cycle. Additionally, recent inflation data indicates a slower-than-expected decline in price levels. This dynamic continues to support elevated yields on US Treasury bonds, shifting investor interest away from gold.

The overnight break below the psychological level of $2,600 was perceived as a new catalyst for bearish momentum. Combined with negative oscillators on the daily chart, this indicates that the most likely direction for gold prices remains downward. A further decline below the 100-day SMA, currently near $2,542, is highly probable. If this level is breached, it could pave the way for an extended sharp pullback from recent historical highs, potentially exposing the $2,500 psychological level.

Recovery efforts are expected to encounter resistance near the previous day's high around the $2,581 level, followed by the $2,600 psychological threshold. Sustained strength above this point could trigger a short-covering rally toward the key resistance level at $2,630. If this barrier is overcome, the next significant hurdle lies in the $2,660 level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română