Analysis of Friday's Trades:

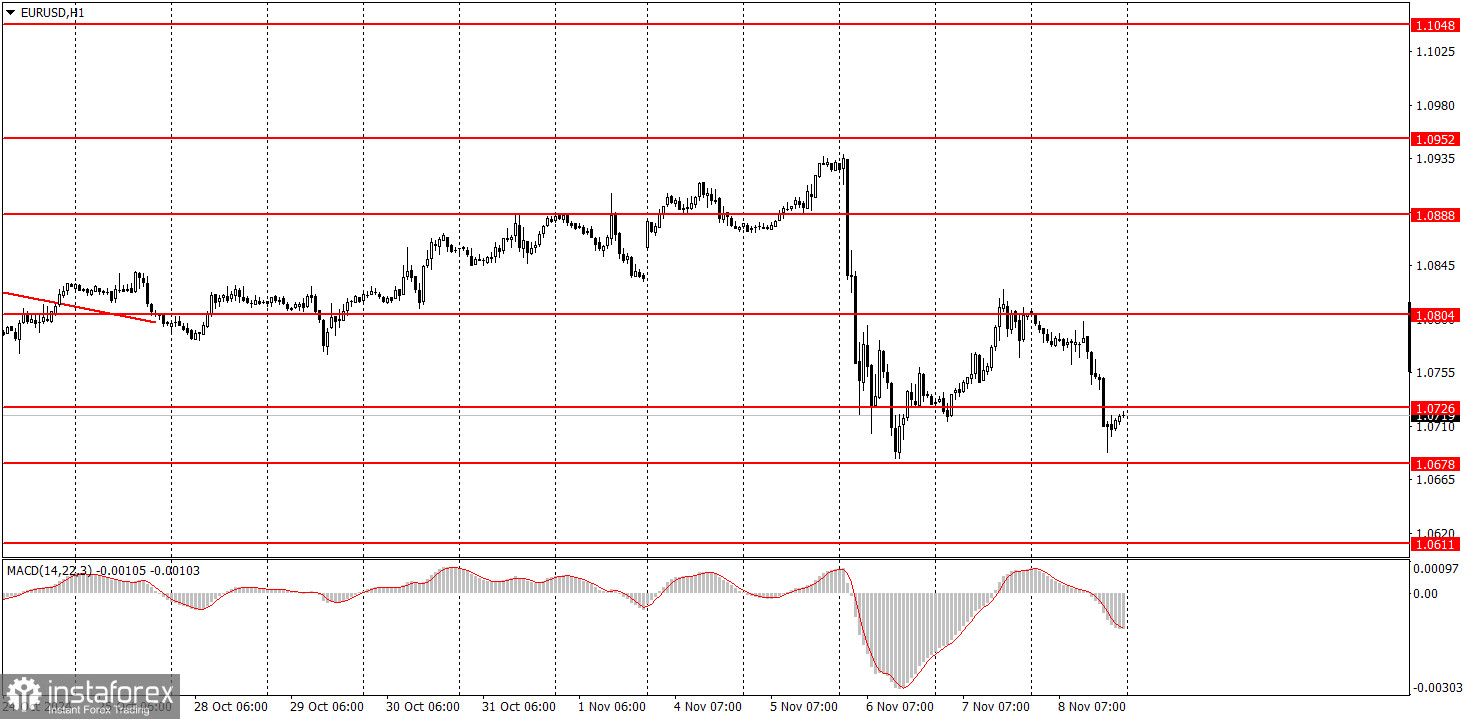

1H Chart of EUR/USD Pair

The EUR/USD currency pair continued its downward movement on Friday. This development is significant as it occurred on a day without substantial macroeconomic or fundamental news. The dollar strengthened again, underscoring a recurring theme: it should continue to rise because its previous prolonged decline was unwarranted. This week demonstrated that markets have positively reacted to Donald Trump's election victory, the Federal Reserve is in no hurry to lower rates, and a pause in December is even possible.

We believe this fundamental backdrop supports the dollar's medium-term appreciation. However, we repeat—the American currency should rise in price in almost any case. Moreover, the EUR/USD pair has corrected sufficiently to resume its downtrend, which began a month and a half ago and could be just the beginning of a prolonged decline.

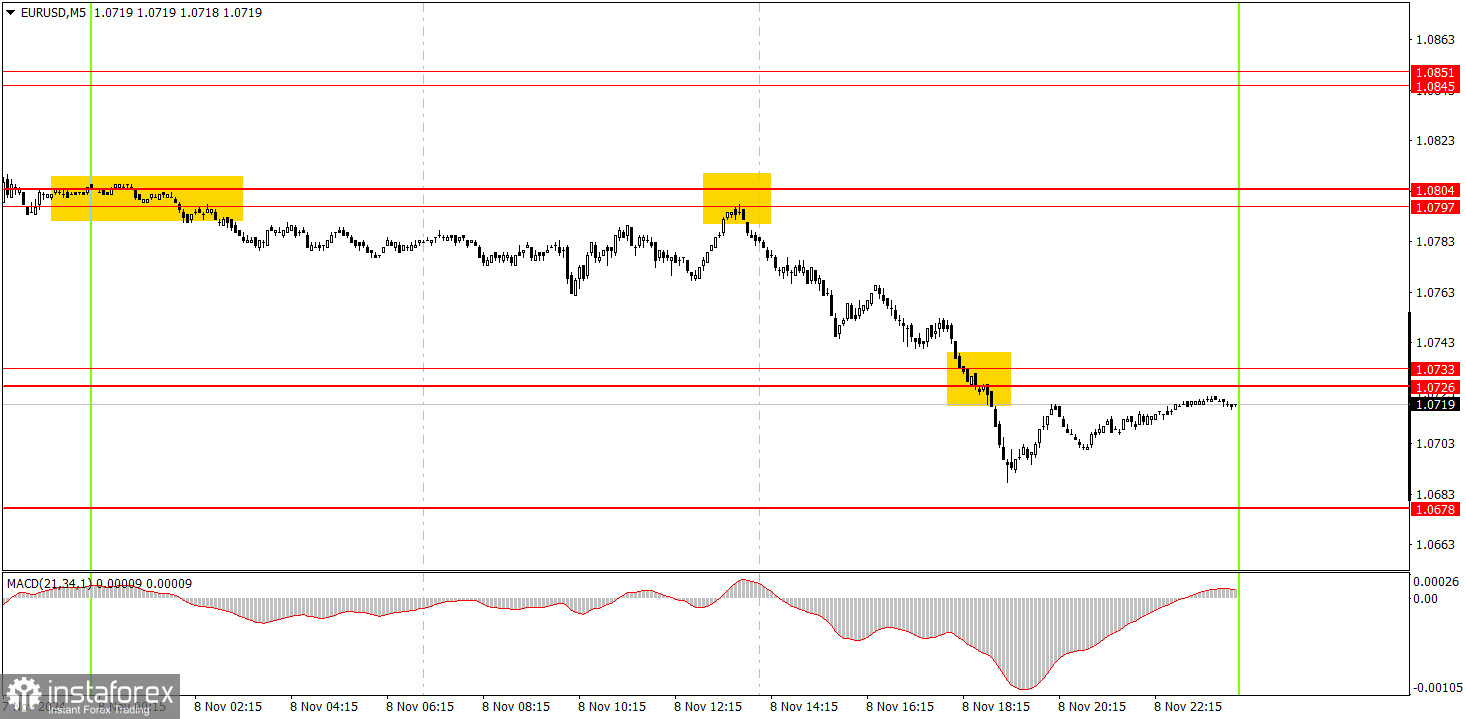

5M Chart of EUR/USD Pair

Three solid signals were generated on Friday in the 5-minute time frame. First, the pair twice rebounded from the 1.0797–1.0804 zone, providing compelling reasons to initiate short positions. Later in the evening, the pair broke below the 1.0726–1.0733 zone, allowing novice traders to maintain their sell positions. As a result, good profits could be achieved.

How to Trade on Monday:

In the hourly time frame, the EUR/USD pair could begin a new correction after a month-long decline, as the midweek drop lacked the characteristics of a structured move. However, we believe any new correction is unlikely strong unless consistently supported by euro-positive news. Even then, the market's current sentiment favors dollar purchases.

For Monday, the 1.0726–1.0733 zone is crucial. The price may rebound from this area and continue its decline.

On the 5-minute TF, we should consider the levels of 1.0611, 1.0678, 1.0726-1.0733, 1.0797-1.0804, 1.0845-1.0851, 1.0888-1.0896, 1.0940-1.0951, 1.1011, 1.1048, 1.1091. No significant events are scheduled for Monday in the Eurozone or the U.S. However, this doesn't guarantee that the price will remain stagnant. Recall that the past week was challenging, and numerous fundamental factors remain in play. For example, Friday showed strong price action despite an almost empty calendar.

Basic Trading System Rules:

- The strength of a signal is determined by the time it takes to form (whether a bounce or breakthrough of a level). The quicker the formation, the stronger the signal.

- If two or more trades have been made near a level due to false signals, any further signals from that level should be ignored.

- In a flat market, a pair can generate many false signals or none at all. In any case, it's best to stop trading at the first signs of a flat market.

- Trading occurs between the start of the European and middle of the US sessions, after which all trades should be manually closed.

- On the hourly time frame, it's recommended to trade MACD indicator signals only when there is good volatility and a trendline or trend channel confirms a trend.

- If two levels are too close together (5 to 20 pips apart), they should be treated as support or resistance areas.

- After the price moves 15 pips in the intended direction, set the Stop Loss to breakeven.

What's on the Charts:

Support and Resistance Levels: Levels that serve as targets for opening buys or sells. Take Profit levels can be placed around these areas.

Red Lines: Channels or trend lines that indicate the current trend and the preferred trading direction.

MACD Indicator (14,22,3): Histogram and signal line—an auxiliary indicator that can also be used as a source of signals.

Major speeches and reports (always found in the news calendar) can significantly impact currency pair movements. Therefore, it's advised to trade cautiously or exit the market during their release to avoid sharp price reversals against prior movements.

Beginners trading on the forex market should remember that not every trade will be profitable. A clear strategy and money management are the keys to success in long-term trading.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română