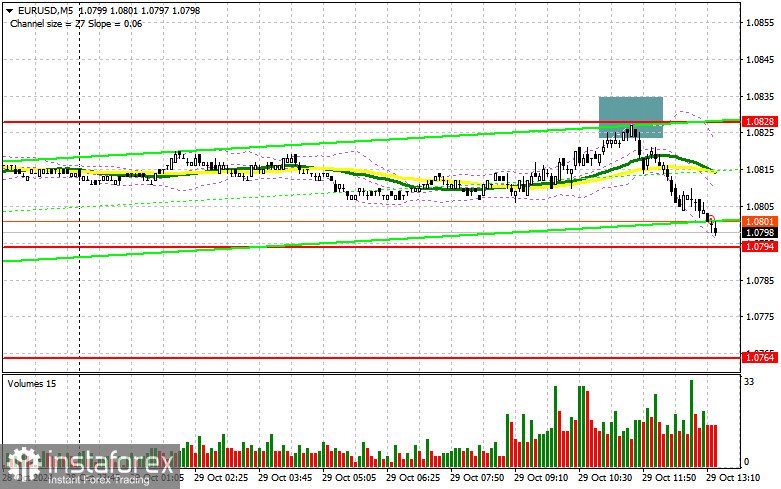

In my morning forecast, I highlighted the 1.0828 level as a key level for initiating trades. Let's review the 5-minute chart to analyze the results. The rise and formation of a false breakout at that level provided an excellent entry point for a short position, resulting in a fall toward the target level of 1.0794, yielding around 30 points of profit. The technical picture has since been adjusted for the second half of the day.

To Open Long Positions on EUR/USD:

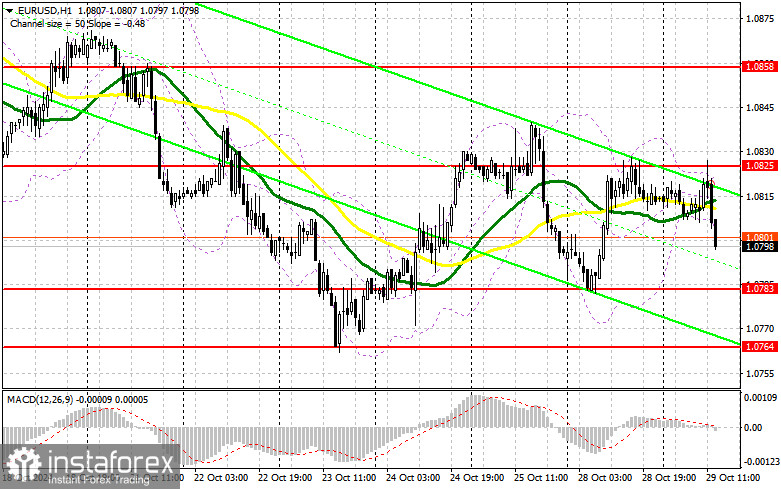

The bulls' unsuccessful attempts to break above 1.0825 and the upper boundary of the triangle, as discussed in my morning analysis, likely encouraged sellers to act. In the second half of the day, data on the U.S. goods trade balance, the S&P/Case-Shiller 20-City Composite Home Price Index, and consumer confidence are expected, with the latter attracting the most attention. Strong data will put additional pressure on the pair, likely pushing it down to new support at 1.0783, where I plan to act. A false breakout there would create a good condition for building long positions, potentially opening the way back to the 1.0825 level, which has remained unbroken today. A breakout and retest of this range would confirm a long position entry with a target of 1.0858. The ultimate target is 1.0900, where I'll lock in profits. If EUR/USD declines without significant buying interest around 1.0783 in the afternoon, the market will likely shift in favor of sellers, with the pair expected to drop back to support at 1.0764, creating challenges for buyers. I'll only enter there after a false breakout. I plan to open long positions on a rebound from 1.0738, aiming for a 30-35 point intraday upward correction.

To Open Short Positions on EUR/USD:

Sellers have performed well and are now targeting yesterday's low. In the event of another upward attempt, a false breakout around 1.0825, as discussed above, would provide a short-entry opportunity targeting support at 1.0783. A breakout and consolidation below this range, followed by a bottom-up retest, would create another selling opportunity, aiming for the 1.0764 area, which would invalidate the buyers' growth prospects. The ultimate target would be the 1.0738 area, where I'll lock in profits. If EUR/USD rises in the second half of the day without bearish activity at 1.0825, buyers may attempt a larger upward correction. In that case, I'll delay shorting until testing the next resistance at 1.0858, where I'll also sell, but only after a failed consolidation. I'll open short positions immediately on a rebound from 1.0900, aiming for a 30-35 point downward correction.

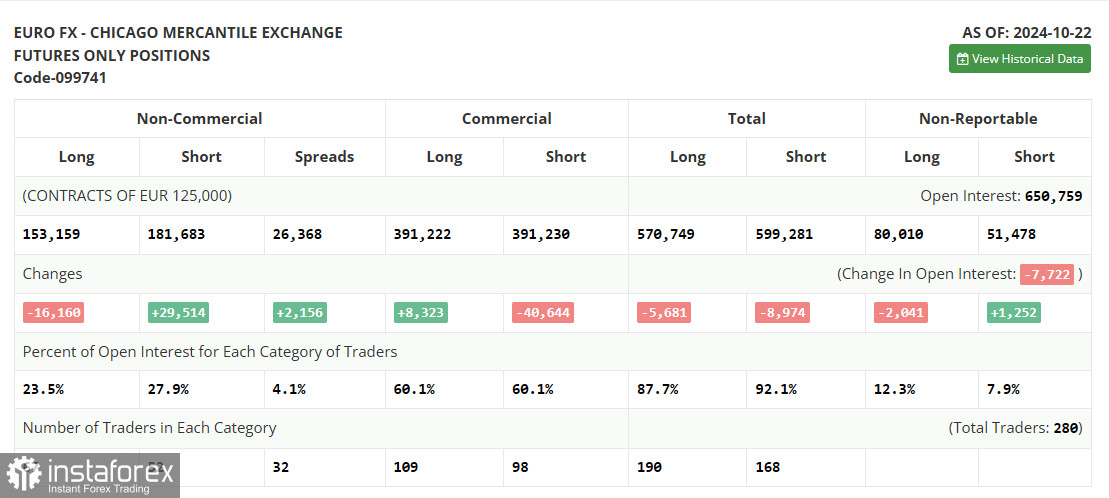

The October 22 COT report indicated a sharp increase in short positions and a continued decrease in long positions. This suggests high expectations for an active rate cut by the ECB, a view shared by European policymakers, whereas the U.S. Federal Reserve is anticipated to take a more cautious stance. This week's data on U.S. GDP and labor market figures are likely to clarify the situation, potentially reducing the urgency for further rate cuts and offering additional support to the dollar. The COT report showed that long non-commercial positions decreased by 16,160 to 153,159, while short non-commercial positions rose by 29,514 to 181,683, with the gap between longs and shorts widening by 2,156.

Indicator Signals:

Moving Averages:

Current price action remains close to the 30- and 50-day moving averages, suggesting a sideways market trend.

Bollinger Bands:

If the price declines, support is likely around the lower band at 1.0800.

Indicator Descriptions:

- 30-period Moving Average: Defines the current trend by smoothing volatility and noise, marked in green on the chart.

- 50-period Moving Average: Defines the current trend by smoothing volatility and noise, marked in yellow on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA – 12 periods, Slow EMA – 26 periods, SMA – 9 periods.

- Bollinger Bands: 20 periods.

- Non-commercial traders: Speculators including individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long non-commercial positions: Total long open positions of non-commercial traders.

- Short non-commercial positions: Total short open positions of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română